Question: Please help me understand how to get the correct answers for 24, 26, and 28. Use the following information to answer the next 8 questions.

Please help me understand how to get the correct answers for 24, 26, and 28.

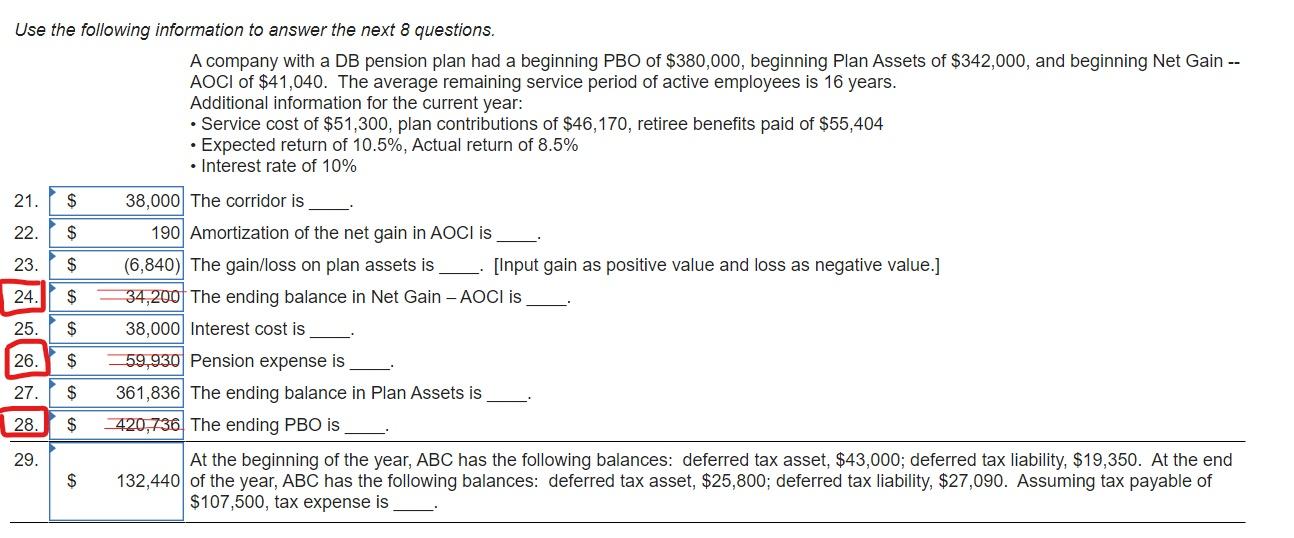

Use the following information to answer the next 8 questions. A company with a DB pension plan had a beginning PBO of $380,000, beginning Plan Assets of $342,000, and beginning Net Gain -- AOCI of $41,040. The average remaining service period of active employees is 16 years. Additional information for the current year: Service cost of $51,300, plan contributions of $46,170, retiree benefits paid of $55,404 Expected return of 10.5%, Actual return of 8.5% Interest rate of 10% 21. $ 22. $ 23. $ 24. $ 25. $ 26. $ 38,000 The corridor is 190 Amortization of the net gain in AOCI is (6,840) The gain/loss on plan assets is ____ [Input gain as positive value and loss as negative value.] 34,200 The ending balance in Net Gain - AOCI is 38,000 Interest cost is 59,930 Pension expense is 361,836 The ending balance in Plan Assets is 420,736 The ending PBO is At the beginning of the year, ABC has the following balances: deferred tax asset, $43,000; deferred tax liability, $19,350. At the end 132,440 of the year, ABC has the following balances: deferred tax asset, $25,800; deferred tax liability, $27,090. Assuming tax payable of $107,500, tax expense is 27. $ 28. $ 29. $ Use the following information to answer the next 8 questions. A company with a DB pension plan had a beginning PBO of $380,000, beginning Plan Assets of $342,000, and beginning Net Gain -- AOCI of $41,040. The average remaining service period of active employees is 16 years. Additional information for the current year: Service cost of $51,300, plan contributions of $46,170, retiree benefits paid of $55,404 Expected return of 10.5%, Actual return of 8.5% Interest rate of 10% 21. $ 22. $ 23. $ 24. $ 25. $ 26. $ 38,000 The corridor is 190 Amortization of the net gain in AOCI is (6,840) The gain/loss on plan assets is ____ [Input gain as positive value and loss as negative value.] 34,200 The ending balance in Net Gain - AOCI is 38,000 Interest cost is 59,930 Pension expense is 361,836 The ending balance in Plan Assets is 420,736 The ending PBO is At the beginning of the year, ABC has the following balances: deferred tax asset, $43,000; deferred tax liability, $19,350. At the end 132,440 of the year, ABC has the following balances: deferred tax asset, $25,800; deferred tax liability, $27,090. Assuming tax payable of $107,500, tax expense is 27. $ 28. $ 29. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts