Question: Please help me with the following question, there is only one option that is correct. Please also explain why is the option correct and other

Please help me with the following question, there is only one option that is correct. Please also explain why is the option correct and other options are wrong.

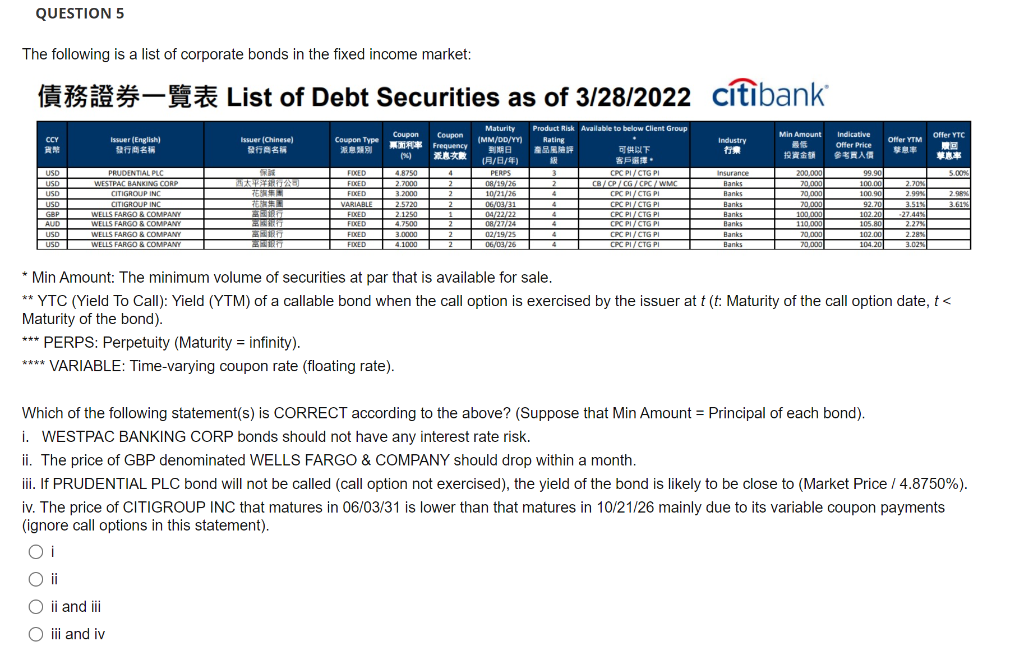

QUESTION 5 The following is a list of corporate bonds in the fixed income market: *-*# List of Debt Securities as of 3/28/2022 ctbank offer VIC CCY AN Issuer (English) Issuer (Chinese) 21A Industry Min Amount SE Indicative Offer Price ERAR Offer YTM 5.00 USD USD USD USD GBP AUD USD USD Maturity Coupon Coupon Type Coupon (MM/DD/YY) / # Frequency (A/B/) FOXED 4.8750 4 4 PERPS FOCED 2.7000 2 08/19/26 FOCED 3.2000 2 2 10/21/26 VARIABLE 2.5720 2 2 06/03/31 FOCED 2.1250 1 04/22/22 FOCED 4.7500 0 2 08/27/24 FOGED 3.0000 2 02/19/25 2 FOCED 4.1000 2 06/03/26 PRUDENTIAL PLC WESTPAC BANKING CORP CITIGROUP INC CITIGROUP INC WELLS FARGO & COMPANY WELLS FARGO & COMPANY WELLS FARGO & COMPANY WELLS FARGO & COMPANY TETRA Product Risk Available to below Client Group Rating . 3 CPCPI/CTG PI 2 CB/CP/CG/CPC/WMC 4 CPCPI/CTG PI 4 CPC PI/CTG PI 4 CPCPI/CTG PI CRC PICTGPI 4 CPCPI/CTG PI 4 CPCPI/CTG PI Insurance Banks Banks Banks Banks Banks Banks Banks 99.90 100.00 100.90 92.70 102.20 105.80 102.00 104.20 2.98% 3.61% 200,000 70,000 70,000 20.000 100,000 110,000 70,000 70,000 30 2.70 2.99% 3.51% -27.44% 2.27% 2.28% 3.02% * Min Amount: The minimum volume of securities at par that is available for sale. ** YTC (Yield To Call): Yield (YTM) of a callable bond when the call option is exercised by the issuer at t(t: Maturity of the call option date, t

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts