Question: Please help me with question A and B. The second photo is the information from the other questions and the company is Tesla. a. Provide

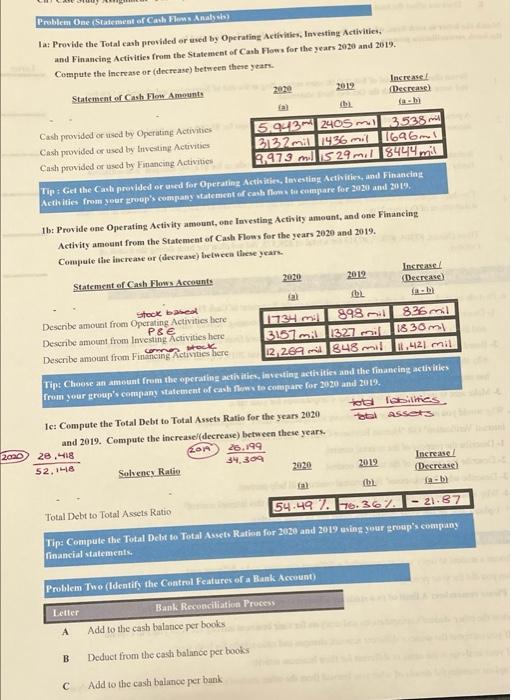

a. Provide an explanation for the financing activities on the Statement of Cash Flows: 1- Describe the "One" Operating Actvity amount, the "One" Investing Activity amount, and the "One" Financing Activity amount that you listed above from the Statement of Cash Inflows. 2- Based on your results for 1a, 1b, and 1c for the years 2020 and 2019, explain two reasons why the company's solvency status (cash flow ability to make payments over the long-term) has improved or become worse. 3- Make sure to include the details of your computations for your ratio. b. Why would you recommend for the company to implement either "Independent Internal Verification" OR "Human Resource Controls" as an Internal Control: 1- Describe the purpose of the internal control. 2- Describe the benefits of the internal control. 3- Describe what "weaknesses" this internal control will help prevent. 4- Why would you recommend for the company to implement this internal control? Problem One Statement of Cash Flows Analysis la: Provide the Total cash presided or used by Operating Activities, Investing Activities. and Financing Activities from the Statement of Cash Flows for the years 2020 and 2019. Compute the increase or decrease) between these years. Increase Statement of Cash Flom Amounts 2019 (Descase) th Cash provided or used by Operating Activities 5.943 2405 m 13.538 Cash provided or used by Investing Activities BEZ 1936 mil 1696m. Cash provided or used by Financing Activities 2.973 m. 529 mil 8444 mil Tip: Get the Cash provided or used for Operating Activities, Investing Activities, and Financing Actities from your group's company statement of cash flom tu compare for 2020 and 2019. coring cities bere Ihr Provide one Operating Activity amount, one luvesting Activity amount, and one Financing Activity amount from the Statement of Cash Flows for the years 2020 and 2019. Compute the increase or decrease) been these years Increase 2020 Statement of Cash Flows Accounts 2019 (Decrease) (n. stock barat Describe amount from Operating Activities here 1734.898 826 mil PSE Describe amount from Investing Activities here 3157 mil 1327 mil 18 30ml wa Describe amount from Financing 12,269 848 mi! 0.421 mill Tip: Choose an amount from the operating activities, investing activities and the financing activities from your group's company statement of cash flows to compare for 2020 and 2019. tote labilities le: Compute the Total Debt to Total Assets Ratio for the years 2020 total Assets and 2019. Compute the increasel(decrease) between these years. 28.418 26.199 52.46 34,304 Increase Sebenss Ratio 2020 2019 (Decrease b2 Total Debt to Total Assets Ratio 54.49.367 21.87 Tip: Compute the Total Debt to Total Assets Ration for 2020 and 2019 using your group's company financial statements CO 2000 Problem Tho (Identify the Central Features of a Bank Account) Letter Bank Reconciliation Process Add to the cash balance per books Deduct from the cash balanoc per books B Add to the cash balance per bank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts