Question: excel work please Part One Directions Complete pro forma for NOI Commercial Complex 4 tenants Property will be held for 5 years Current Lease Tenant

excel work please

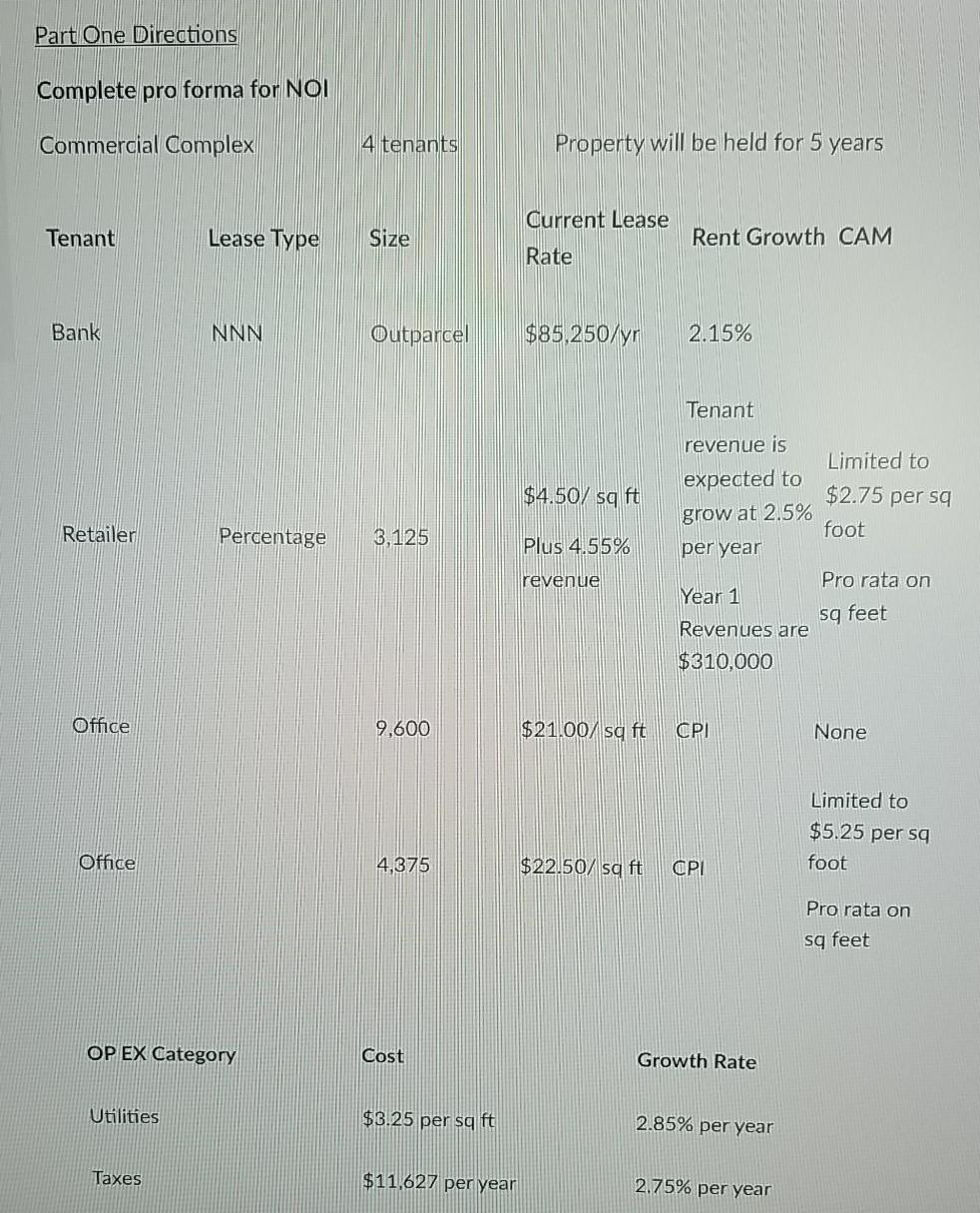

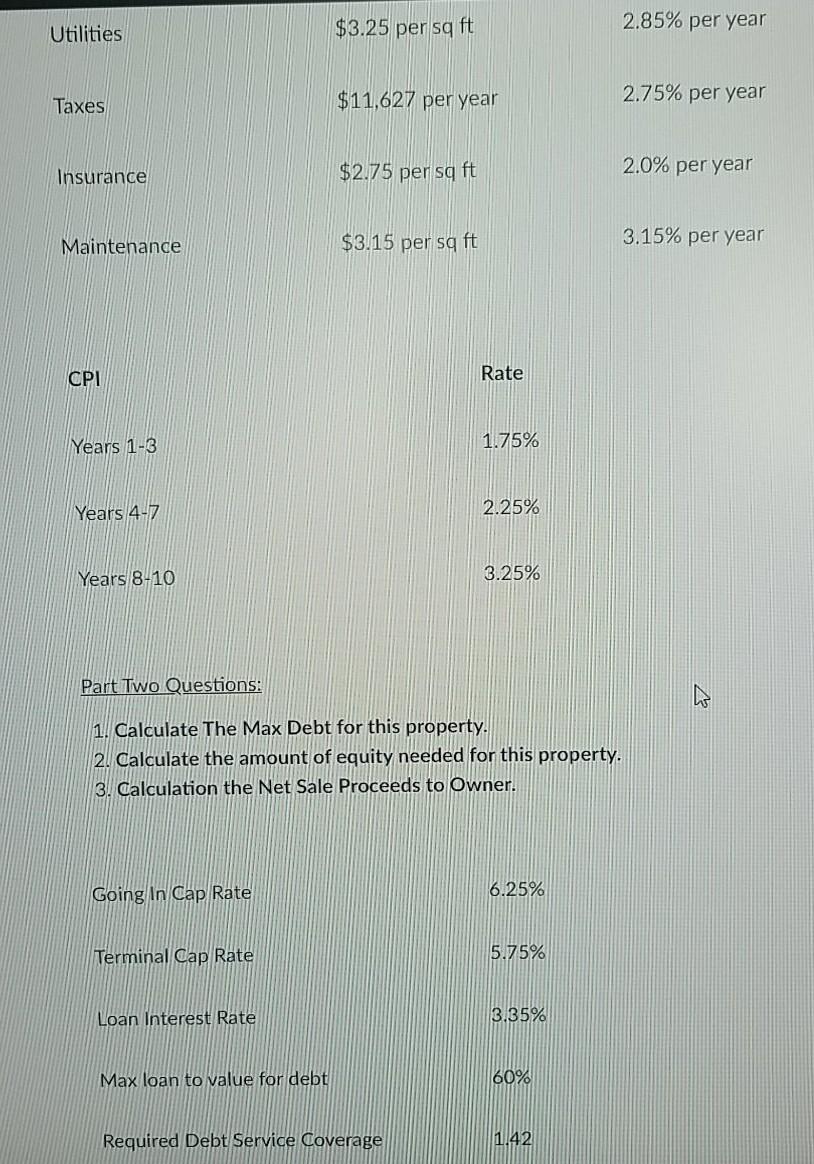

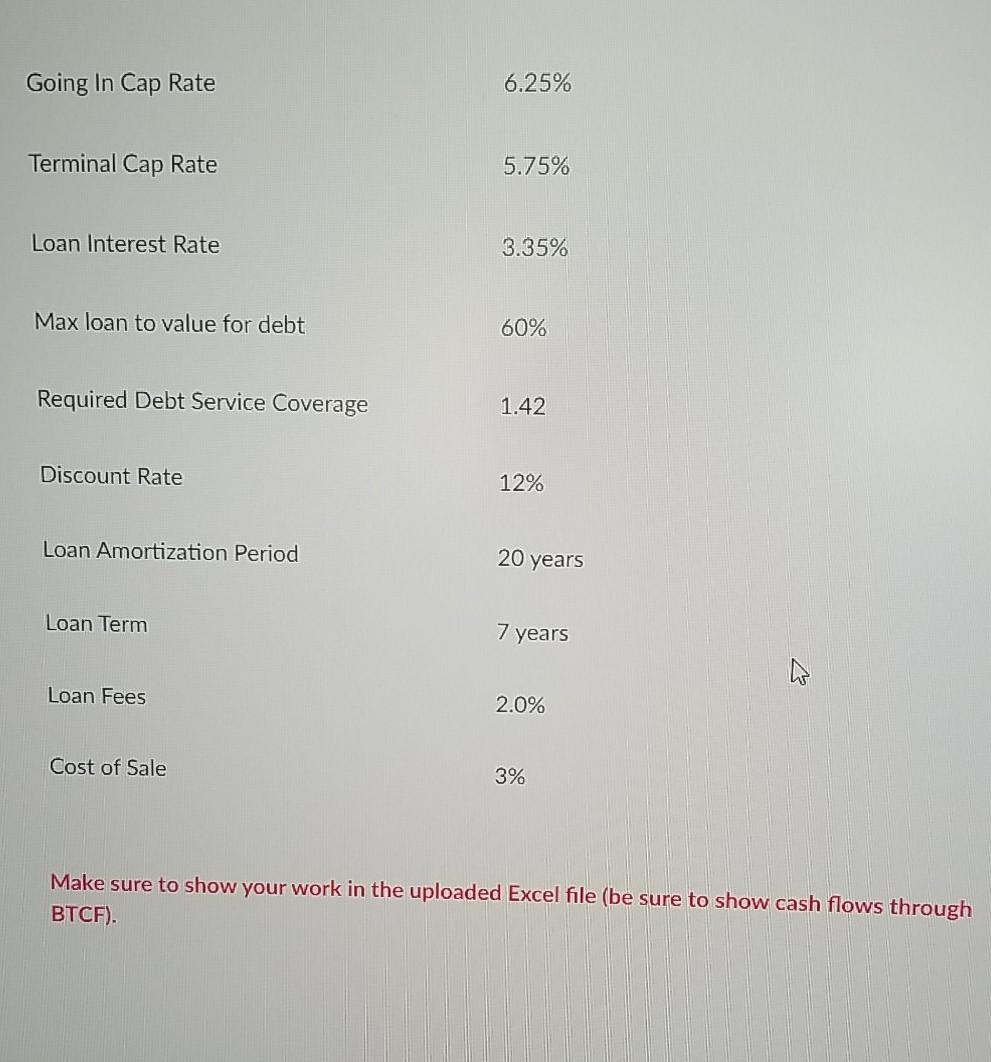

Part One Directions Complete pro forma for NOI Commercial Complex 4 tenants Property will be held for 5 years Current Lease Tenant Lease Type Size Rent Growth CAM Rate Bank NNN Outparcel $85,250/yr 2.15% Tenant revenue is $4.50/ sq ft expected to grow at 2.5% Limited to $2.75 per sa foot Retailer Percentage 3.125 Plus 4.55% per year revenue Pro rata on Year 1 sq feet Revenues are $310,000 Office 9.600 $21.00/ sq ft CPI None Limited to $5.25 per sq foot Office 4,375 $22.507 sq ft CPI Pro rata on sq feet OP EX Category Cost Growth Rate Utilities $3.25 per sq ft 2.85% per year Taxes $11,627 per year 2.75% per year Utilities $3.25 per sq ft 2.85% per year Taxes $11,627 per year 2.75% per year Insurance $2.75 per sq ft 2.0% per year Maintenance $3.15 per sq ft 3.15% per year CPI Rate Years 1-3 1.75% Years 4-7 2.25% Years 8-10 3.25% Part Two Questions: 1. Calculate The Max Debt for this property. 2. Calculate the amount of equity needed for this property. 3. Calculation the Net Sale Proceeds to Owner. Going In Cap Rate 6.25% Terminal Cap Rate 5.75% Loan Interest Rate 3.35% Max loan to value for debt 60% Required Debt Service Coverage 1.42 Going In Cap Rate 6.25% Terminal Cap Rate 5.75% Loan Interest Rate 3.35% Max loan to value for debt 60% Required Debt Service Coverage 1.42 Discount Rate 12% Loan Amortization Period 20 years Loan Term 7 years Loan Fees 2.0% Cost of Sale 3% Make sure to show your work in the uploaded Excel file (be sure to show cash flows through BTCF). Part One Directions Complete pro forma for NOI Commercial Complex 4 tenants Property will be held for 5 years Current Lease Tenant Lease Type Size Rent Growth CAM Rate Bank NNN Outparcel $85,250/yr 2.15% Tenant revenue is $4.50/ sq ft expected to grow at 2.5% Limited to $2.75 per sa foot Retailer Percentage 3.125 Plus 4.55% per year revenue Pro rata on Year 1 sq feet Revenues are $310,000 Office 9.600 $21.00/ sq ft CPI None Limited to $5.25 per sq foot Office 4,375 $22.507 sq ft CPI Pro rata on sq feet OP EX Category Cost Growth Rate Utilities $3.25 per sq ft 2.85% per year Taxes $11,627 per year 2.75% per year Utilities $3.25 per sq ft 2.85% per year Taxes $11,627 per year 2.75% per year Insurance $2.75 per sq ft 2.0% per year Maintenance $3.15 per sq ft 3.15% per year CPI Rate Years 1-3 1.75% Years 4-7 2.25% Years 8-10 3.25% Part Two Questions: 1. Calculate The Max Debt for this property. 2. Calculate the amount of equity needed for this property. 3. Calculation the Net Sale Proceeds to Owner. Going In Cap Rate 6.25% Terminal Cap Rate 5.75% Loan Interest Rate 3.35% Max loan to value for debt 60% Required Debt Service Coverage 1.42 Going In Cap Rate 6.25% Terminal Cap Rate 5.75% Loan Interest Rate 3.35% Max loan to value for debt 60% Required Debt Service Coverage 1.42 Discount Rate 12% Loan Amortization Period 20 years Loan Term 7 years Loan Fees 2.0% Cost of Sale 3% Make sure to show your work in the uploaded Excel file (be sure to show cash flows through BTCF)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts