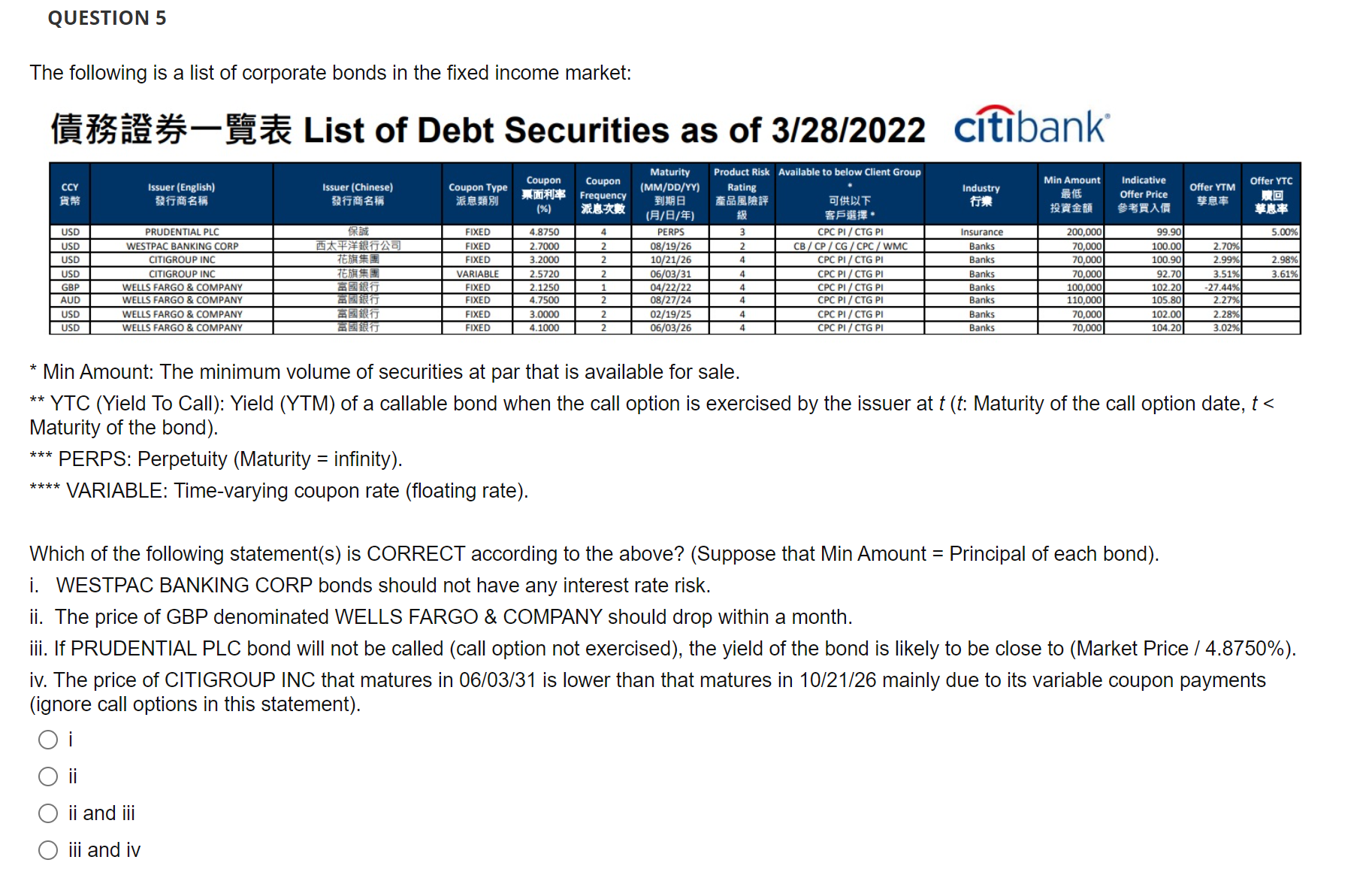

Question: Please help me with the following question, there is only one option that is correct. Please also explain why is the option correct and other

Please help me with the following question, there is only one option that is correct. Please also explain why is the option correct and other options are wrong.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock