Question: please help me with the answer and explanation You have been assigned to estimate the cost of capital of Merck 5C0 based solelyr on the

please help me with the answer and explanation

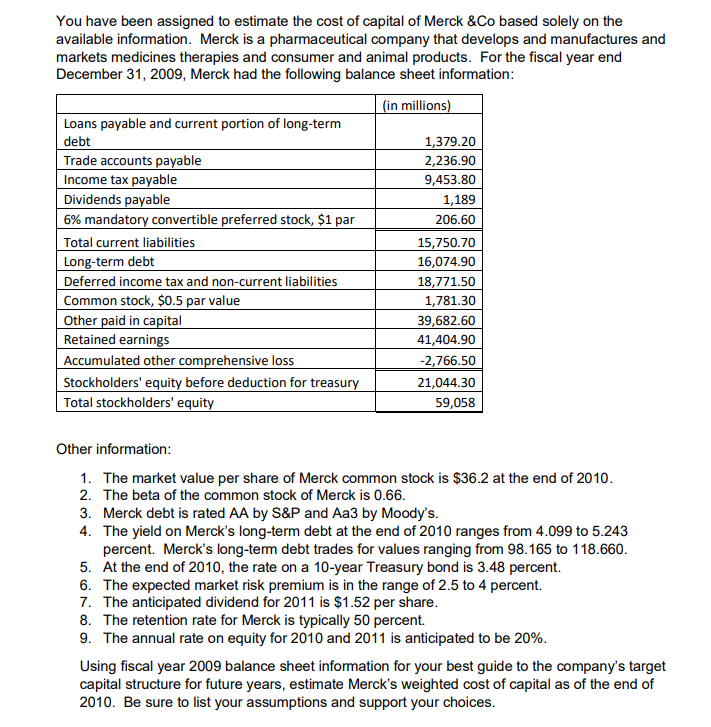

You have been assigned to estimate the cost of capital of Merck 5C0 based solelyr on the available information. Merck is a pharmaceutical company that develops and manufactures and markets medicines therapies and consumer and animal products. For the scal year end December 31. 2009. Merck had the following balance sheet information: in millions Loans payable and current portion of longterm 1,379.20 debt Trade accounts payable 2,235.90 Income tax payable Dividends payable 6% mandatory convertible preferred stock, 51 par Total current liabilities 15,250.?0 Longterm debt 16324.90 Deferred income tax and noncurrent liabilities 16321.50 Common stock, $0.5 par value 1,231.30 Other paid in capital Retained earnings Accumulated other comprehensive loss Stockholders' equity before deduction for treasury Total stockholders' equity 59,058 Other information: The market value per share of Merck common stock is $36.2 at the end of 2010. The beta of the common stock of Merck is 0.66. Merck debt is rated M by SliP and its?! by Moody's. The yield on Merck's long-term debt at the end of 2010 ranges from 4.099 to 5.243 percent Merck's long-term debt trades for values ranging from 66.165 to 116.660. At the end of 2010, the rate on a 10-year Treasury bond is 3.46 percent. The expected market risk premium is in the range of 2.5 to 4 percent. The anticipated dividend for 201 1 is $1 .52 per share. The retention rate for Merck is typically 50 percent The annual rate on equity for 2010 and 2011 is anticipated to be 20%. PPNT' 9995745355\" Using scal year 2009 balance sheet information for your best guide to the company's target capital structure for future years. est'rnate Merck's weighted cost of capital as of the end of 2010. Be sure to list your assumptions and support your choices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts