Question: please help me with number 1. Problem Set: Capital Budgeting under Certainty 4 1. The firm Nalyd is considering an investment in equipment to produce

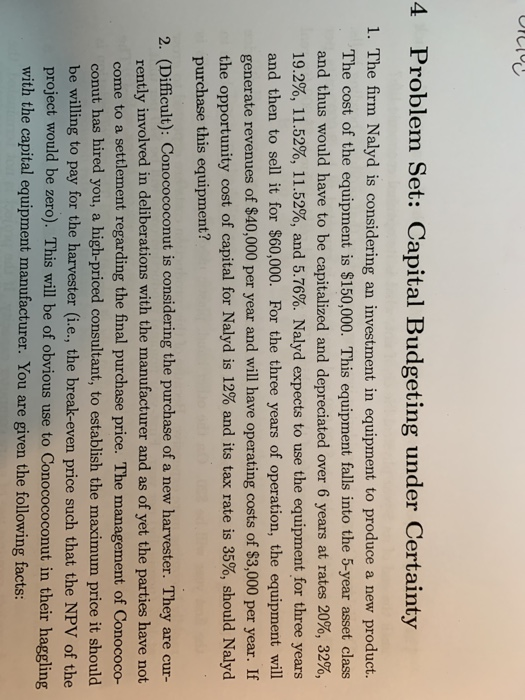

Problem Set: Capital Budgeting under Certainty 4 1. The firm Nalyd is considering an investment in equipment to produce a new product. The cost of the equipment is $150,000. This equipment falls into the 5-year asset class and thus would have to be capitalized and depreciated over 6 years at rates 20%, 32%, 19.2%, 11.52%, 11.52%, and 5.76%. Nayd expects to use the equipment for three years and then to sell it for $60,000. For the three years of operation, the equipment will generate revenues of $40,000 per year and will have operating costs of $3,000 per year. If the opportunity cost of capital for Nalyd is 12% and its tax rate is 35%, should Nalyd purchase this equipment? 2. (Difficult): Conocococonut is considering the purchase of a new harvester. They are cur- rently involved in deliberations with the manufacturer and as of yet the parties have not come to a settlement regarding the final purchase price. The management of Conococo- conut has hired you, a high-priced consultant, to establish the maximum price it should be willing to pay for the harvester (i.e., the break-even price such that the NPV of the project would be zero). This will be of obvious use to Conocococonut in their haggling with the capital equipment manufacturer. You are given the following facts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts