Question: please help me with his question. make sure to number each part and write it clear so i can understand and see it. i will

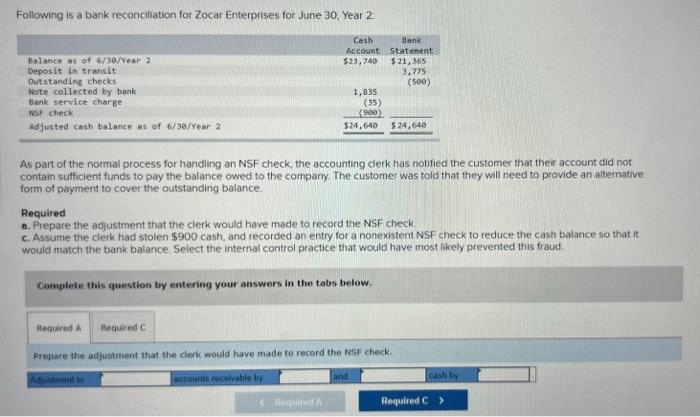

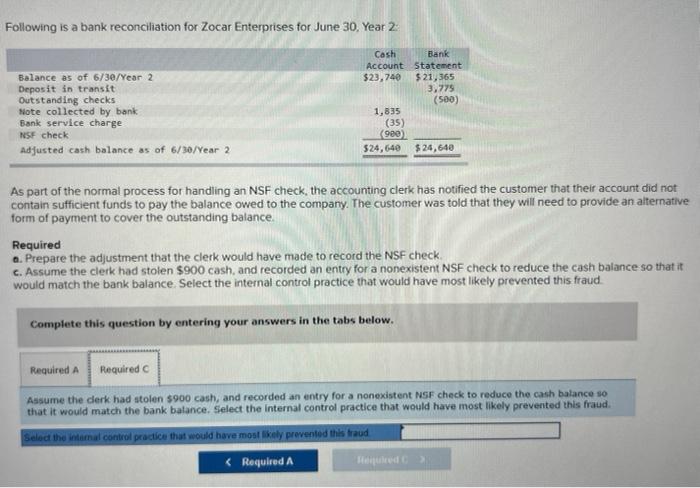

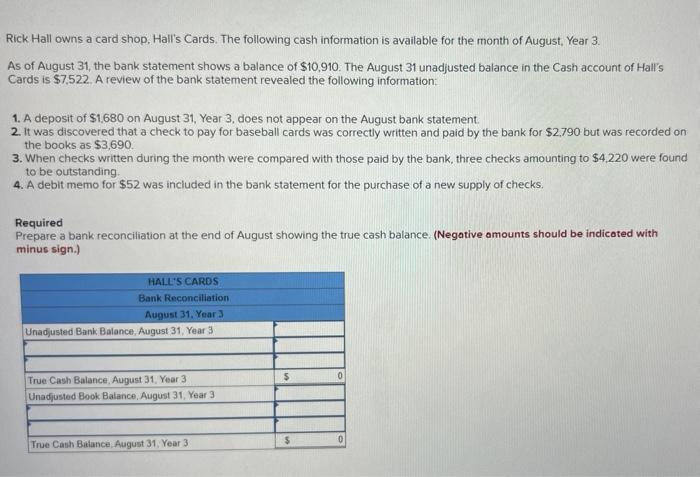

Following is a bank reconciliation for Zocar Enterptises for June 30, Year 2 . As part of the normai process for handing an NSF check, the accounting clerk has notified the customer that their account did not contain sufficient funds to pay the balance owed to the company. The customer was told that they will need to provide an altemative form of payment to cover the outstanding balance. Required 0. Prepare the adjustment that the clerk would have made to record the NSF check. c. Assume the derk had stolen $900cash, and recorded an entry for a nonexistent NSF check to reduce the cash baiance so that it would match the bank balance. Select the internal control practice that would have most likely prevented this fraud. Complete this question by entering your answers in the tabs below. Prepare the adjustment that the clerk would have made to record the Ns check. Following is a bank reconciliation for Zocar Enterprises for June 30, Year 2: As part of the normal process for handling an NSF check, the accounting clerk has notified the customer that their account did not contain sufficient funds to pay the balance owed to the company. The customer was told that they will need to provide an aiternative form of payment to cover the outstanding balance. Required a. Prepare the adjustment that the clerk would have made to record the NSF check. c. Assume the clerk had stolen $900 cash, and recorded an entry for a nonexistent NSF check to reduce the cash balance so that it would match the bank balance. Select the internal control practice that would have most likely prevented this fraud. Complete this question by entering your answers in the tabs below. Assume the derk had stolen $900 cash, and recorded an entry for a nonexistent NsF check to reduce the cash balance so that it would match the bank balance. Select the internal control practice that would have most likely prevented this fraud. Rick. Hall owns a card shop. Hall's Cards. The following cash information is available for the month of August, Year 3. As of August 31, the bank statement shows a balance of $10,910. The August 31 unadjusted balance in the Cash account of Hall's Cards is $7,522. A review of the bank statement revealed the following information: 1. A deposit of $1,680 on August 31, Year 3, does not appear on the August bank statement. 2. It was discovered that a check to pay for baseball cards was correctly written and paid by the bank for $2,790 but was recorded on the books as $3,690. 3. When checks written during the month were compared with those paid by the bank, three checks amounting to $4,220 were found to be outstanding. 4. A debit memo for $52 was included in the bank statement for the purchase of a new supply of checks. Required Prepare a bank reconciliation at the end of August showing the true cash balance. (Negative amounts should be indicated with minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts