Question: please help with required's 2, 3, 4, & 5 ty! Erin Shelton, Inc., wants to earn a target profit of $930,000 this year. The company's

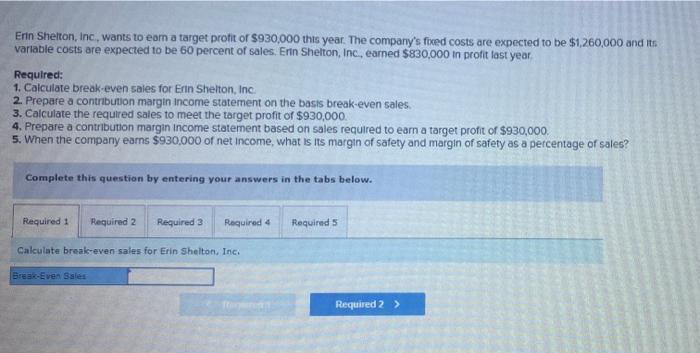

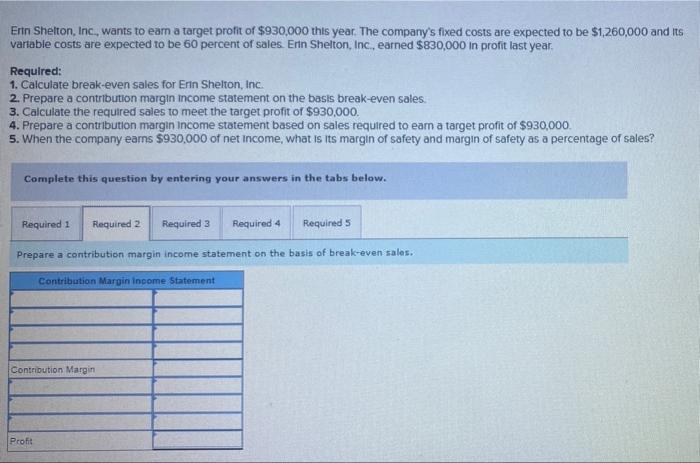

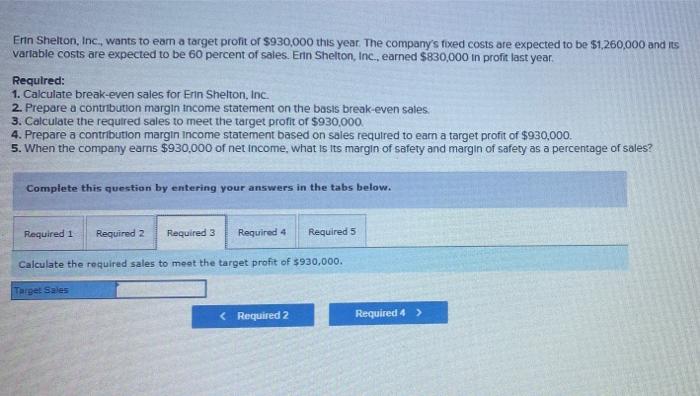

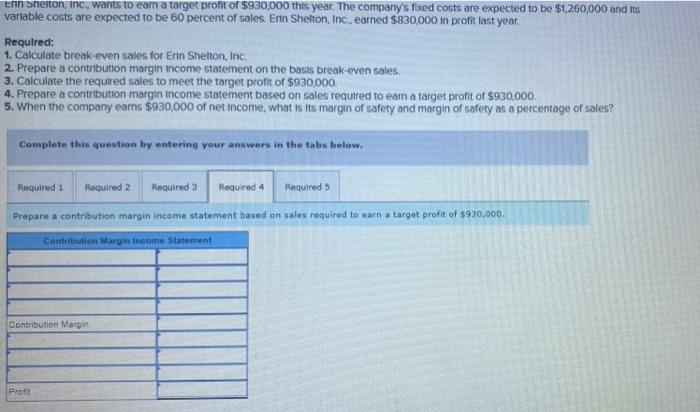

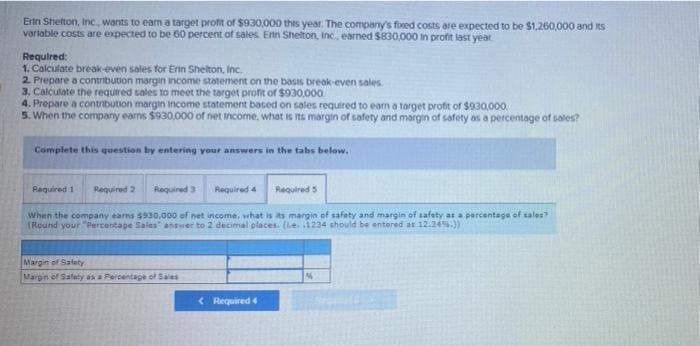

Erin Shelton, Inc., wants to earn a target profit of $930,000 this year. The company's fixed costs are expected to be $1,260,000 and Its variable costs are expected to be 60 percent of sales. Erin Shelton, Inc., earned $830,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $930,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $930,000. 5. When the company earns $930,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate break-even sales for Erin Shelton, Inc. Break-Even Sales Required 4 Required 5 Required 2 > Erin Shelton, Inc., wants to earn a target profit of $930,000 this year. The company's fixed costs are expected to be $1,260,000 and Its variable costs are expected to be 60 percent of sales. Erin Shelton, Inc., earned $830,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $930,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $930,000. 5. When the company earns $930,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a contribution margin income statement on the basis of break-even sales. Contribution Margin Income Statement Contribution Margin Profit Erin Shelton, Inc., wants to earn a target profit of $930,000 this year. The company's fixed costs are expected to be $1,260,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Inc., earned $830,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $930,000. 4. Prepare a contribution margin Income statement based on sales required to earn a target profit of $930,000. 5. When the company earns $930,000 of net income, what is Its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Target Sales Required 4 Calculate the required sales to meet the target profit of $930,000. Required 5 Enn Shelton, Inc., wants to earn a target profit of $930,000 this year. The company's fixed costs are expected to be $1,260,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Inc., earned $830,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $930,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $930,000. 5. When the company ears $930,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Prepare a contribution margin income statement based on sales required to earn a target profit of $930,000. Contribution Margin Income Statement Contribution Margin Required 5 Profit Erin Shelton, Inc., wants to earn a target profit of $930,000 this year. The company's fixed costs are expected to be $1,250,000 and its variable costs are expected to be 60 percent of sales. Enn Shelton, Inc., earned $830,000 in profit last year Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $930,000 4. Prepare a contribution margin income statement based on sales required to earn a torget profit of $930,000 5. When the company earns $930,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Margin of Safety Margin of Safety as a Percentage of Sales When the company earns $930,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? (Round your "Percentage Sales answer to 2 decimal places. (e. .1234 should be entered as 12.24%.)) Required 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts