Question: please help me understand with some short written explanations, questions 12 AND 17 ONLY please 9 thank you DISCUSSION QUESTIONS SOLUTIONS to the discussion questions

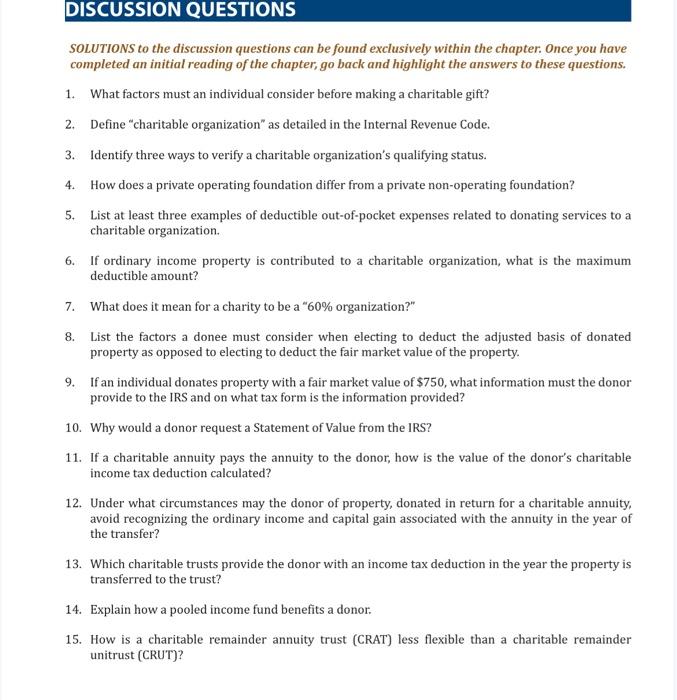

DISCUSSION QUESTIONS SOLUTIONS to the discussion questions can be found exclusively within the chapter. Once you have completed an initial reading of the chapter, go back and highlight the answers to these questions. 1. What factors must an individual consider before making a charitable gift? 2. Define "charitable organization" as detailed in the Internal Revenue Code. 3. Identify three ways to verify a charitable organization's qualifying status. 4. How does a private operating foundation differ from a private non-operating foundation? 5. List at least three examples of deductible out-of-pocket expenses related to donating services to a charitable organization. 6. If ordinary income property is contributed to a charitable organization, what is the maximum deductible amount? 7. What does it mean for a charity to be a " 60% organization?" 8. List the factors a donee must consider when electing to deduct the adjusted basis of donated property as opposed to electing to deduct the fair market value of the property. 9. If an individual donates property with a fair market value of $750, what information must the donor provide to the IRS and on what tax form is the information provided? 10. Why would a donor request a Statement of Value from the IRS? 11. If a charitable annuity pays the annuity to the donor, how is the value of the donor's charitable income tax deduction calculated? 12. Under what circumstances may the donor of property, donated in return for a charitable annuity, avoid recognizing the ordinary income and capital gain associated with the annuity in the year of the transfer? 13. Which charitable trusts provide the donor with an income tax deduction in the year the property is transferred to the trust? 14. Explain how a pooled income fund benefits a donor: 15. How is a charitable remainder annuity trust (CRAT) less flexible than a charitable remainder unitrust (CRUT)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts