Question: Please help me with its solution It is 2021 and Capital Tech Ltd wishes to expand its firm , adding 5 stations of trade. Based

Please help me with its solution

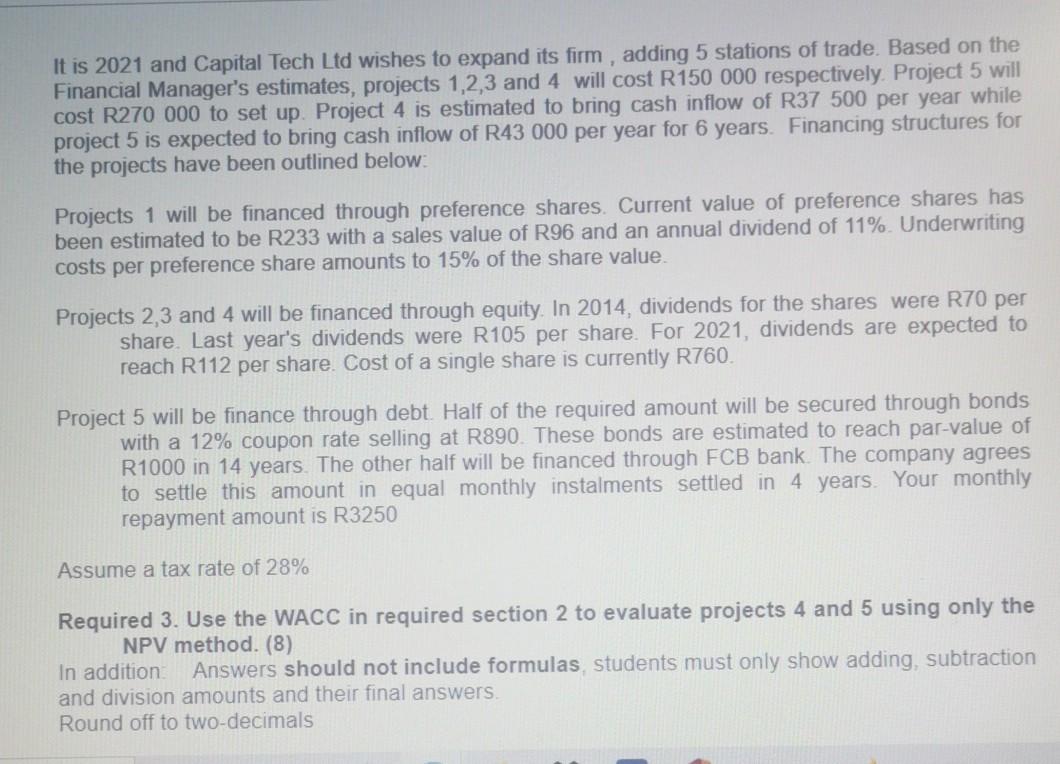

It is 2021 and Capital Tech Ltd wishes to expand its firm , adding 5 stations of trade. Based on the Financial Manager's estimates, projects 1,2,3 and 4 will cost R150 000 respectively. Project 5 will cost R270 000 to set up. Project 4 is estimated to bring cash inflow of R37 500 per year while project 5 is expected to bring cash inflow of R43 000 per year for 6 years. Financing structures for 6. the projects have been outlined below: Projects 1 will be financed through preference shares. Current value of preference shares has been estimated to be R233 with a sales value of R96 and an annual dividend of 11%. Underwriting costs per preference share amounts to 15% of the share value. Projects 2,3 and 4 will be financed through equity. In 2014, dividends for the shares were R70 per share. Last year's dividends were R105 per share. For 2021, dividends are expected to reach R112 per share. Cost of a single share is currently R760. Project 5 will be finance through debt Half of the required amount will be secured through bonds with a 12% coupon rate selling at R890. These bonds are estimated to reach par-value of R1000 in 14 years. The other half will be financed through FCB bank. The company agrees to settle this amount in equal monthly instalments settled in 4 years. Your monthly repayment amount is R3250 Assume a tax rate of 28% Required 3. Use the WACC in required section 2 to evaluate projects 4 and 5 using only the NPV method. (8) In addition Answers should not include formulas students must only show adding, subtraction and division amounts and their final answers. Round off to two-decimals It is 2021 and Capital Tech Ltd wishes to expand its firm , adding 5 stations of trade. Based on the Financial Manager's estimates, projects 1,2,3 and 4 will cost R150 000 respectively. Project 5 will cost R270 000 to set up. Project 4 is estimated to bring cash inflow of R37 500 per year while project 5 is expected to bring cash inflow of R43 000 per year for 6 years. Financing structures for 6. the projects have been outlined below: Projects 1 will be financed through preference shares. Current value of preference shares has been estimated to be R233 with a sales value of R96 and an annual dividend of 11%. Underwriting costs per preference share amounts to 15% of the share value. Projects 2,3 and 4 will be financed through equity. In 2014, dividends for the shares were R70 per share. Last year's dividends were R105 per share. For 2021, dividends are expected to reach R112 per share. Cost of a single share is currently R760. Project 5 will be finance through debt Half of the required amount will be secured through bonds with a 12% coupon rate selling at R890. These bonds are estimated to reach par-value of R1000 in 14 years. The other half will be financed through FCB bank. The company agrees to settle this amount in equal monthly instalments settled in 4 years. Your monthly repayment amount is R3250 Assume a tax rate of 28% Required 3. Use the WACC in required section 2 to evaluate projects 4 and 5 using only the NPV method. (8) In addition Answers should not include formulas students must only show adding, subtraction and division amounts and their final answers. Round off to two-decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts