Question: please help me with the child claim Ch 4 Homework Help Sere Sum 1 Check my work Part 1 of 2 Required information The following

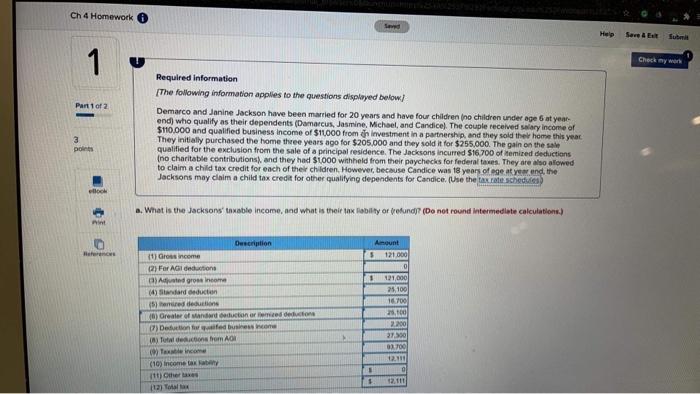

Ch 4 Homework Help Sere Sum 1 Check my work Part 1 of 2 Required information The following information applies to the questions displayed below! Demarco and Janine Jackson have been married for 20 years and have four children (no children under age 6 at year end) who qualify as their dependents (Damarcus, Jasmine, Michael, and Candice). The couple received salary income of $110,000 and qualified business Income of $11,000 from en investment in a partnership, and they sold the home this year They initially purchased the home three years ago for $205,000 and they sold it for $255,000. The gain on the sale qualified for the exclusion from the sale of a principal residence. The Jacksons incurred 516 700 of temited deductions (no charitable contributions, and they had sooo withheld from their paychecks for federal taxes. They are also allowed to claim a child tax credit for each of their children. However, because Candice was 18 years of age at yow end, the Jacksons may claim a child tax credit for other qualifying dependents for Candice. Use the tax rate schedules 3 points .. What is the Jacksons' timable income, and what is their box lability or refund? (Do not found intermediate calculation) Herence Amount 5 121000 Description 11) Grosincome (2) For Adi deductions Add gross income (4) dard deducten (5) hendetin 10) reale of Mandard auctor med en 7) Deti fed business Total de consom AON Tax (10) income taxa 11) Otheraxes 112) Toto 121.000 25,100 16.700 25,00 2.2001 27.500 0700 12.10 ol 12.11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts