Question: Please help me with the following math task 3. Now that a lot of your initial business expenses are out of the way (food truck

- Please help me with the following math task

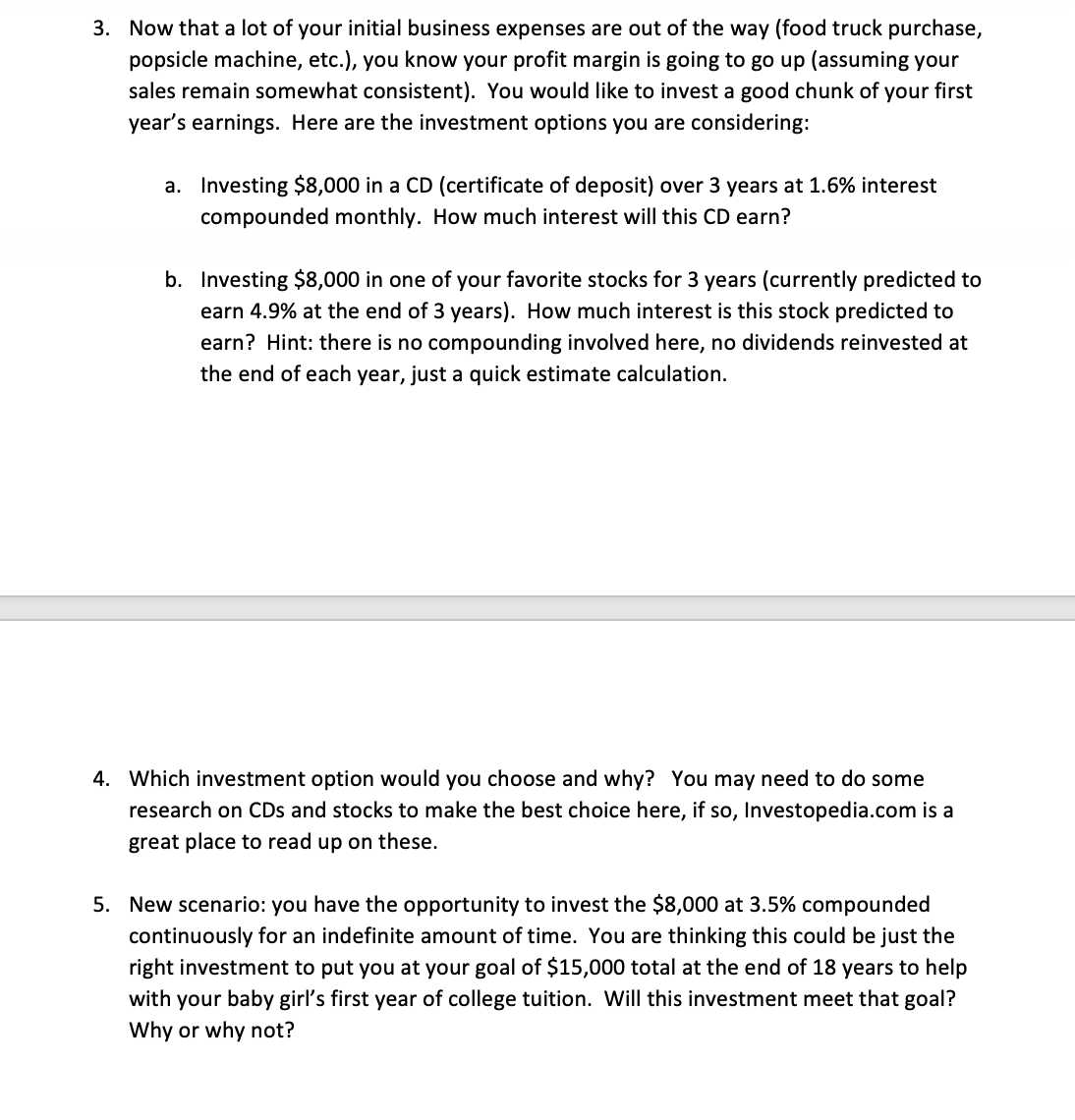

3. Now that a lot of your initial business expenses are out of the way (food truck purchase, popsicle machine, etc.}, you know your profit margin is going to go up (assuming your sales remain somewhat consistent}. You would like to invest a good chunk of your rst year's earnings. Here are the investment options you are considering: a. Investing $3,000 in a CD (certificate of deposit} over 3 years at 1.6% interest compounded monthly. How much interest will this CD earn? b. Investing $3,000 in one of your favorite stocks for 3 years (currently predicted to earn 4.9% at the end of 3 years}. How much interest is this stock predicted to earn? Hint: there is no compounding involved here, no dividends reinvested at the end of each year, just a quick estimate calculation. 4. Which investment option would you choose and why? You may need to do some research on CDs and stocks to make the best choice here, if so, |nvestopedia.com is a great place to read up on these. 5. New scenario: you have the opportunity to invest the $8,000 at 3.5% compounded continuously for an indefinite amount of time. You are thinking this could be just the right investment to put you at your goal of $15,000 total at the end of 18 years to help with your baby girl's first year of college tuition. Will this investment meet that goal? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts