Question: please help me with the following 2 questions down below . please and thank you.. including brief explanation if possible. 1. required : a.bad account

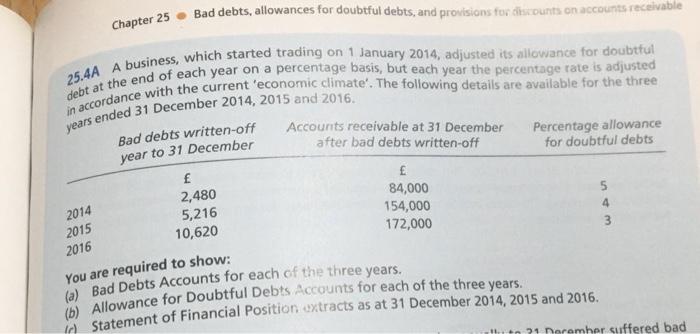

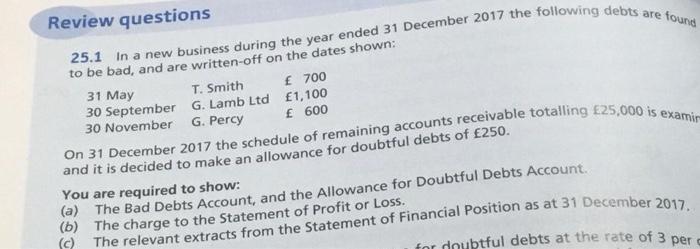

Bad debts, allowances for doubtful debts, and provisions for discounts on accounts receivable Chapter 25 25.4A A business, which started trading on 1 January 2014, adjusted its allowance for doubtful in accordance with the current 'economic climate. The following details are available for the three debt at the end of each year on a percentage basis, but each year the percentage rate is adjusted years ended 31 December 2014, 2015 and 2016. Bad debts written-off year to 31 December Percentage allowance for doubtful debts 2,480 5,216 5 4 10,620 3 Accounts receivable at 31 December after bad debts written-off 84,000 154,000 172,000 2014 2015 2016 You are required to show: (a) Bad Debts Accounts for each of the three years. 6) Allowance for Doubtful Debts Accounts for each of the three years. Statement of Financial Position extracts as at 31 December 2014, 2015 and 2016. 21 December suffered bad 700 Review questions 25.1 in a new business during the year ended 31 December 2017 the following debts are found to be bad, and are written-off on the dates shown: 31 May T. Smith 30 September G. Lamb Ltd 1,100 30 November G. Percy 600 On 31 December 2017 the schedule of remaining accounts receivable totalling 25,000 is examir and it is decided to make an allowance for doubtful debts of 250. You are required to show: (a) The Bad Debts Account, and the Allowance for Doubtful Debts Account. (b) The charge to the Statement of Profit or Loss. (C) The relevant extracts from the Statement of Financial Position as at 31 December 2017. for doubtful debts at the rate of 3 per

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts