Question: Please help me with the pro forms for NOI and BTCF as well as the questions for part two ok excel. I'm really lost OP

Please help me with the pro forms for NOI and BTCF as well as the questions for part two ok excel. I'm really lost

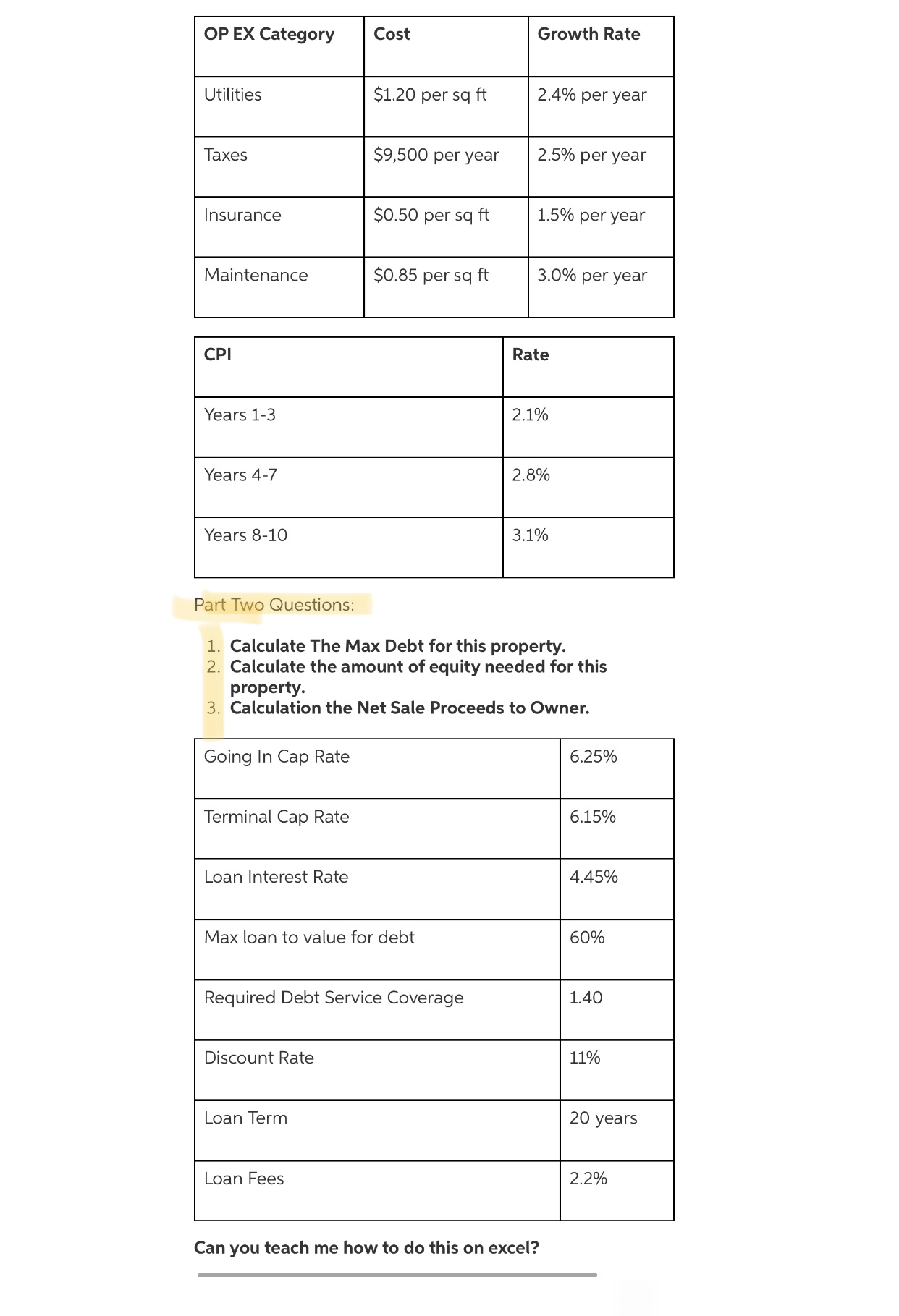

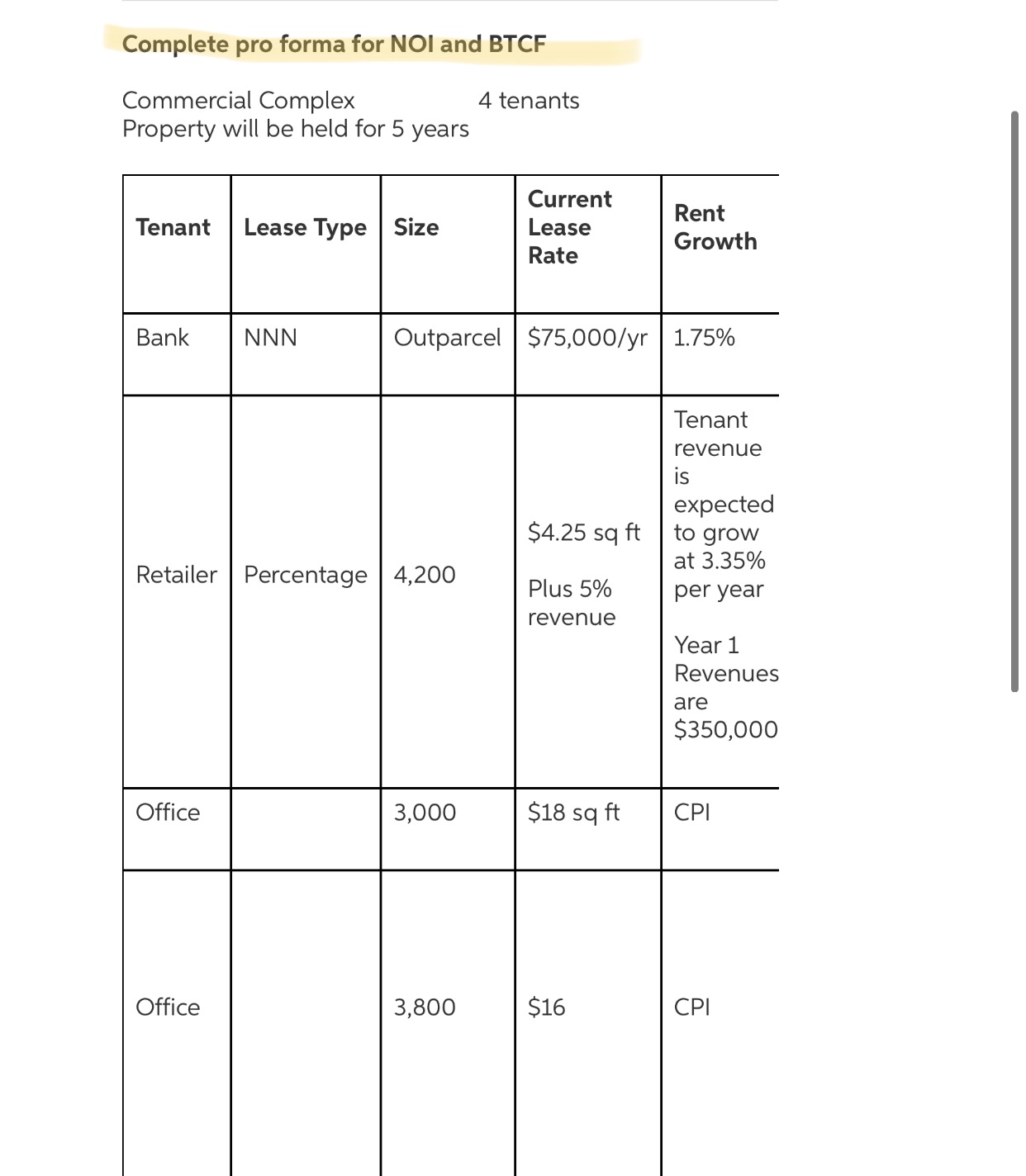

OP EX Category Cost Growth Rate Utilities $1.20 per sq ft 2.4% per year Taxes $9,500 per year 2.5% per year Insurance $0.50 per sq ft 1.5% per year Maintenance $0.85 per sq ft 3.0% per year CPI Rate Years 1-3 2.1% Years 4-7 2.8% Years 8-10 3.1% Part Two Questions: 1. Calculate The Max Debt for this property. 2. Calculate the amount of equity needed for this property. 3. Calculation the Net Sale Proceeds to Owner. Going In Cap Rate 6.25% Terminal Cap Rate 6.15% Loan Interest Rate 4.45% Max loan to value for debt 60% Required Debt Service Coverage 1.40 Discount Rate 11% Loan Term 20 years Loan Fees 2.2% Can you teach me how to do this on excel?Complete pro forma for NOI and BTCF Commercial Complex 4 tenants Property will be held for 5 years Current Tenant Lease Type Size Lease Rent Rate Growth Bank NNN Outparcel $75,000/yr 1.75% Tenant revenue is expected $4.25 sq ft to grow Retailer Percentage | 4,200 at 3.35% Plus 5% per year revenue Year 1 Revenues are $350,000 Office 3,000 $18 sq ft CPI Office 3,800 $16 CPI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts