Question: Please help me understand what I am completing. B C G H Apollo Shoes, Inc. A-0 AUDIT PLAN-PLANNING You are responsible for completing all steps

Please help me understand what I am completing.

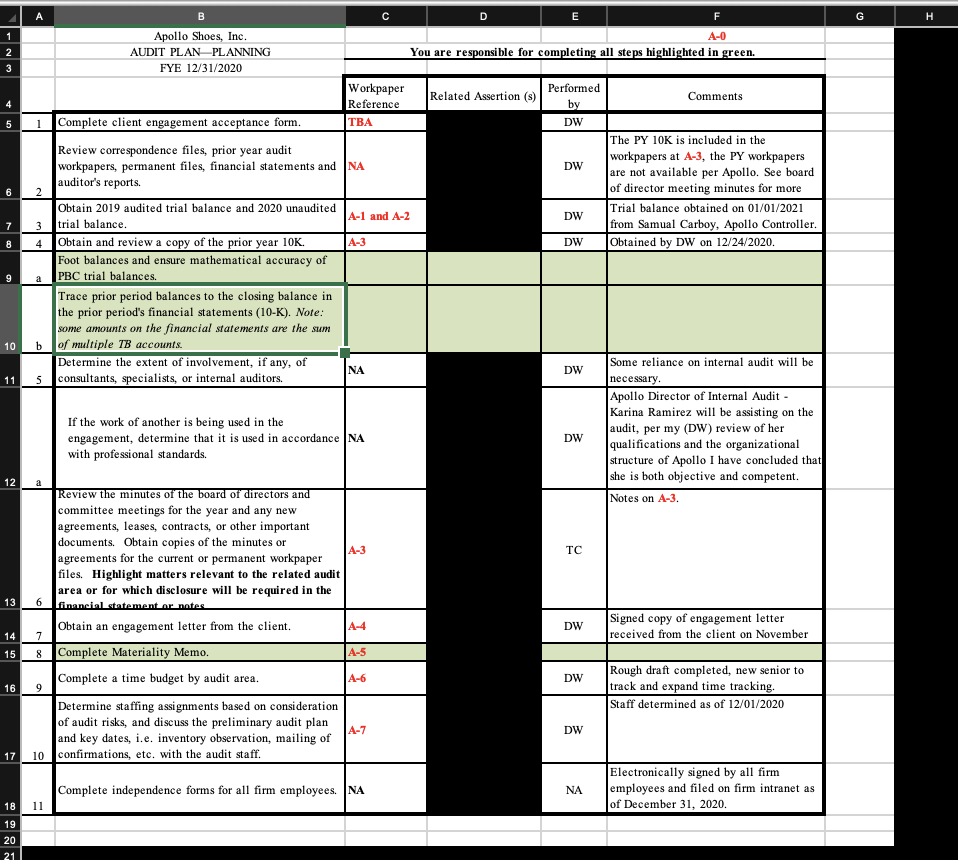

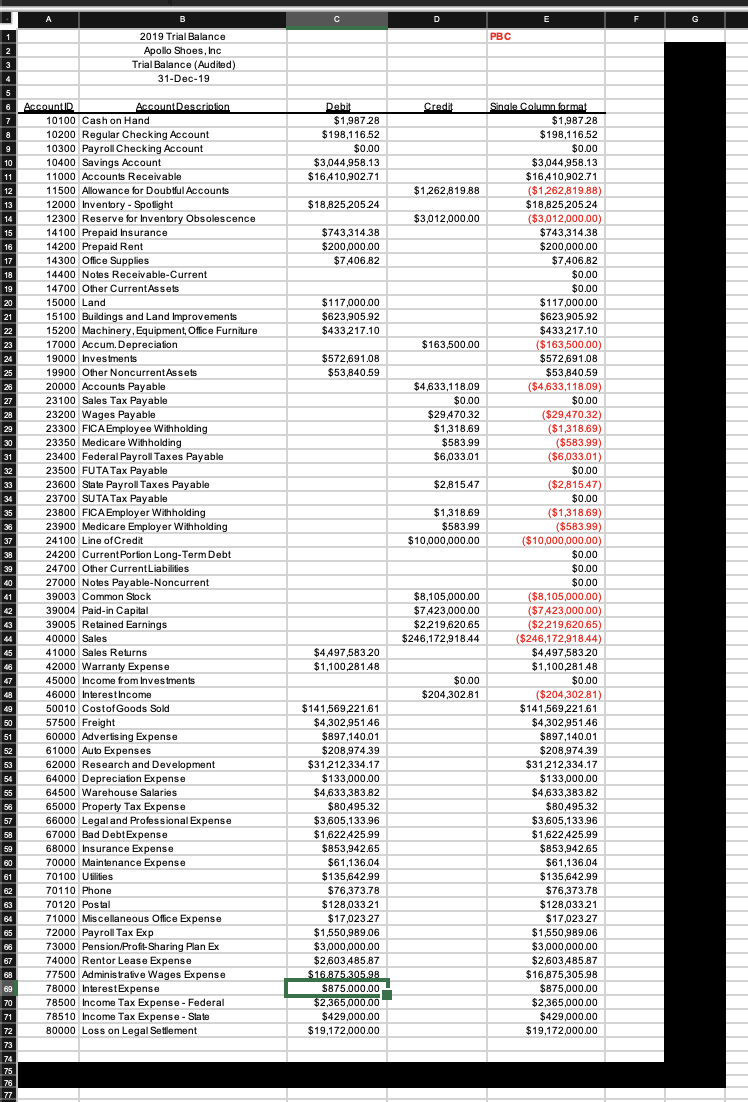

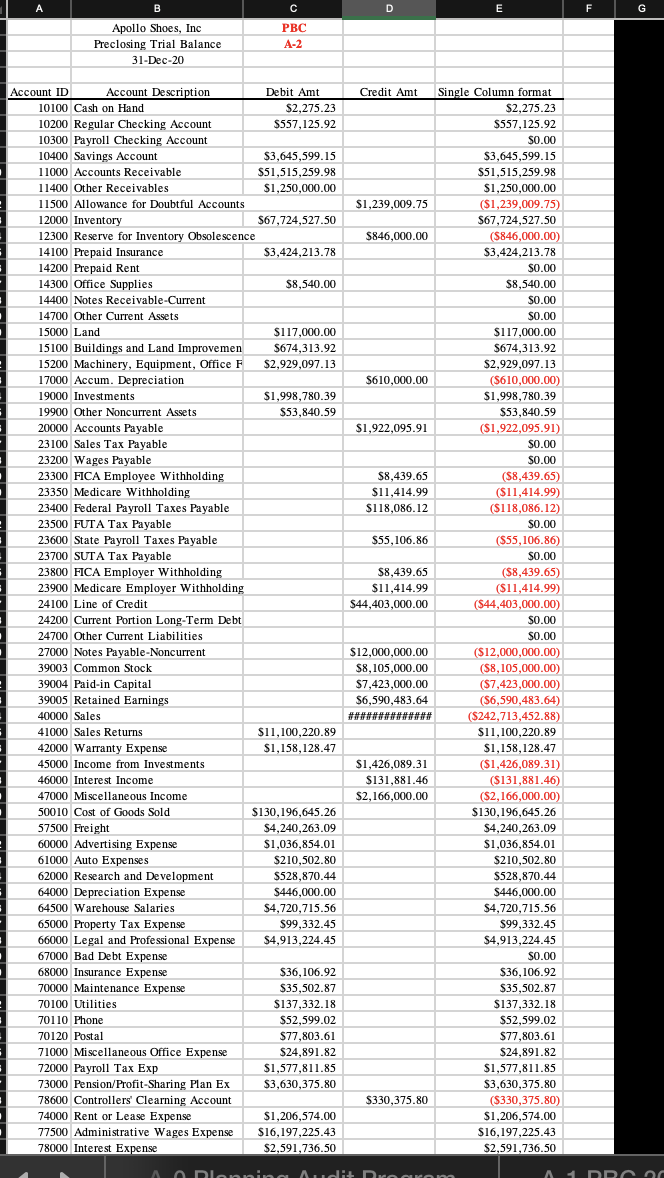

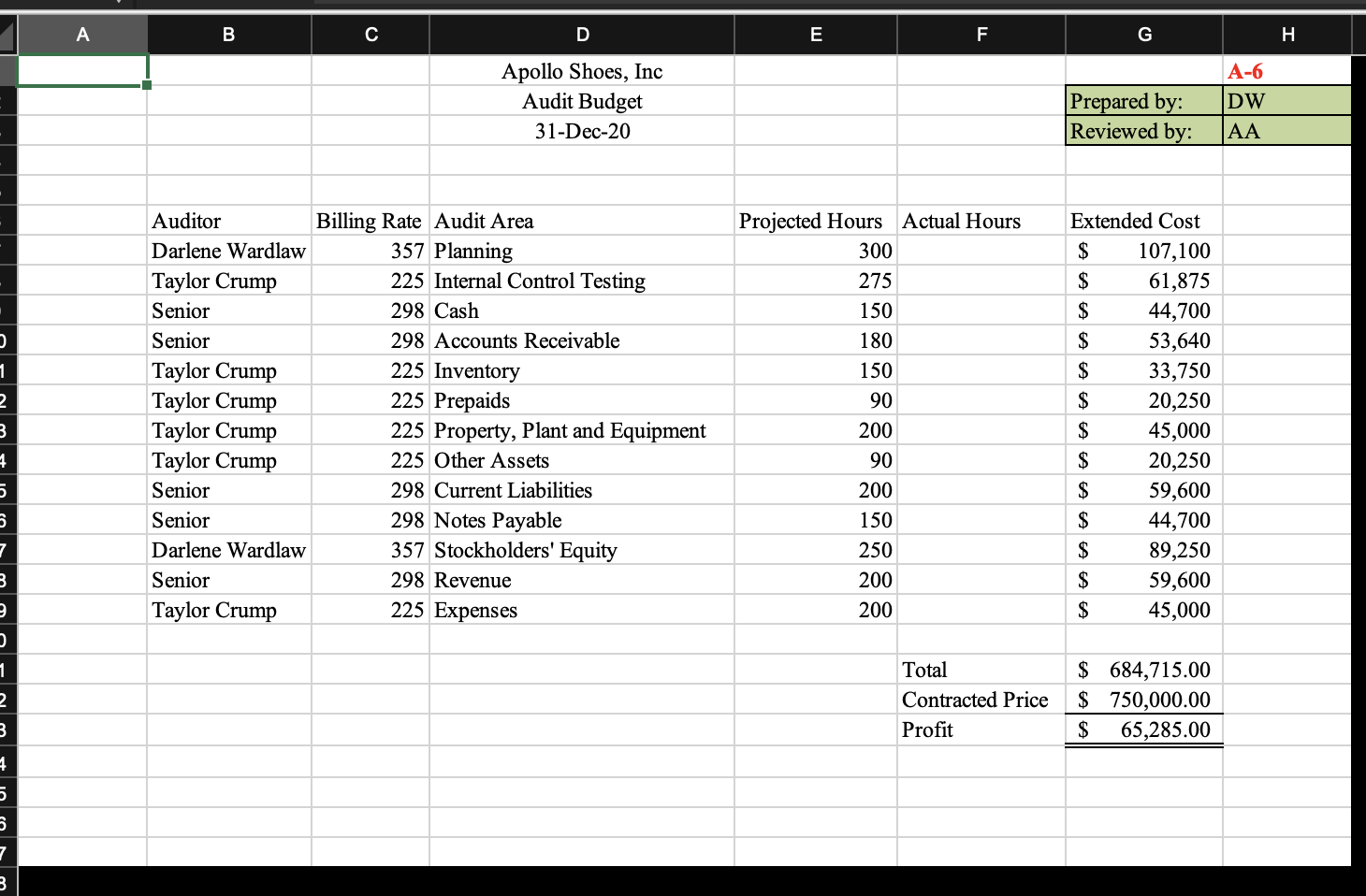

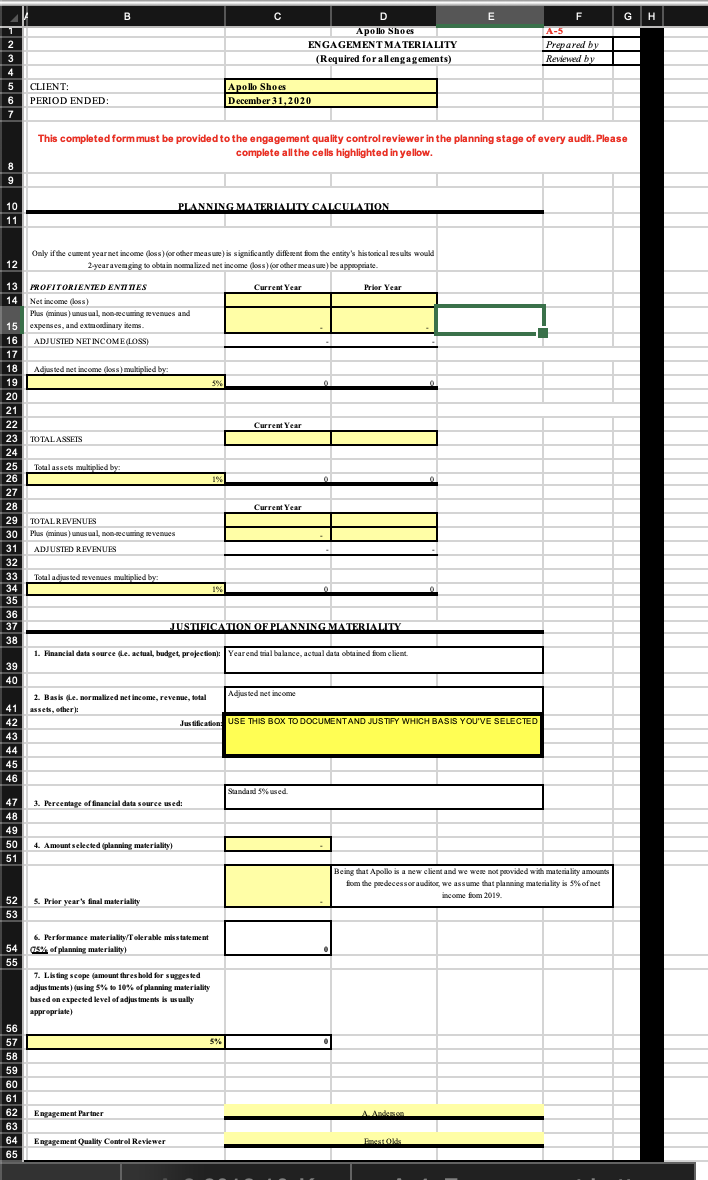

B C G H Apollo Shoes, Inc. A-0 AUDIT PLAN-PLANNING You are responsible for completing all steps highlighted in green. FYE 12/31/2020 Workpaper Related Assertion (s) Performed Comments Reference by 1 Complete client engagement acceptance form. TBA DW The PY 10K is included in the Review correspondence files, prior year audit workpapers, permanent files, financial statements and NA DW workpapers at A-3, the PY workpapers are not available per Apollo. See board auditor's reports. 2 of director meeting minutes for more Obtain 2019 audited trial balance and 2020 unaudited A-1 and A-2 DW Trial balance obtained on 01/01/2021 7 3 trial balance. from Samual Carboy, Apollo Controller. B 4 Obtain and review a copy of the prior year 10K. A-3 DW Obtained by DW on 12/24/2020. Foot balances and ensure mathematical accuracy of 9 PBC trial balances. Trace prior period balances to the closing balance in the prior period's financial statements (10-K). Note: some amounts on the financial statements are the sum 10 b of multiple TB accounts. Determine the extent of involvement, if any, of NA DW Some reliance on internal audit will be 11 5 consultants, specialists, or internal auditors. necessary Apollo Director of Internal Audit - Karina Ramirez will be assisting on the If the work of another is being used in the audit, per my (DW) review of her engagement, determine that it is used in accordance |NA DW qualifications and the organizational with professional standards. structure of Apollo I have concluded that 2 she is both objective and competent. Review the minutes of the board of directors and Notes on A-3. committee meetings for the year and any new agreements, leases, contracts, or other important documents. Obtain copies of the minutes or TC agreements for the current or permanent workpaper A-3 files. Highlight matters relevant to the related audit area or for which disclosure will be required in the 13 6 financial statement or notes Obtain an engagement letter from the client. A-4 DW Signed copy of engagement letter 14 received from the client on November 15 Complete Materiality Memo A-5 Complete a time budget by audit area. A-6 DW Rough draft completed, new senior to 16 track and expand time tracking Determine staffing assignments based on consideration Staff determined as of 12/01/2020 of audit risks, and discuss the preliminary audit plan and key dates, i.e. inventory observation, mailing of A-7 DW 17 10 confirmations, etc. with the audit staff. Electronically signed by all firm Complete independence forms for all firm employees. NA NA employees and filed on firm intranet as 18 of December 31, 2020. 19 20C D E G 2019 Trial Balance PBC Apollo Shoes, Inc Trial Balance (Audited) 31-Dec-19 AccountID Account Description Debit Credit Single Column format 10100 Cash on Hand $1,987.28 $1,987.28 10200 Regular Checking Account $198,116.52 $198,116.52 10300 Payroll Checking Account $0.00 $0.00 10400 Savings Account $3,044,958.13 $3,044,958.13 11000 Accounts Receivable $16,410,902.71 $16,410,902.71 11500 Allowance for Doubtful Accounts $1,262,819.88 ($1,262,819.88) 12000 Inventory - Spotlight $18,825,205.24 $18,825,205.24 12300 Reserve for Inventory Obsolescence $3,012,000.00 ($3,012,000.00) 14100 Prepaid Insurance $743,314.38 $743,314.38 14200 Prepaid Rent $200,000.00 $200,000.00 14300 Office Supplies $7,406.82 $7 ,406.82 14400 Notes Receivable-Current $0.00 14700 Other CurrentAssets $0.00 15000 Land $117,000.00 $117,000.00 15100 Buildings and Land Improvements $623,905.92 $623,905.92 15200 Machinery, Equipment, Office Furniture $433,217.10 $433,217.10 17000 Accum. Depreciation $163,500.00 ($163,500.00) 19000 Investments $572,691.08 $572,691.08 19900 Other NoncurrentAssets $53,840.59 $53,840.5 20000 Accounts Payable $4,633,118.09 ($4,633,118.09) 23100 Sales Tax Payable $0.00 $0.00 23200 Wages Payable $29,470.32 ($29,470.32) 23300 FICA Employee Withholding $1,318.69 318.69 23350 Medicare Withholding $583.99 ($583.99) 23400 Federal Payroll Taxes Payable $6,033.01 ($6,033.01) 23500 FUTA Tax Payable $0.00 23600 Slate Payroll Taxes Payable $2,815.47 ($2,815.47 23700 SUTA Tax Payable $0.00 23800 FICA Employer Withholding $1,318.69 $1,318.69) 23900 Medicare Employer Withholding $583.99 $583.99 24100 Line of Credit $10,000,000.00 ($10,000,000.00 24200 CurrentPortion Long-Term Debt $0.00 24700 Other CurrentLiabilities $0.00 27000 Notes Payable-Noncurrent $0.00 39003 Common Stock $8,105,000.00 ($8,105,000.00) 39004 Paid-in Capital $7 ,423,000.00 $7 ,423,000.00 39005 Retained Earnings $2,219,620.65 $2,219,620.65 40000 Sales $246,172,918.44 ($246,172,918.44 41000 Sales Returns $4,497,583.20 $4,497,583.20 42000 Warranty Expense $1,100,281.48 $1,100,281.48 45000 Income from Investments $0.00 $0.00 46000 Interestincome $204,302.81 ($204,302.81 50010 CostofGoods Sold $141,569,221.61 $141,569,221.61 57500 Freight $4,302,951.46 $4,302,951.46 60000 Advertising Expense $897,140.01 $897,140.01 $1000 Auto Expenses $208,974.39 $208,974.35 62000 Research and Development $31,212,334.17 $31,212,334.17 64000 Depreciation Expense 83,000.00 $133,000.0 $4500 Warehouse Salaries $4,633,383.82 $4,633,383.82 65000 Property Tax Expense $80,495.32 $80.495.32 66000 Legal and Professional Expense $3,605,133.96 $3,605,133.96 67000 Bad DebtExpense $1,622,425.9 $1,622,425.9 68000 Insurance Expense $853,942.65 $853,942.65 70000 Maintenance Expense $61,136.04 $61,136.04 70100 Utilities $135,642.9 $135,642.99 70110 Phone $76,373.78 $76,373.78 70120 Pos $128,033.21 28,033.21 1000 Miscellaneous Office Expense $17,023.27 $17,023.27 72000 Payroll Tax Exp $1,550,989.06 $1,550,989.06 73000 Pension/Profit-Sharing Plan Ex $3,000,000.00 $3,000,000.00 $2.603,485.87 $2,603,485.87 2 2 9 8 74000 Rentor Lease Expense 77500 Administrative Wages Expense $16 875.305.98 $16,875,305.98 78000 InterestExpense $875.000.00 $875,000.00 78500 Income Tax Expense - Federal 2,365,000.00 $2,365,000.0 78510 Income Tax Expense - Slate $429,000.00 $429,000.00 80000 Loss on Legal Settlement $19,172,00 $19,172,00 78B C D E G Apollo Shoes, Inc PBC Preclosing Trial Balance A-2 31-Dec-20 Account ID Account Description Debit Amt Credit Amt Single Column format 10100 Cash on Hand $2,275.23 $2,275.23 10200 Regular Checking Account $557,125.92 $557,125.92 10300 Payroll Checking Account $0.00 10400 Savings Account $3,645,599.15 $3,645,599.15 1 1000 Accounts Receivable $51,515,259.98 $51,515,259.98 11400 Other Receivables $1,250,000.00 $1,250,000.00 11500 Allowance for Doubtful Accounts $1,239,009.75 ($1,239,009.75) 12000 Inventory $67,724,527.50 $67,724,527.50 12300 Reserve for Inventory Obsolescence $846,000.00 ($846,000.00) 14100 Prepaid Insurance $3,424,213.78 $3,424,213.78 14200 Prepaid Rent $0.00 14300 Office Supplies $8,540.00 $8,540.00 14400 Notes Receivable-Current $0.00 14700 Other Current Assets $0.00 15000 Land $117,000.00 $117,000.00 15100 Buildings and Land Improvemen $674,313.92 $674,313.92 15200 Machinery, Equipment, Office F $2,929,097.13 $2,929,097.13 17000 Accum. Depreciation $610,000.00 ($610,000.00) 19000 Investments $1,998,780.39 $1,998,780.39 19900 Other Noncurrent Assets $53,840.59 $53,840.59 20000 Accounts Payable $1,922,095.91 ($1,922,095.91) 23100 Sales Tax Payable $0.00 23200 Wages Payable $0.00 23300 FICA Employee Withholding $8,439.65 ($8,439.65) 23350 Medicare Withholding $11,414.99 ($11,414.99) 23400 Federal Payroll Taxes Payable $118,086.12 ($1 18,086.12) 23500 FUTA Tax Payable $0.00 23600 State Payroll Taxes Payable $55,106.86 $55,106.86) 23700 SUTA Tax Payable $0.00 23800 FICA Employer Withholding $8,439.65 ($8,439.65) 23900 Medicare Employer Withholding $11,414.99 ($11,414.99) 24100 Line of Credit $44,403,000.00 ($44,403,000.00) 24200 Current Portion Long-Term Debt $0.00 24700 Other Current Liabilities $0.00 27000 Notes Payable-Noncurrent $12,000,000.00 ($12,000,000.00) 39003 Common Stock $8, 105,000.00 ($8, 105,000.00) 39004 Paid-in Capital $7,423,000.00 ($7,423,000.00) 39005 Retained Earnings $6,590,483.64 ($6,590,483.64) 40000 Sales ($242,713,452.88) 41000 Sales Returns $11,100,220.89 $11,100,220.89 42000 Warranty Expense $1,158,128.47 $1,158,128.47 45000 Income from Investments $1,426,089.31 ($1,426,089.31) 46000 Interest Income $131,881.46 ($131,881.46) 47000 Miscellaneous Income $2,166,000.00 ($2, 166,000.00) 50010 Cost of Goods Sold $130,196,645.26 $130,196,645.26 57500 Freight $4,240,263.09 $4,240,263.09 60000 Advertising Expense $1,036,854.01 $1,036,854.01 61000 Auto Expenses $210,502.80 $210,502.80 62000 Research and Development $528,870.44 $528,870.44 64000 Depreciation Expense $446,000.00 $446,000.00 64500 Warehouse Salaries $4,720,715.56 $4,720,715.56 65000 Property Tax Expense $99,332.45 $99,332.45 66000 Legal and Professional Expense $4,913,224.45 $4,913,224.45 67000 Bad Debt Expense $0.00 68000 Insurance Expense $36,106.92 $36, 106.92 70000 Maintenance Expense $35,502.87 $35,502.87 70100 Utilities $137,332.18 $137,332.18 70110 Phone $52,599.02 $52,599.02 70120 Postal $77,803.61 $77,803.61 71000 Miscellaneous Office Expense $24,891.82 $24,891.82 72000 Payroll Tax Exp $1,577,811.85 $1,577,811.85 73000 Pension/Profit-Sharing Plan Ex $3,630,375.80 $3,630,375.80 78600 Controllers' Clearning Account $330,375.80 ($330,375.80) 74000 Rent or Lease Expense $1,206,574.00 $1,206,574.00 77500 Administrative Wages Expense $16,197,225.43 $16,197,225.43 78000 Interest Expense $2,591,736.50 $2,591,736.50A B C D E F G H Apollo Shoes, Inc A-6 Audit Budget Prepared by: DW 31-Dec-20 Reviewed by: JAA Auditor Billing Rate Audit Area Projected Hours Actual Hours Extended Cost Darlene Wardlaw 357 Planning 300 107,100 Taylor Crump 225 Internal Control Testing 275 61,875 Senior 298 Cash 150 44,700 Senior 298 Accounts Receivable 180 53,640 Taylor Crump 225 Inventory 150 33,750 Taylor Crump 225 Prepaids 90 20,250 Taylor Crump 225 Property, Plant and Equipment 200 45,000 Taylor Crump 225 Other Assets 90 20,250 Senior 298 Current Liabilities 200 59,600 Senior 298 Notes Payable 150 44,700 Darlene Wardlaw 357 Stockholders' Equity 250 89,250 Senior 298 Revenue 200 59,600 Taylor Crump 225 Expenses 200 45,000 Total $ 684,715.00 Contracted Price $ 750,000.00 Profit $ 65,285.00B C D E F G H Apollo Shoe A-5 ENGAGEMENT MATERIALITY Prepared by (Required for all engagements) Reviewed by CLIENT: Apollo Shoes PERIOD ENDED: December 31,2020 This completed form must be provided to the engagement quality control reviewer in the planning stage of every audit. Please complete all the cells highlighted in yellow. 8 10 PLANNING MATERIALITY CALCULATION 11 Only if the current year net income (loss ) (or other measure) is significantly different from the entity's historical results would 12 2-year avenging to obtain normalized net income (loss )(or other measure ) be appropriate. 13 PROFITORIENTED ENTITIES Current Year Prior Year 14 Net income (loss) Plus (minus ) unusual, non-securing revenues and 15 expenses, and eatmoodinary items. 16 ADJUSTED NET INCOME (LOSS) 17 18 Adjusted net income (loss ) multiplied by 19 Current Year TOTAL ASSETS Total assets makiplied by: Current Year TOTAL REVENUES Plus (minus ) unusual, non-securing Revenues ADJUSTED REVENUES 33 Total adjusted revenues makiplied by: 34 19% 35 36 37 JUSTIFICATION OF PLANNING MATERIALITY 38 1. Financial data source (le. actual, budget, projection): Yearend trial balance, actual data obtained from client. 39 40 2. Basis Le. normalized net income, revenue, total Adjusted net income 41 assets, other ): 42 Justifications USE THIS BOX TO DOCUMENT AND JUSTIFY WHICH BASIS YOU'VE SELECTED 43 44 45 46 handand ?Me used. 47 3. Percentage of financial data source used: 48 49 50 4. Amount selected (planning materiality) 51 Being that Apollo is a new client and we were not provided with materiality amounts from the predecessor auditor, we assume that planning materiality is 3% of net income from 2019. 52 5. Prior year's final materiality 53 6. Performance materiality/Tolerable misstatement 54 (35% of planning materiality 55 7. Listing scope (amount threshold for suggested adjustments ) (using 5% to 10% of planning materiality based on expected level of adjustments is usually appropriate) 56 57 5%% 58 59 Engagement Partner Engagement Quality Control Reviewer 65Apollo Shoes, Inc. Audit Stafng Memo - A7 December 31, 2020 Based on the information reviewed in the Apollo Shoes 10-K, minutes of the board of directors, and other documents, I believe that the audit team will require the following specialized expertise: a. Special expertise in Apollo' s business and products 1s probably not necessary. The products are ordinary shoes. The company gave no indication of dealing 111 complicated transactions such as rubber futures hedging. Auditors with general retail and wholesale experience ought to be able to cope with the expertise demands. b. The audit team will need some special expertise in several areas: (1) the tax personnel probably know how to prepare the state franchise tax return, and that expertise might not be very special, (2) auditors with SEC knowledge and experience will need to participate, and (3) the team will need people with computer expertise on the engagement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts