Question: please help me with these problems , they correlate, and can you also send the excel files You have just taken out a 30 year

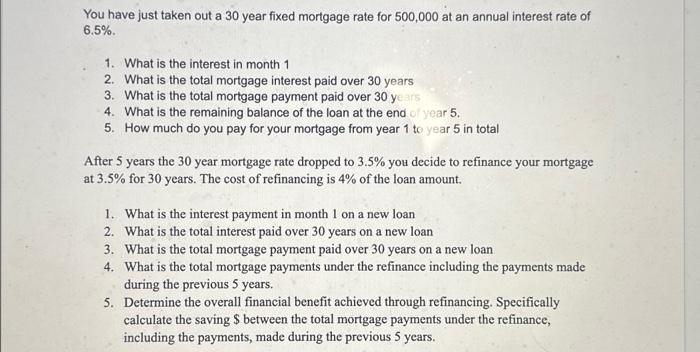

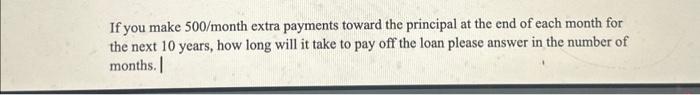

You have just taken out a 30 year fixed mortgage rate for 500,000 at an annual interest rate of 6.5%. 1. What is the interest in month 1 2. What is the total mortgage interest paid over 30 years 3. What is the total mortgage payment paid over 30y 4. What is the remaining balance of the loan at the end of year 5 . 5. How much do you pay for your mortgage from year 1 to year 5 in total After 5 years the 30 year mortgage rate dropped to 3.5% you decide to refinance your mortgage at 3.5% for 30 years. The cost of refinancing is 4% of the loan amount. 1. What is the interest payment in month 1 on a new loan 2. What is the total interest paid over 30 years on a new loan 3. What is the total mortgage payment paid over 30 years on a new loan 4. What is the total mortgage payments under the refinance including the payments made during the previous 5 years. 5. Determine the overall financial benefit achieved through refinancing. Specifically calculate the saving $ between the total mortgage payments under the refinance, including the payments, made during the previous 5 years. If you make 500/ month extra payments toward the principal at the end of each month for the next 10 years, how long will it take to pay off the loan please answer in the number of months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts