Question: Please help me with task 4 and 5 4. The company uses the following sources of funding: common shares outstanding -700 thousand rubles, preferred shares

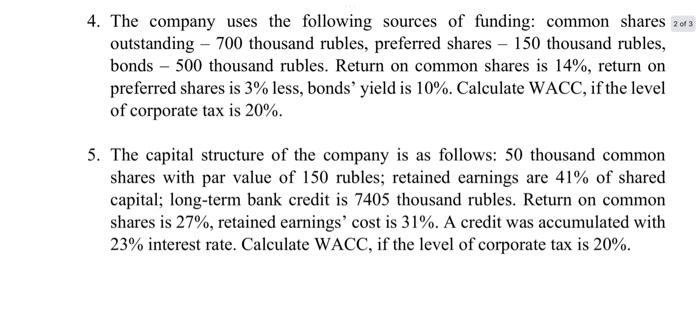

4. The company uses the following sources of funding: common shares outstanding -700 thousand rubles, preferred shares -150 thousand rubles, bonds -500 thousand rubles. Return on common shares is 14%, return on preferred shares is 3% less, bonds' yield is 10%. Calculate WACC, if the level of corporate tax is 20%. 5. The capital structure of the company is as follows: 50 thousand common shares with par value of 150 rubles; retained earnings are 41% of shared capital; long-term bank credit is 7405 thousand rubles. Return on common shares is 27%, retained earnings' cost is 31%. A credit was accumulated with 23% interest rate. Calculate WACC, if the level of corporate tax is 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts