Question: please help me with the problems. i have attached the photo below for the questions i need help. if you could very clear on how

question 2

question 2  question 3 & 4

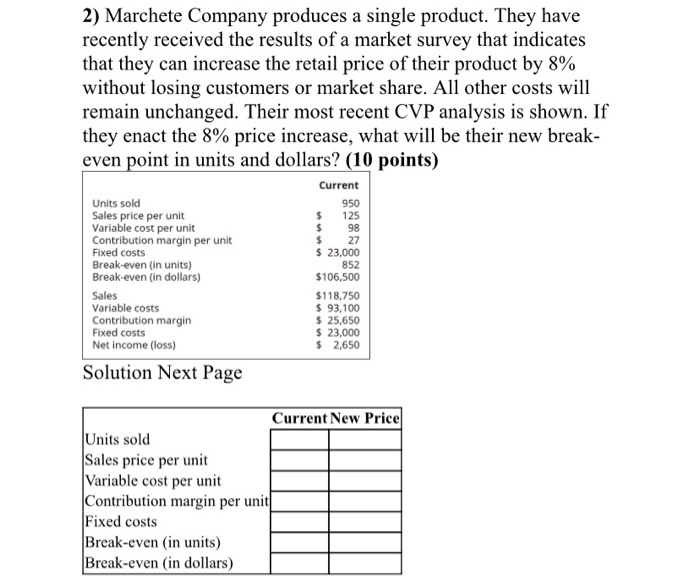

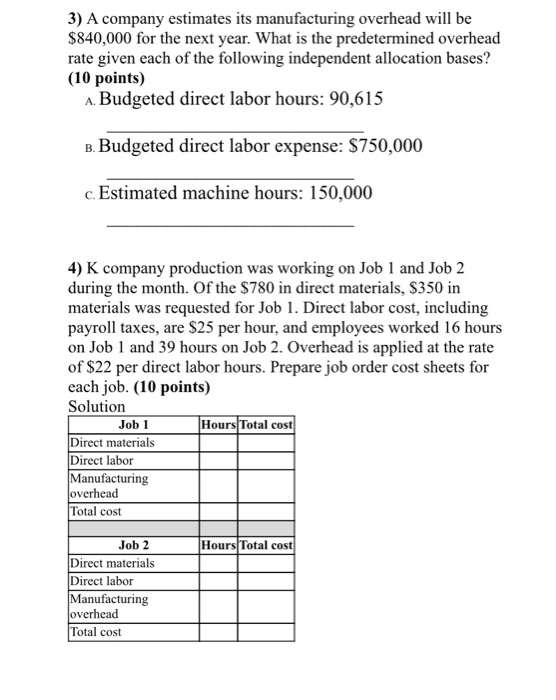

question 3 & 42) Marchete Company produces a single product. They have recently received the results of a market survey that indicates that they can increase the retail price of their product by 8% without losing customers or market share. All other costs will remain unchanged. Their most recent CVP analysis is shown. If they enact the 8% price increase, what will be their new break- even point in units and dollars? (10 points) Current Units sold 950 125 $ 98 Sales price per unit Variable cost per unit Contribution margin per unit Fixed costs Break-even (in units) Break-even (in dollars) Sales Variable costs Contribution margin Fixed costs Net income (loss) $ 23,000 852 $106,500 $118,750 $ 93,100 $ 25,650 $ 23,000 $ 2,650 Solution Next Page Current New Price Units sold Sales price per unit Variable cost per unit Contribution margin per unit Fixed costs Break-even (in units) Break-even (in dollars) 3) A company estimates its manufacturing overhead will be $840,000 for the next year. What is the predetermined overhead rate given each of the following independent allocation bases? (10 points) A Budgeted direct labor hours: 90,615 B. Budgeted direct labor expense: $750,000 c. Estimated machine hours: 150,000 4) K company production was working on Job 1 and Job 2 during the month. Of the $780 in direct materials, $350 in materials was requested for Job 1. Direct labor cost, including payroll taxes, are $25 per hour, and employees worked 16 hours on Job 1 and 39 hours on Job 2. Overhead is applied at the rate of $22 per direct labor hours. Prepare job order cost sheets for each job. (10 points) Solution Hours Total cost Direct materials Direct labor Manufacturing overhead Total cost Hours Total cost Job 2 Direct materials Direct labor Manufacturing overhead Total cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts