Question: PLEASE HELP ME WITH THESE FIVE, WILL GIVE THUMBS UP!!!!!!! THANKS!!!!!!! You find a zero coupon bond with a par value of $10,000 and 15

PLEASE HELP ME WITH THESE FIVE, WILL GIVE THUMBS UP!!!!!!!

THANKS!!!!!!!

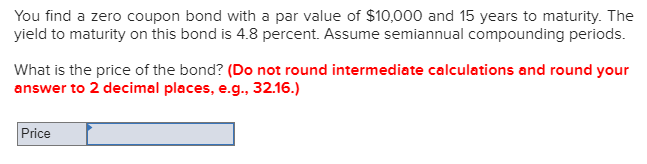

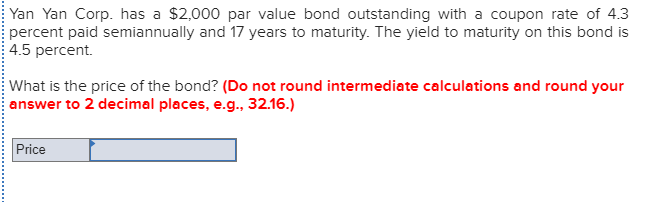

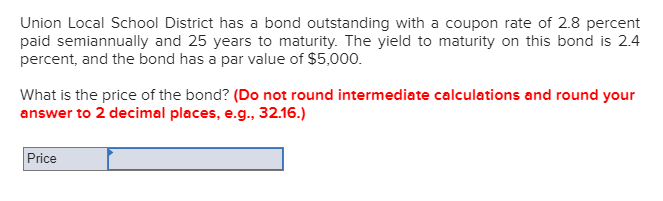

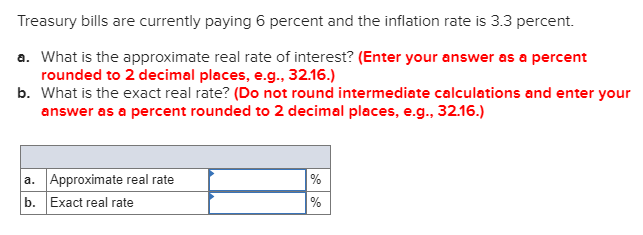

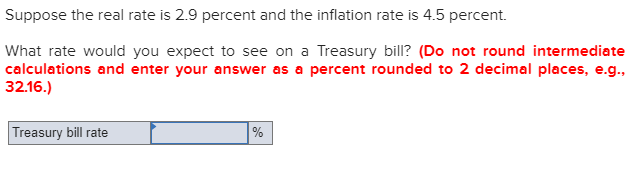

You find a zero coupon bond with a par value of $10,000 and 15 years to maturity. The yield to maturity on this bond is 4.8 percent. Assume semiannual compounding periods. What is the price of the bond? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Price Yan Yan Corp. has a $2,000 par value bond outstanding with a coupon rate of 4.3 percent paid semiannually and 17 years to maturity. The yield to maturity on this bond is 4.5 percent What is the price of the bond? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Price Union Local School District has a bond outstanding with a coupon rate of 2.8 percent paid semiannually and 25 years to maturity. The yield to maturity on this bond is 2.4 percent, and the bond has a par value of $5,000. What is the price of the bond? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Price Suppose the real rate is 2.9 percent and the inflation rate is 4.5 percent. What rate would you expect to see on a Treasury bill? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Treasury bill rate %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts