Question: PLEASE HELP ME WITH CASE! PLEASE PROVIDE STEP BY STEP EXPLANATIONS! THANK YOU! answer the questions in the attached exercises. note that the data for

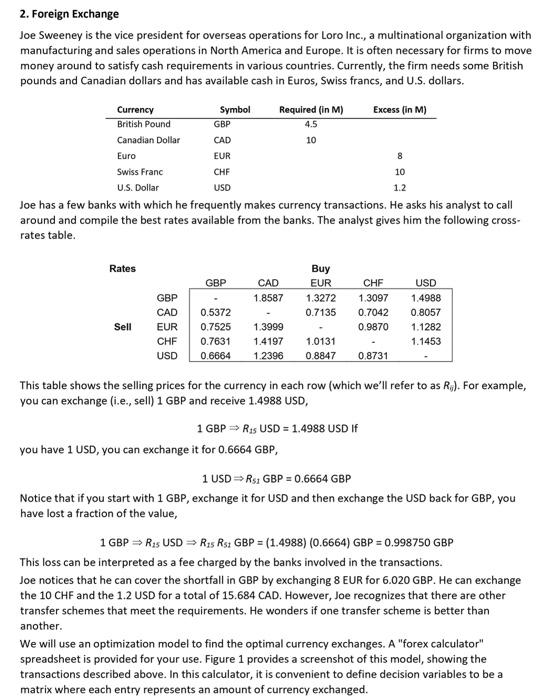

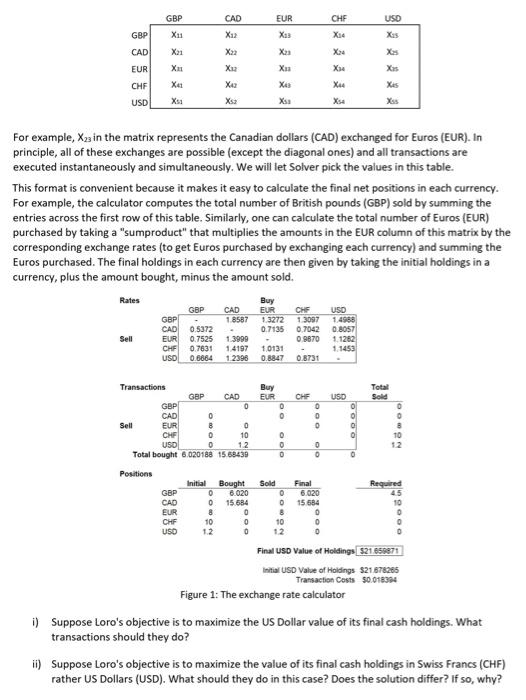

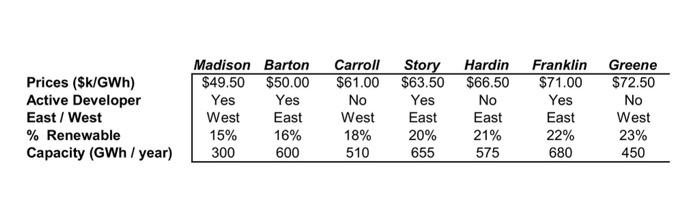

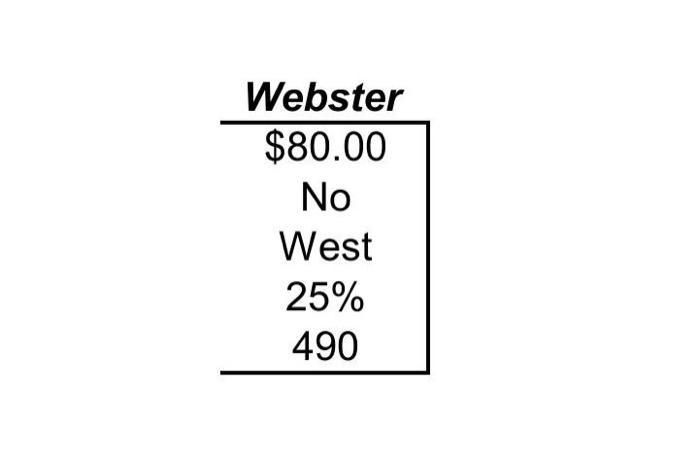

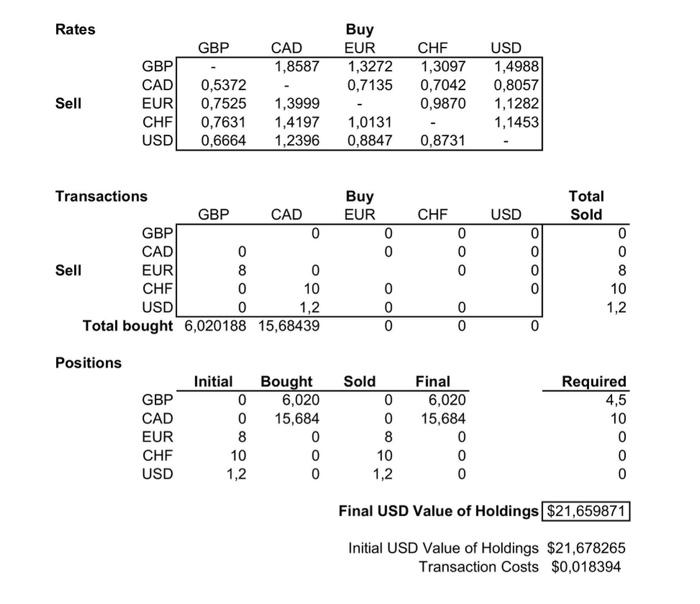

2. Foreign Exchange Joe Sweeney is the vice president for overseas operations for Loro Inc., a multinational organization with manufacturing and sales operations in North America and Europe. It is often necessary for firms to move money around to satisfy cash requirements in various countries. Currently, the firm needs some British pounds and Canadian dollars and has available cash in Euros, Swiss francs, and U.S. dollars. Joe has a few banks with which he frequently makes currency transactions. He asks his analyst to call around and compile the best rates available from the banks. The analyst gives him the following crossrates table. This table shows the selling prices for the currency in each row (which we'll refer to as Rij ). For example, you can exchange (i.e., sell) 1GBP and receive 1.4988 USD, 1GBPRtsUSD=1.4988USDIf you have 1 USD, you can exchange it for 0.6664GBP, 1USDRs1GBP=0.6664GBP Notice that if you start with 1 GBP, exchange it for USD and then exchange the USD back for GBP, you have lost a fraction of the value, 1GBPR15USDR15R51GBP=(1.4988)(0.6664)GBP=0.998750GBP This loss can be interpreted as a fee charged by the banks involved in the transactions. Joe notices that he can cover the shortfall in GBP by exchanging 8 EUR for 6.020GBP. He can exchange the 10CHF and the 1.2 USD for a total of 15.684 CAD. However, Joe recognizes that there are other transfer schemes that meet the requirements. He wonders if one transfer scheme is better than another. We will use an optimization model to find the optimal currency exchanges. A "forex calculator" spreadsheet is provided for your use. Figure 1 provides a screenshot of this model, showing the transactions described above. In this calculator, it is convenient to define decision variables to be a matrix where each entry represents an amount of currency exchanged. For example, X23 in the matrix represents the Canadian dollars (CAD) exchanged for Euros (EUR). In principle, all of these exchanges are possible (except the diagonal ones) and all transactions are executed instantaneously and simultaneously. We will let Solver pick the values in this table. This format is convenient because it makes it easy to calculate the final net positions in each currency. For example, the calculator computes the total number of British pounds (GBP) sold by summing the entries across the first row of this table. Similarly, one can calculate the total number of Euros (EUR) purchased by taking a "sumproduct" that multiplies the amounts in the EUR column of this matrix by the corresponding exchange rates (to get Euros purchased by exchanging each currency) and summing the Euros purchased. The final holdings in each currency are then given by taking the initial holdings in a currency, plus the amount bought, minus the amount sold. Pesitioes Final uSD Value of Holdings 521,650871 linitial USD Value of Holdings 521.678265 Tramaction Cests 50.018934 Figure 1: The exchange rate calculator i) Suppose Loro's objective is to maximize the US Dollar value of its final cash holdings. What transactions should they do? ii) Suppose Loro's objective is to maximize the value of its final cash holdings in Swiss Francs (CHF) rather US Dollars (USD). What should they do in this case? Does the solution differ? If so, why? Prices (\$k/GWh) Active Developer East / West % Renewable Capacity (GWh / year) \begin{tabular}{|ccccccc} \multicolumn{1}{c}{ Madison } & Barton & Carroll & Story & Hardin & Franklin & Greene \\ \hline$49.50 & $50.00 & $61.00 & $63.50 & $66.50 & $71.00 & $72.50 \\ Yes & Yes & No & Yes & No & Yes & No \\ West & East & West & East & East & East & West \\ 15% & 16% & 18% & 20% & 21% & 22% & 23% \\ 300 & 600 & 510 & 655 & 575 & 680 & 450 \\ \hline \end{tabular} \begin{tabular}{l|} \multicolumn{1}{l}{ Webster } \\ \hline$80.00 \\ No \\ West \\ 25% \\ 490 \\ \hline \end{tabular} Positions Final USD Value of Holdings Initial USD Value of Holdings $21,678265 Transaction Costs $0,018394 2. Foreign Exchange Joe Sweeney is the vice president for overseas operations for Loro Inc., a multinational organization with manufacturing and sales operations in North America and Europe. It is often necessary for firms to move money around to satisfy cash requirements in various countries. Currently, the firm needs some British pounds and Canadian dollars and has available cash in Euros, Swiss francs, and U.S. dollars. Joe has a few banks with which he frequently makes currency transactions. He asks his analyst to call around and compile the best rates available from the banks. The analyst gives him the following crossrates table. This table shows the selling prices for the currency in each row (which we'll refer to as Rij ). For example, you can exchange (i.e., sell) 1GBP and receive 1.4988 USD, 1GBPRtsUSD=1.4988USDIf you have 1 USD, you can exchange it for 0.6664GBP, 1USDRs1GBP=0.6664GBP Notice that if you start with 1 GBP, exchange it for USD and then exchange the USD back for GBP, you have lost a fraction of the value, 1GBPR15USDR15R51GBP=(1.4988)(0.6664)GBP=0.998750GBP This loss can be interpreted as a fee charged by the banks involved in the transactions. Joe notices that he can cover the shortfall in GBP by exchanging 8 EUR for 6.020GBP. He can exchange the 10CHF and the 1.2 USD for a total of 15.684 CAD. However, Joe recognizes that there are other transfer schemes that meet the requirements. He wonders if one transfer scheme is better than another. We will use an optimization model to find the optimal currency exchanges. A "forex calculator" spreadsheet is provided for your use. Figure 1 provides a screenshot of this model, showing the transactions described above. In this calculator, it is convenient to define decision variables to be a matrix where each entry represents an amount of currency exchanged. For example, X23 in the matrix represents the Canadian dollars (CAD) exchanged for Euros (EUR). In principle, all of these exchanges are possible (except the diagonal ones) and all transactions are executed instantaneously and simultaneously. We will let Solver pick the values in this table. This format is convenient because it makes it easy to calculate the final net positions in each currency. For example, the calculator computes the total number of British pounds (GBP) sold by summing the entries across the first row of this table. Similarly, one can calculate the total number of Euros (EUR) purchased by taking a "sumproduct" that multiplies the amounts in the EUR column of this matrix by the corresponding exchange rates (to get Euros purchased by exchanging each currency) and summing the Euros purchased. The final holdings in each currency are then given by taking the initial holdings in a currency, plus the amount bought, minus the amount sold. Pesitioes Final uSD Value of Holdings 521,650871 linitial USD Value of Holdings 521.678265 Tramaction Cests 50.018934 Figure 1: The exchange rate calculator i) Suppose Loro's objective is to maximize the US Dollar value of its final cash holdings. What transactions should they do? ii) Suppose Loro's objective is to maximize the value of its final cash holdings in Swiss Francs (CHF) rather US Dollars (USD). What should they do in this case? Does the solution differ? If so, why? Prices (\$k/GWh) Active Developer East / West % Renewable Capacity (GWh / year) \begin{tabular}{|ccccccc} \multicolumn{1}{c}{ Madison } & Barton & Carroll & Story & Hardin & Franklin & Greene \\ \hline$49.50 & $50.00 & $61.00 & $63.50 & $66.50 & $71.00 & $72.50 \\ Yes & Yes & No & Yes & No & Yes & No \\ West & East & West & East & East & East & West \\ 15% & 16% & 18% & 20% & 21% & 22% & 23% \\ 300 & 600 & 510 & 655 & 575 & 680 & 450 \\ \hline \end{tabular} \begin{tabular}{l|} \multicolumn{1}{l}{ Webster } \\ \hline$80.00 \\ No \\ West \\ 25% \\ 490 \\ \hline \end{tabular} Positions Final USD Value of Holdings Initial USD Value of Holdings $21,678265 Transaction Costs $0,018394

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts