Question: please help me with the first two questions The following information pertains to Diane Company. Assume that all balance sheet amounts represent both average and

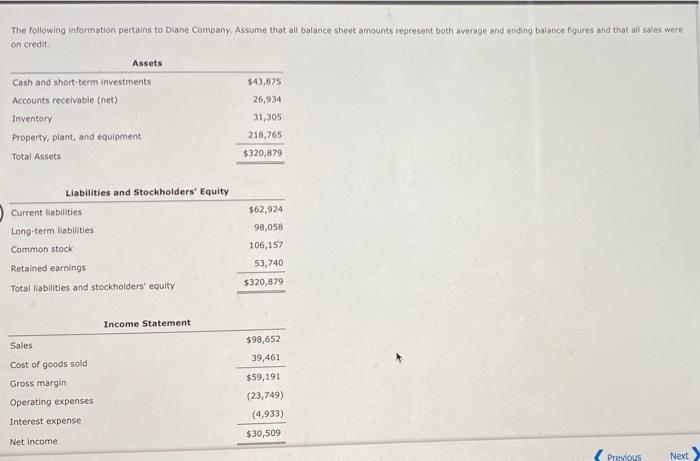

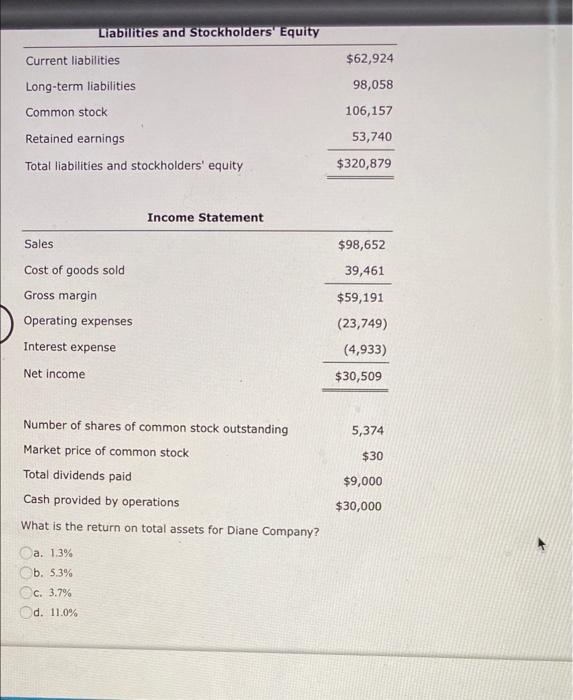

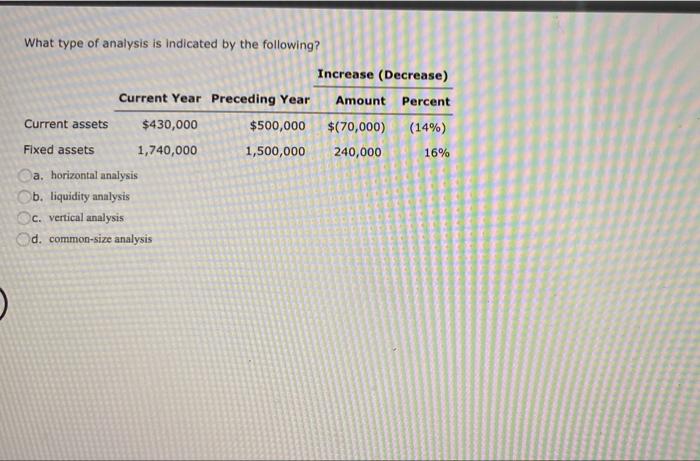

The following information pertains to Diane Company. Assume that all balance sheet amounts represent both average and ending balance figures and that all sales were on credit Assets Cash and short-term investments Accounts receivable (net) Inventory Property, plant, and equipment Total Assets $43,875 26,934 31,305 218,765 $320,879 Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock $62,924 98,058 106,157 53,740 Retained earnings Total Habilities and stockholders' equity $320,879 Income Statement Sales $98,652 39,461 Cost of goods sold Gross margin $59,191 Operating expenses Interest expense (23,749) (4,933) $30,509 Net Income Previous Next Liabilities and Stockholders' Equity Current liabilities $62,924 Long-term liabilities 98,058 Common stock 106,157 Retained earnings 53,740 Total liabilities and stockholders' equity $320,879 Income Statement Sales $98,652 Cost of goods sold Gross margin Operating expenses 39,461 $59,191 (23,749) Interest expense (4,933) Net income $30,509 5,374 $30 Number of shares of common stock outstanding Market price of common stock Total dividends paid Cash provided by operations What is the return on total assets for Diane Company? $9,000 $30,000 a. 1.3% b. 5.3% c. 3.7% d. 11.0% What type of analysis is indicated by the following? Increase (Decrease) Current Year Preceding Year Amount Percent Current assets $430,000 $500,000 $(70,000) (14%) Fixed assets 1,740,000 1,500,000 240,000 16% a. horizontal analysis b. liquidity analysis c. vertical analysis d. common-size analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts