Question: please help me with all the required please help Erin Shelton, Incorporated, wants to earn a target profit of $900,000 this year. The conpany's fixed

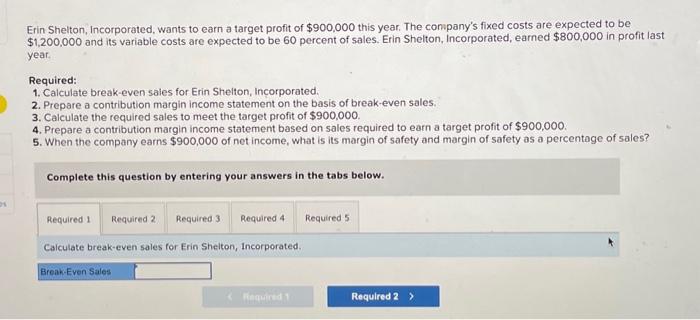

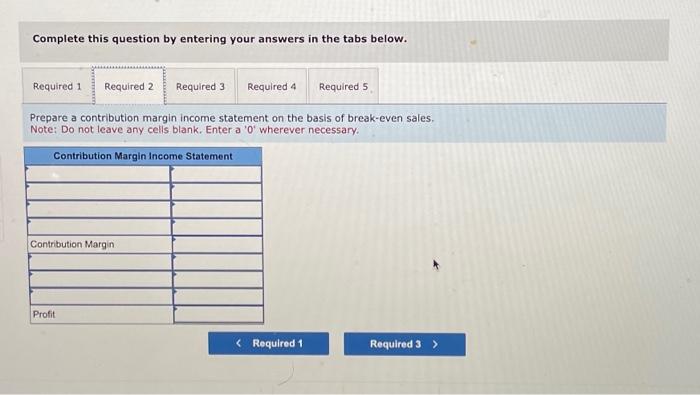

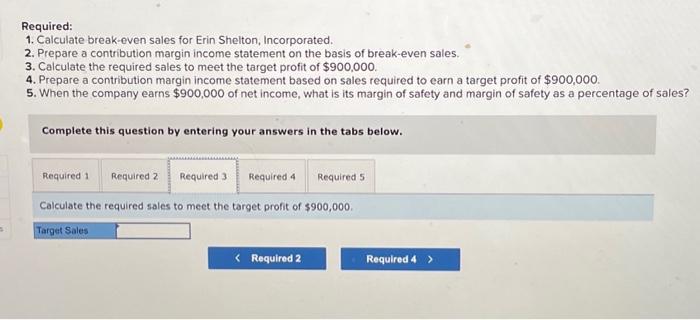

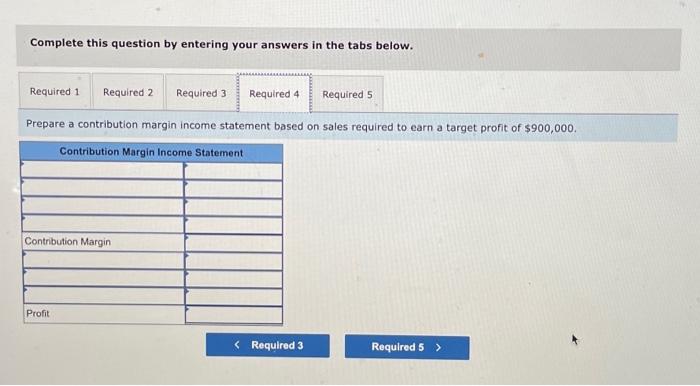

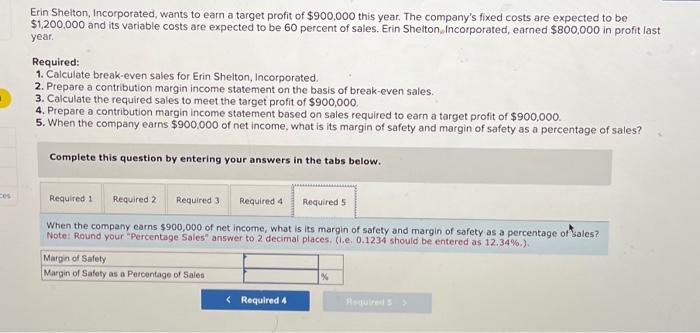

Erin Shelton, Incorporated, wants to earn a target profit of $900,000 this year. The conpany's fixed costs are expected to be $1,200,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Incorporated, earned $800,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Incorporated. 2. Prepare a contribution margin income statement on the basis of break-even sales. 3. Calculate the required sales to meet the target profit of $900,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $900,000. 5. When the company earns $900,000 of net income, what is its margin of safety and margin of safety as a percentoge of sales? Complete this question by entering your answers in the tabs below. Calculate break-even sales for Erin Sheiton, Incorporated. Complete this question by entering your answers in the tabs below. Prepare a contribution margin income statement on the basis of break-even sales. Note: Do not leave any cells blank. Enter a ' 0 ' wherever necessary. Required: 1. Calculate break-even sales for Erin Shelton, Incorporated. 2. Prepare a contribution margin income statement on the basis of break-even sales. 3. Calculate the required sales to meet the target profit of $900,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $900,000. 5. When the company earns $900,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Calculate the required sales to meet the target profit of $900,000. Complete this question by entering your answers in the tabs below. Prepare a contribution margin income statement based on sales required to earn a target profit of $900,000. Erin Sheiton, Incorporated, wants to earn a target profit of $900,000 this year. The company's fixed costs are expected to be $1,200,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton. Incorporated, earned $800,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Incorporated. 2. Prepare a contribution margin income statement on the basis of break-even sales. 3. Calculate the required sales to meet the target profit of $900,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $900,000. 5. When the company earns $900,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. When the company earns $900,000 of net income, what is its margin of safety and margin of safety as a percentage of t ales? Note: Round your "Percentage Sales" answer to 2 decimal places. (1.e, 0.1234 should be entered as 12.34%.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts