Question: 0 Saved 4 Homework Help Save & Exit Subml Check my work Required information [The following information applies to the questions displayed below] 2 Rick,

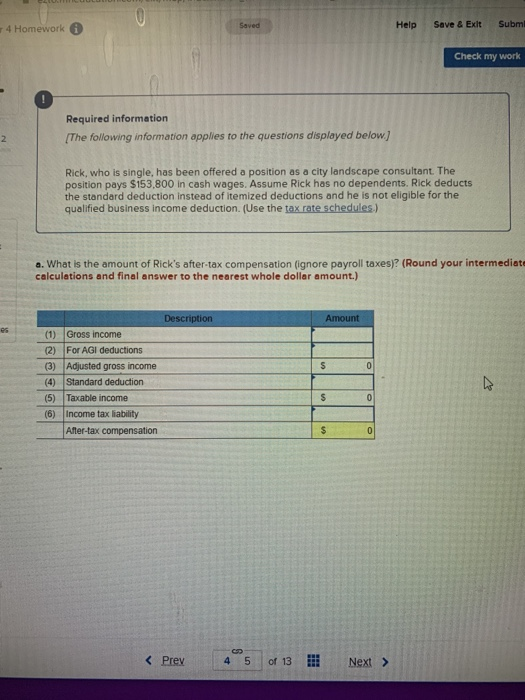

0 Saved 4 Homework Help Save & Exit Subml Check my work Required information [The following information applies to the questions displayed below] 2 Rick, who is single, has been offered a position as a city landscape consultant. The position pays $153,800 in cash wages. Assume Rick has no dependents. Rick deducts the standard deduction instead of itemized deductions and he is not eligible for the qualified business income deduction. (Use the tax rate schedules) a. What is the amount of Rick's after-tax compensation (ignore payroll taxes)? (Round your intermediate calculations and final answer to the nearest whole dollar amount.) Description Amount es S 0 (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Taxable income (6) Income tax liability After-tax compensation - $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts