Question: please help me with his question. make sure to number each part and write it clear so i can understand and see it. i will

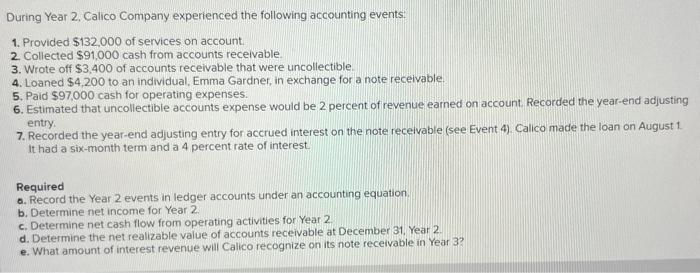

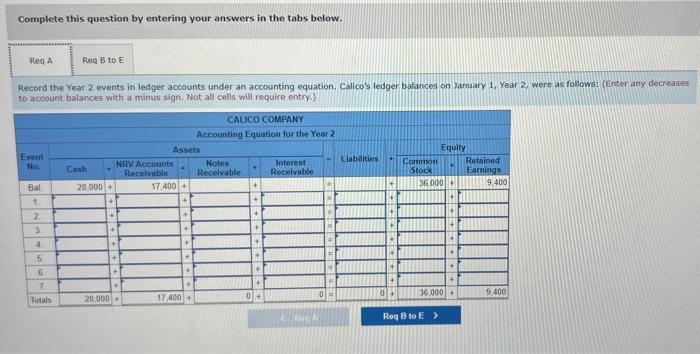

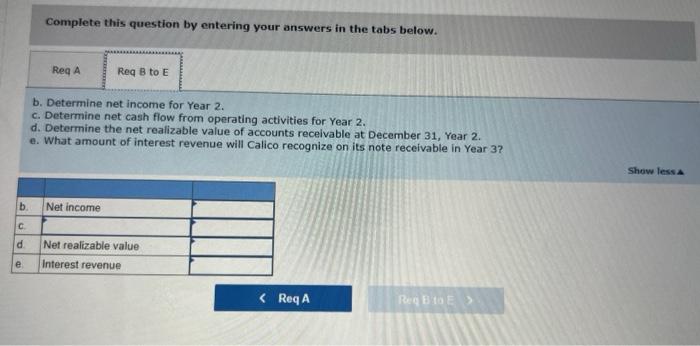

During Year 2, Calico Company experienced the following accounting events: 1. Provided $132,000 of services on account. 2. Collected $91,000 cash from accounts receivable. 3. Wrote off $3,400 of accounts receivable that were uncollectible. 4. Loaned $4,200 to an individual, Emma Gardner, in exchange for a note receivable. 5. Paid $97,000 cash for operating expenses. 6. Estimated that uncollectible accounts expense would be 2 percent of revenue earned on account. Recorded the year-end adjusting entry. 7. Recorded the year-end adjusting entry for accrued interest on the note receivable (see Event 4). Calico made the loan on August 1 . It had a six-month term and a 4 percent rate of interest. Required o. Record the Year 2 events in ledger accounts under an accounting equation, b. Determine net income for Year 2 . c. Determine net cash flow from operating activities for Year 2 . d. Determine the net realizable value of accounts receivable at December 31 , Year 2 e. What amount of interest revenue will Calico recognize on its note recelvable in Year 3? Complete this question by entering your answers in the tabs below. Record the Year 2 evente in ledger accounts under an accounting equation. Calico's ledger balances on hanuary 1 Year 2 , were as follows: (Enter any decreases to account balances with a minus sign, Not all celis will require entry.) Complete this question by entering your answers in the tabs below. Determine net income for Year 2 . Determine net cash flow from operating activities for Year 2 . Determine the net realizable value of accounts receivable at December 31 , Year 2 . What amount of interest revenue will Calico recognize on its note receivable in Year 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts