Question: Please help me with my comprehensive problem so I can pass my class! Let me know if you need more information. Just fill in the

Please help me with my comprehensive problem so I can pass my class! Let me know if you need more information. Just fill in the boxes :)

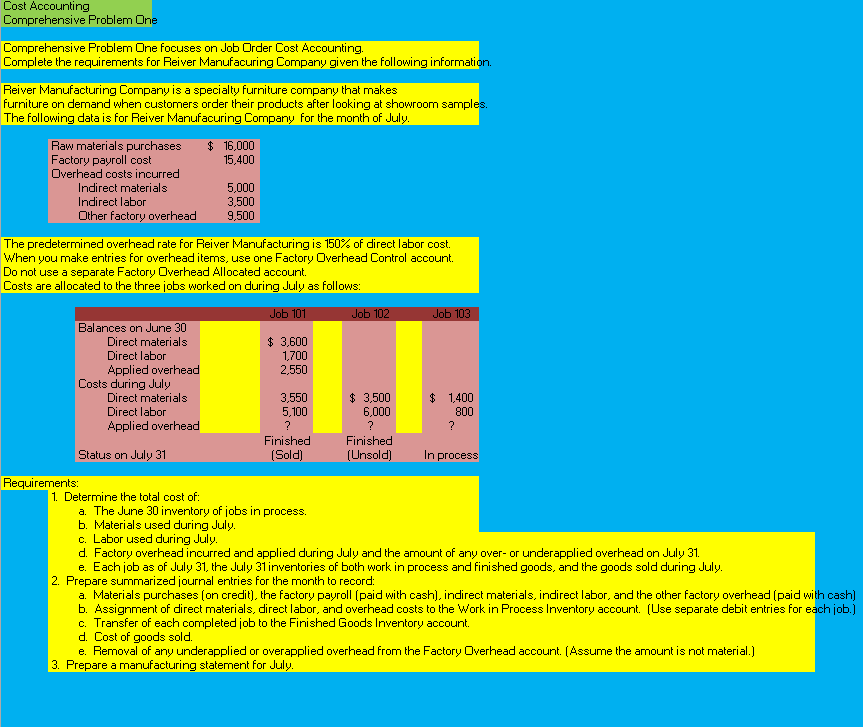

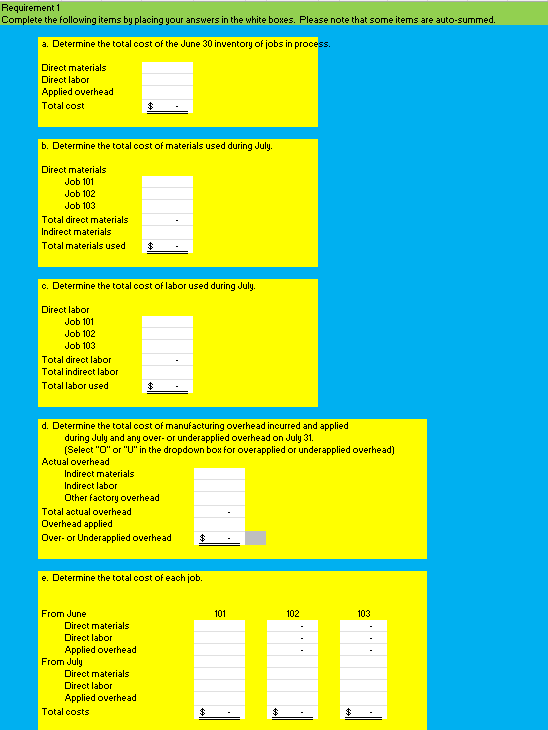

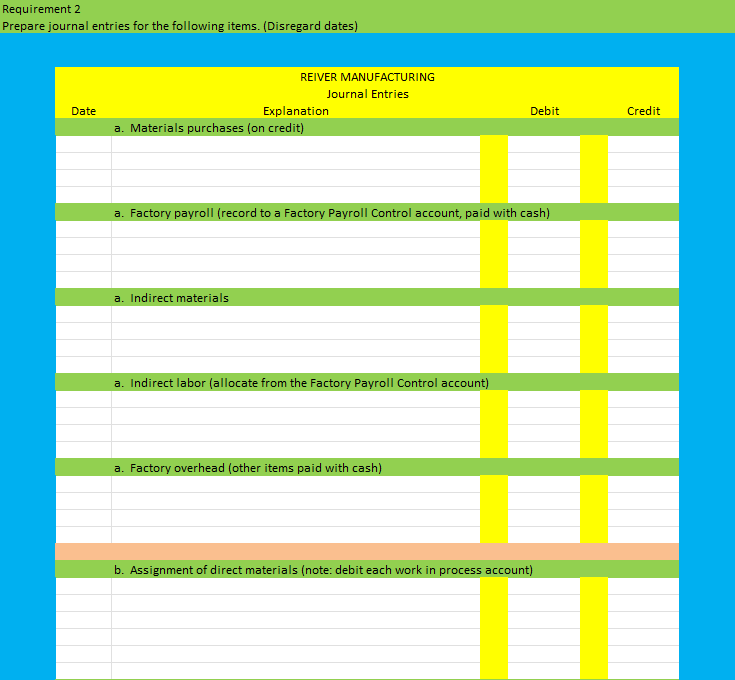

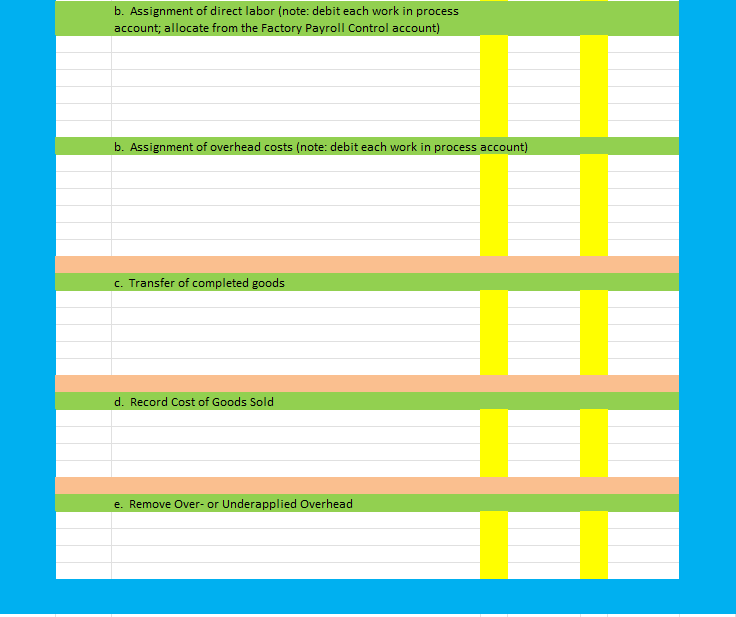

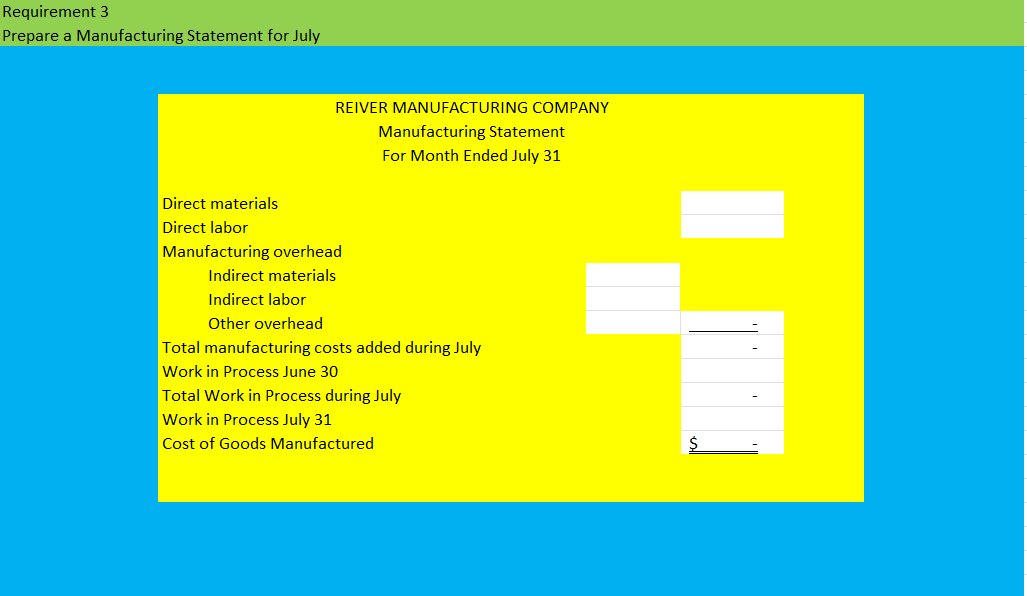

Complete the requirements for Reiver Manufacuring Company given the following information. Reiver Manufacturing Company is a specialty furniture company that makes furniture on demand when customers order their products after looking at showroom samples. The following data is for Reiver Manufacuring Company for the month of July. The predetermined overhead rate for Reiver Manufacturing is 150% of direct labor cost. When you make entries for overhead items, use one Factory Dverhead Control account. Do not use a separate Factory Dverhead Allocated account. Costs are allocated to the three jobs worked on during July as follows: Requirements: 1. Determine the total cost of: a. The June 30 inventory of jobs in process. b. Materials used during July. c. Labor used during July. d. Factory overhead incurred and applied during July and the amount of any over- or underapplied overhead on July 31. e. Each job as of July 31, the July 31 inventories of both work in process and finished goods, and the goods sold during July. 2. Prepare summarized journal entries for the month to record: a. Materials purchases (on credit), the factory payroll (paid with cash), indirect materials, indirect labor, and the other factory overhead (paid with cast b. Assignment of direct materials, direct labor, and overhead costs to the Work in Process Inventory account. (Use separate debit entries for each job. c. Transfer of each completed job to the Finished Goods Inventory account. d. Cost of goods sold. e. Removal of any underapplied or overapplied overhead from the Factory Dverhead account. (Assume the amount is not material.) 3. Prepare a manufacturing statement for July. Requirement 1 Complete the following items by placing your answers in the white bones. Please note that some items are auto-summed. a. Determine the total cost of the June 30 inventory of jobs in process. b. Determine the total cost of materials used during July. c. Determine the total cost of labor used during July. d. Determine the total cost of manufacturing overhead incurred and applied during July and any over- or underapplied overhead on July 31. (Select "D" or "U" in the dropdown bon for overapplied or underapplied overhead) Antusl nuarkast e. Determine the total cost of each job. Requirement 2 Prepare journ b. Assignment of direct labor (note: debit each work in process account; allocate from the Factory Payroll Control account) b. Assignment of overhead costs (note: debit each work in process account) c. Transfer of completed goods d. Record Cost of Goods Sold e. Remove Over- or Underapplied Overhead Requirement 3 Prepare a Manufacturing Statement for July Complete the requirements for Reiver Manufacuring Company given the following information. Reiver Manufacturing Company is a specialty furniture company that makes furniture on demand when customers order their products after looking at showroom samples. The following data is for Reiver Manufacuring Company for the month of July. The predetermined overhead rate for Reiver Manufacturing is 150% of direct labor cost. When you make entries for overhead items, use one Factory Dverhead Control account. Do not use a separate Factory Dverhead Allocated account. Costs are allocated to the three jobs worked on during July as follows: Requirements: 1. Determine the total cost of: a. The June 30 inventory of jobs in process. b. Materials used during July. c. Labor used during July. d. Factory overhead incurred and applied during July and the amount of any over- or underapplied overhead on July 31. e. Each job as of July 31, the July 31 inventories of both work in process and finished goods, and the goods sold during July. 2. Prepare summarized journal entries for the month to record: a. Materials purchases (on credit), the factory payroll (paid with cash), indirect materials, indirect labor, and the other factory overhead (paid with cast b. Assignment of direct materials, direct labor, and overhead costs to the Work in Process Inventory account. (Use separate debit entries for each job. c. Transfer of each completed job to the Finished Goods Inventory account. d. Cost of goods sold. e. Removal of any underapplied or overapplied overhead from the Factory Dverhead account. (Assume the amount is not material.) 3. Prepare a manufacturing statement for July. Requirement 1 Complete the following items by placing your answers in the white bones. Please note that some items are auto-summed. a. Determine the total cost of the June 30 inventory of jobs in process. b. Determine the total cost of materials used during July. c. Determine the total cost of labor used during July. d. Determine the total cost of manufacturing overhead incurred and applied during July and any over- or underapplied overhead on July 31. (Select "D" or "U" in the dropdown bon for overapplied or underapplied overhead) Antusl nuarkast e. Determine the total cost of each job. Requirement 2 Prepare journ b. Assignment of direct labor (note: debit each work in process account; allocate from the Factory Payroll Control account) b. Assignment of overhead costs (note: debit each work in process account) c. Transfer of completed goods d. Record Cost of Goods Sold e. Remove Over- or Underapplied Overhead Requirement 3 Prepare a Manufacturing Statement for July

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts