Question: please help me with the following question: 7. Consider a one-year at-the-money European put option on a nondividend-paying stock. You are given: . Delta of

please help me with the following question:

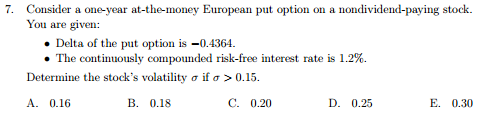

7. Consider a one-year at-the-money European put option on a nondividend-paying stock. You are given: . Delta of the put option is -0.4364. . The continuously compounded risk-free interest rate is 1.2% Determine the stock's volatility o if a > 0.15. A. 0.16 B. 0.18 C. 0.20 D. 0.25 E. 0.30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts