Question: PLEASE HELP ME WITH CASE! PLEASE PROVIDE STEP BY STEP EXPLANATIONS! THANK YOU SO MUCH! answer the questions in the attached exercises. note that the

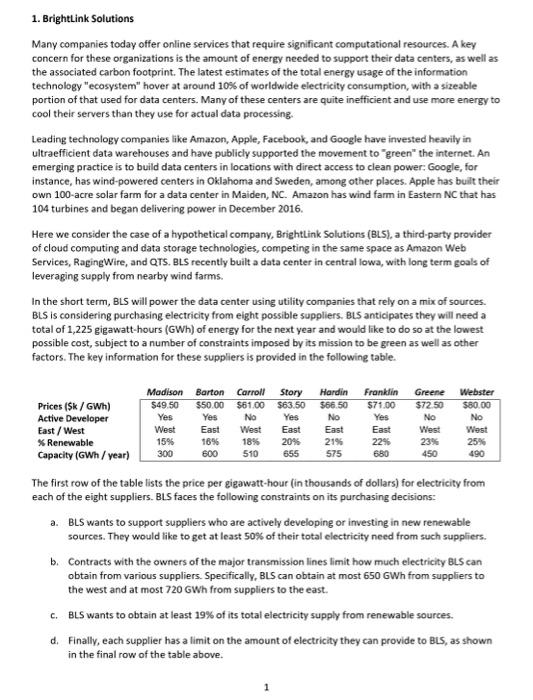

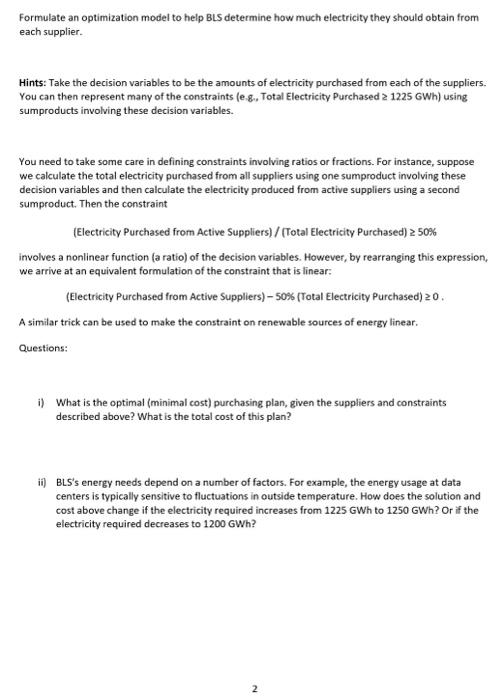

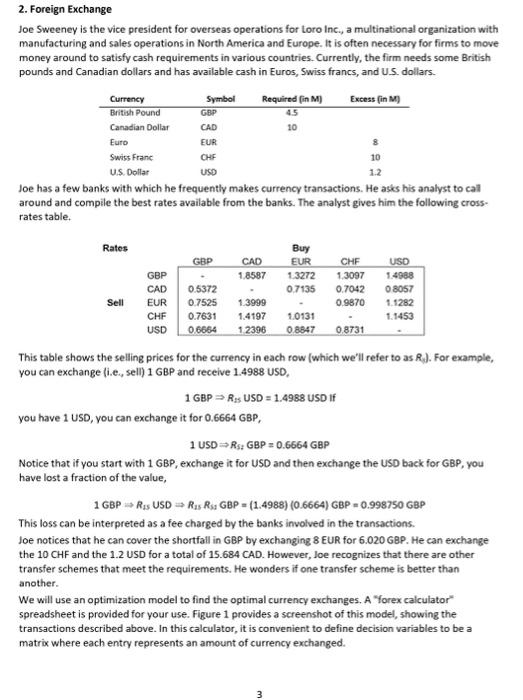

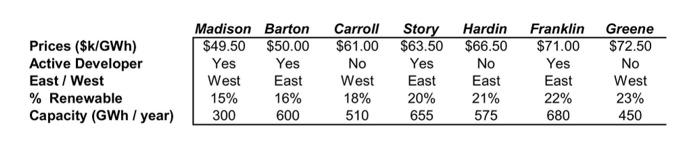

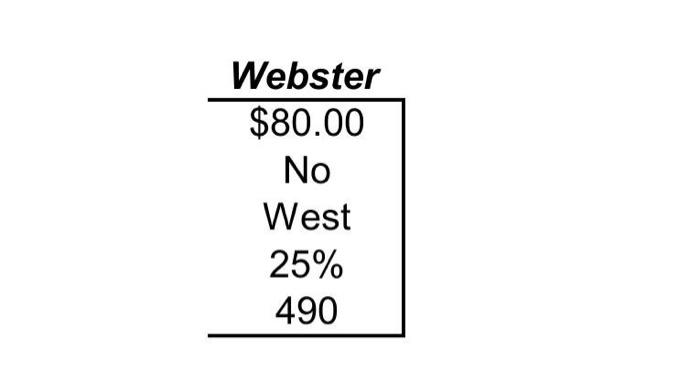

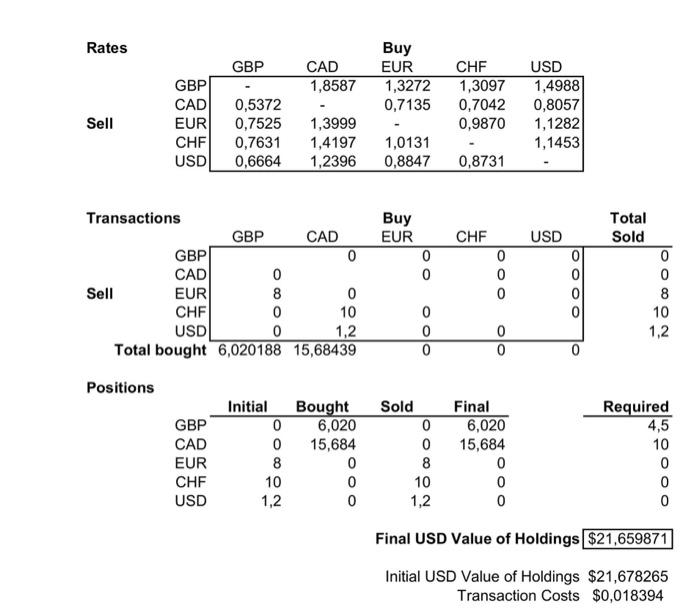

1. BrightLink Solutions Many companies today offer online services that require significant computational resources. A key concern for these organizations is the amount of energy needed to support their data centers, as well as the associated carbon footprint. The latest estimates of the total energy usage of the information technology "ecosystem" hover at around 10% of worldwide electricity consumption, with a sizeable portion of that used for data centers. Many of these centers are quite inefficient and use more energy to cool their servers than they use for actual data processing. Leading technology companies like Amazon, Apple, Facebook, and Google have invested heavily in ultraefficient data warehouses and have publicly supported the movement to "green" the internet. An emerging practice is to build data centers in locations with direct access to clean power: Google, for instance, has wind-powered centers in Oklahoma and Sweden, among other places. Apple has bullt their own 100-acre solar farm for a data center in Maiden, NC. Amazon has wind farm in Eastern NC that has 104 turbines and began delivering power in December 2016. Here we consider the case of a hypothetical company, Brightlink Solutions (BLS), a third-party provider of cloud computing and data storage technologies, competing in the same space as Amazon Web Services, RagingWire, and QTS. BLS recently built a data center in central lowa, with long term goals of leveraging supply from nearby wind farms. In the short term, BLS will power the data center using utility companies that rely on a mix of sources. BLS is considering purchasing electricity from eight possible suppliers. BLS anticipates they will need a total of 1,225 gigawatt-hours (GWh) of energy for the next year and would like to do so at the lowest possible cost, subject to a number of constraints imposed by its mission to be green as well as other factors. The key information for these suppliers is provided in the following table. The first row of the table lists the price per gigawatt-hour (in thousands of dollars) for electricity from each of the eight suppliers. BLS faces the following constraints on its purchasing decisions: a. BLS wants to support suppliers who are actively developing or investing in new renewable sources. They would like to get at least 50% of their total electricity need from such suppliers. b. Contracts with the owners of the major transmission lines limit how much electricity BLS can obtain from various suppliers. Specifically, BLS can obtain at most 650GWh from suppliers to the west and at most 720GWh from suppliers to the east. c. BLS wants to obtain at least 19% of its total electricity supply from renewable sources. d. Finally, each supplier has a limit on the amount of electricity they can provide to BLS, as shown in the final row of the table above. Formulate an optimization model to help BLS determine how much electricity they should obtain from each supplier. Hints: Take the decision variables to be the amounts of electricity purchased from each of the suppliers. You can then represent many of the constraints (e.8. Total Electricity Purchased 1225GWh ) using sumproducts involving these decision variables. You need to take some care in defining constraints involving ratios or fractions. For instance, suppose we calculate the total electricity purchased from all suppliers using one sumproduct involving these decision variables and then calculate the electricity produced from active suppliers using a second sumproduct. Then the constraint (Electricity Purchased from Active Suppliers) / (Total Electricity Purchased) 50% involves a nonlinear function (a ratio) of the decision variables. However, by rearranging this expression, we arrive at an equivalent formulation of the constraint that is linear: (Electricity Purchased from Active Suppliers) - 50% (Total Electricity Purchased) 0. A similar trick can be used to make the constraint on renewable sources of energy linear. Questions: i) What is the optimal (minimal cost) purchasing plan, given the suppliers and constraints described above? What is the total cost of this plan? ii) BLS's energy needs depend on a number of factors. For example, the energy usage at data centers is typically sensitive to fluctuations in outside temperature. How does the solution and cost above change if the electricity required increases from 1225GWh to 1250GWh ? Or if the electricity required decreases to 1200 GWh? 2. Foreign Exchange Joe Sweeney is the vice president for overseas operations for toro Inc., a multinational organization with manufacturing and sales operations in North America and Europe. It is often necessary for firms to move money around to satisfy cash requirements in various countries. Currently, the firm needs some British pounds and Canadian dollars and has available cash in Euros, Swiss francs, and U.S. dollars. Joe has a few banks with which he frequently makes currency transactions. He asks his analyst to call around and compile the best rates available from the banks. The analyst gives him the following crossrates table. you can exchange (i.e., sell) 1GBP and receive 1.4988 USD, 1GBPRSSUSD=1.4988USDif you have 1 USD, you can exchange it for 0.6664GBP, 1USDR5:GBP=0.6664GBP Notice that if you start with 1GBP, exchange it for USD and then exchange the USD back for GBP, you have lost a fraction of the value, 1GBPR1SUSDR15Rs4GBP=(1.4988)(0.6664)GBP=0.998750GBP This loss can be interpreted as a fee charged by the banks involved in the transactions. Joe notices that he can cover the shortfall in GBP by exchanging 8 EUR for 6.020GBP. He can exchange the 10CHF and the 1.2 USD for a total of 15.684 CAD. However, Joe recognizes that there are other transfer schemes that meet the requirements. He wonders if one transfer scheme is better than another. We will use an optimization model to find the optimal currency exchanges. A "forex calculator" spreadsheet is provided for your use. Figure 1 provides a screenshot of this model, showing the transactions described above. In this calculator, it is convenient to define decision variables to be a matrix where each entry represents an amount of currency exchanged. For example, X23 in the matrix represents the Canadian dollars (CAD) exchanged for Euros (EUR). In principle, all of these exchanges are possible (except the diagonalones) and all transactions are executed instantaneously and simultaneously. We will let Solver pick the values in this table. This format is convenient because it makes it easy to calculate the final net positions in each currency. For example, the calculator computes the total number of British pounds (GBP) sold by summing the entries across the first row of this table. Similarly, one can calculate the total number of Euros (EUR) purchased by taking a "sumproduct" that multiplies the amounts in the EUR column of this matrix by the corresponding exchange rates (to get Euros purchased by exchanging each currency) and summing the Euros purchased. The final holdings in each currency are then given by taking the initial holdings in a currency, plus the amount bought, minus the amount sold. Positin Final usD Value of Heldings $21.659871 Intai USb value of Haltings 521.874265 Thanketon Cosh 10 crabs4 Figure 1: The exchange rate calculator i) Suppose Loro's objective is to maximize the US Dollar value of its final cash holdings. What transactions should they do? ii) Suppose Loro's objective is to maximize the value of its final cash holdings in Swiss Francs (CHF) rather US Dollars (USD). What should they do in this case? Does the solution differ? If so, why? Prices (\$k/GWh) Active Developer East / West \% Renewable Capacity (GWh / year) \begin{tabular}{|ccccccc} \multicolumn{1}{c}{ Madison } & Barton & Carroll & Story & Hardin & Franklin & Greene \\ \hline$49.50 & $50.00 & $61.00 & $63.50 & $66.50 & $71.00 & $72.50 \\ Yes & Yes & No & Yes & No & Yes & No \\ West & East & West & East & East & East & West \\ 15% & 16% & 18% & 20% & 21% & 22% & 23% \\ 300 & 600 & 510 & 655 & 575 & 680 & 450 \\ \hline \end{tabular} \begin{tabular}{c|} \hline Webster \\ \hline$80.00 \\ No \\ West \\ 25% \\ 490 \\ \hline \end{tabular} Final USD Value of Holdings Initial USD Value of Holdings $21,678265 Transaction Costs $0,018394 1. BrightLink Solutions Many companies today offer online services that require significant computational resources. A key concern for these organizations is the amount of energy needed to support their data centers, as well as the associated carbon footprint. The latest estimates of the total energy usage of the information technology "ecosystem" hover at around 10% of worldwide electricity consumption, with a sizeable portion of that used for data centers. Many of these centers are quite inefficient and use more energy to cool their servers than they use for actual data processing. Leading technology companies like Amazon, Apple, Facebook, and Google have invested heavily in ultraefficient data warehouses and have publicly supported the movement to "green" the internet. An emerging practice is to build data centers in locations with direct access to clean power: Google, for instance, has wind-powered centers in Oklahoma and Sweden, among other places. Apple has bullt their own 100-acre solar farm for a data center in Maiden, NC. Amazon has wind farm in Eastern NC that has 104 turbines and began delivering power in December 2016. Here we consider the case of a hypothetical company, Brightlink Solutions (BLS), a third-party provider of cloud computing and data storage technologies, competing in the same space as Amazon Web Services, RagingWire, and QTS. BLS recently built a data center in central lowa, with long term goals of leveraging supply from nearby wind farms. In the short term, BLS will power the data center using utility companies that rely on a mix of sources. BLS is considering purchasing electricity from eight possible suppliers. BLS anticipates they will need a total of 1,225 gigawatt-hours (GWh) of energy for the next year and would like to do so at the lowest possible cost, subject to a number of constraints imposed by its mission to be green as well as other factors. The key information for these suppliers is provided in the following table. The first row of the table lists the price per gigawatt-hour (in thousands of dollars) for electricity from each of the eight suppliers. BLS faces the following constraints on its purchasing decisions: a. BLS wants to support suppliers who are actively developing or investing in new renewable sources. They would like to get at least 50% of their total electricity need from such suppliers. b. Contracts with the owners of the major transmission lines limit how much electricity BLS can obtain from various suppliers. Specifically, BLS can obtain at most 650GWh from suppliers to the west and at most 720GWh from suppliers to the east. c. BLS wants to obtain at least 19% of its total electricity supply from renewable sources. d. Finally, each supplier has a limit on the amount of electricity they can provide to BLS, as shown in the final row of the table above. Formulate an optimization model to help BLS determine how much electricity they should obtain from each supplier. Hints: Take the decision variables to be the amounts of electricity purchased from each of the suppliers. You can then represent many of the constraints (e.8. Total Electricity Purchased 1225GWh ) using sumproducts involving these decision variables. You need to take some care in defining constraints involving ratios or fractions. For instance, suppose we calculate the total electricity purchased from all suppliers using one sumproduct involving these decision variables and then calculate the electricity produced from active suppliers using a second sumproduct. Then the constraint (Electricity Purchased from Active Suppliers) / (Total Electricity Purchased) 50% involves a nonlinear function (a ratio) of the decision variables. However, by rearranging this expression, we arrive at an equivalent formulation of the constraint that is linear: (Electricity Purchased from Active Suppliers) - 50% (Total Electricity Purchased) 0. A similar trick can be used to make the constraint on renewable sources of energy linear. Questions: i) What is the optimal (minimal cost) purchasing plan, given the suppliers and constraints described above? What is the total cost of this plan? ii) BLS's energy needs depend on a number of factors. For example, the energy usage at data centers is typically sensitive to fluctuations in outside temperature. How does the solution and cost above change if the electricity required increases from 1225GWh to 1250GWh ? Or if the electricity required decreases to 1200 GWh? 2. Foreign Exchange Joe Sweeney is the vice president for overseas operations for toro Inc., a multinational organization with manufacturing and sales operations in North America and Europe. It is often necessary for firms to move money around to satisfy cash requirements in various countries. Currently, the firm needs some British pounds and Canadian dollars and has available cash in Euros, Swiss francs, and U.S. dollars. Joe has a few banks with which he frequently makes currency transactions. He asks his analyst to call around and compile the best rates available from the banks. The analyst gives him the following crossrates table. you can exchange (i.e., sell) 1GBP and receive 1.4988 USD, 1GBPRSSUSD=1.4988USDif you have 1 USD, you can exchange it for 0.6664GBP, 1USDR5:GBP=0.6664GBP Notice that if you start with 1GBP, exchange it for USD and then exchange the USD back for GBP, you have lost a fraction of the value, 1GBPR1SUSDR15Rs4GBP=(1.4988)(0.6664)GBP=0.998750GBP This loss can be interpreted as a fee charged by the banks involved in the transactions. Joe notices that he can cover the shortfall in GBP by exchanging 8 EUR for 6.020GBP. He can exchange the 10CHF and the 1.2 USD for a total of 15.684 CAD. However, Joe recognizes that there are other transfer schemes that meet the requirements. He wonders if one transfer scheme is better than another. We will use an optimization model to find the optimal currency exchanges. A "forex calculator" spreadsheet is provided for your use. Figure 1 provides a screenshot of this model, showing the transactions described above. In this calculator, it is convenient to define decision variables to be a matrix where each entry represents an amount of currency exchanged. For example, X23 in the matrix represents the Canadian dollars (CAD) exchanged for Euros (EUR). In principle, all of these exchanges are possible (except the diagonalones) and all transactions are executed instantaneously and simultaneously. We will let Solver pick the values in this table. This format is convenient because it makes it easy to calculate the final net positions in each currency. For example, the calculator computes the total number of British pounds (GBP) sold by summing the entries across the first row of this table. Similarly, one can calculate the total number of Euros (EUR) purchased by taking a "sumproduct" that multiplies the amounts in the EUR column of this matrix by the corresponding exchange rates (to get Euros purchased by exchanging each currency) and summing the Euros purchased. The final holdings in each currency are then given by taking the initial holdings in a currency, plus the amount bought, minus the amount sold. Positin Final usD Value of Heldings $21.659871 Intai USb value of Haltings 521.874265 Thanketon Cosh 10 crabs4 Figure 1: The exchange rate calculator i) Suppose Loro's objective is to maximize the US Dollar value of its final cash holdings. What transactions should they do? ii) Suppose Loro's objective is to maximize the value of its final cash holdings in Swiss Francs (CHF) rather US Dollars (USD). What should they do in this case? Does the solution differ? If so, why? Prices (\$k/GWh) Active Developer East / West \% Renewable Capacity (GWh / year) \begin{tabular}{|ccccccc} \multicolumn{1}{c}{ Madison } & Barton & Carroll & Story & Hardin & Franklin & Greene \\ \hline$49.50 & $50.00 & $61.00 & $63.50 & $66.50 & $71.00 & $72.50 \\ Yes & Yes & No & Yes & No & Yes & No \\ West & East & West & East & East & East & West \\ 15% & 16% & 18% & 20% & 21% & 22% & 23% \\ 300 & 600 & 510 & 655 & 575 & 680 & 450 \\ \hline \end{tabular} \begin{tabular}{c|} \hline Webster \\ \hline$80.00 \\ No \\ West \\ 25% \\ 490 \\ \hline \end{tabular} Final USD Value of Holdings Initial USD Value of Holdings $21,678265 Transaction Costs $0,018394

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts