Question: please help me with this AP 5-2 (CCA Calculations) On January 2, 2021, Carlson Manufacturing had the following UCC balances: Class 53 Class 50 Class

please help me with this

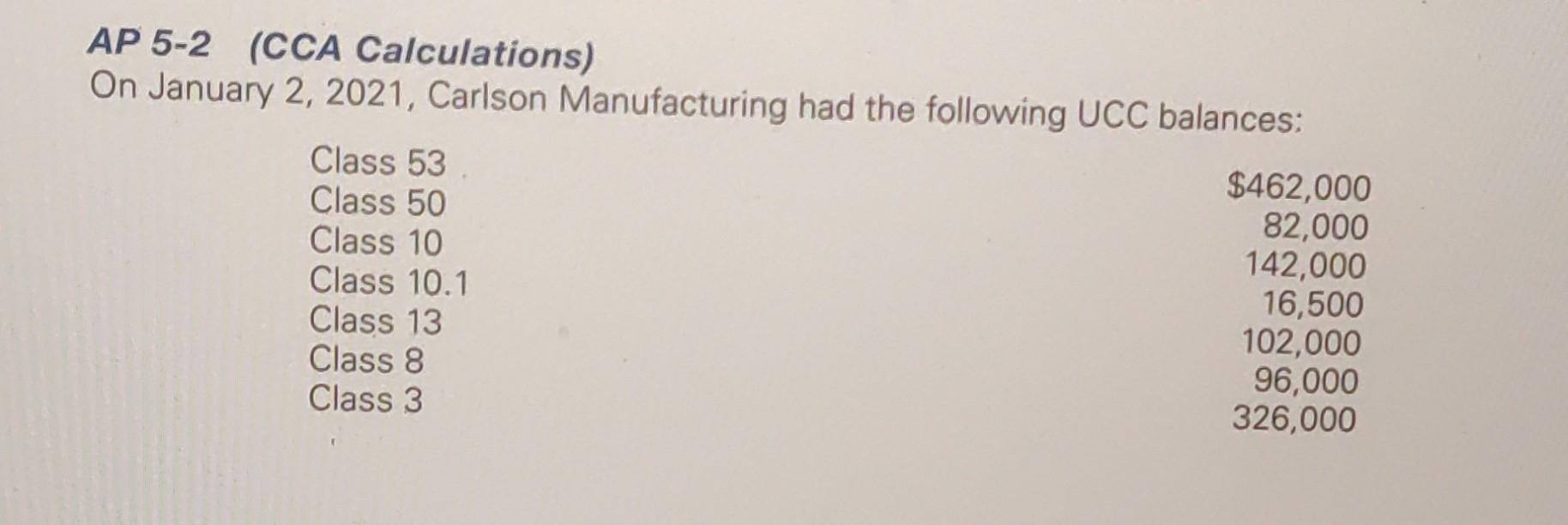

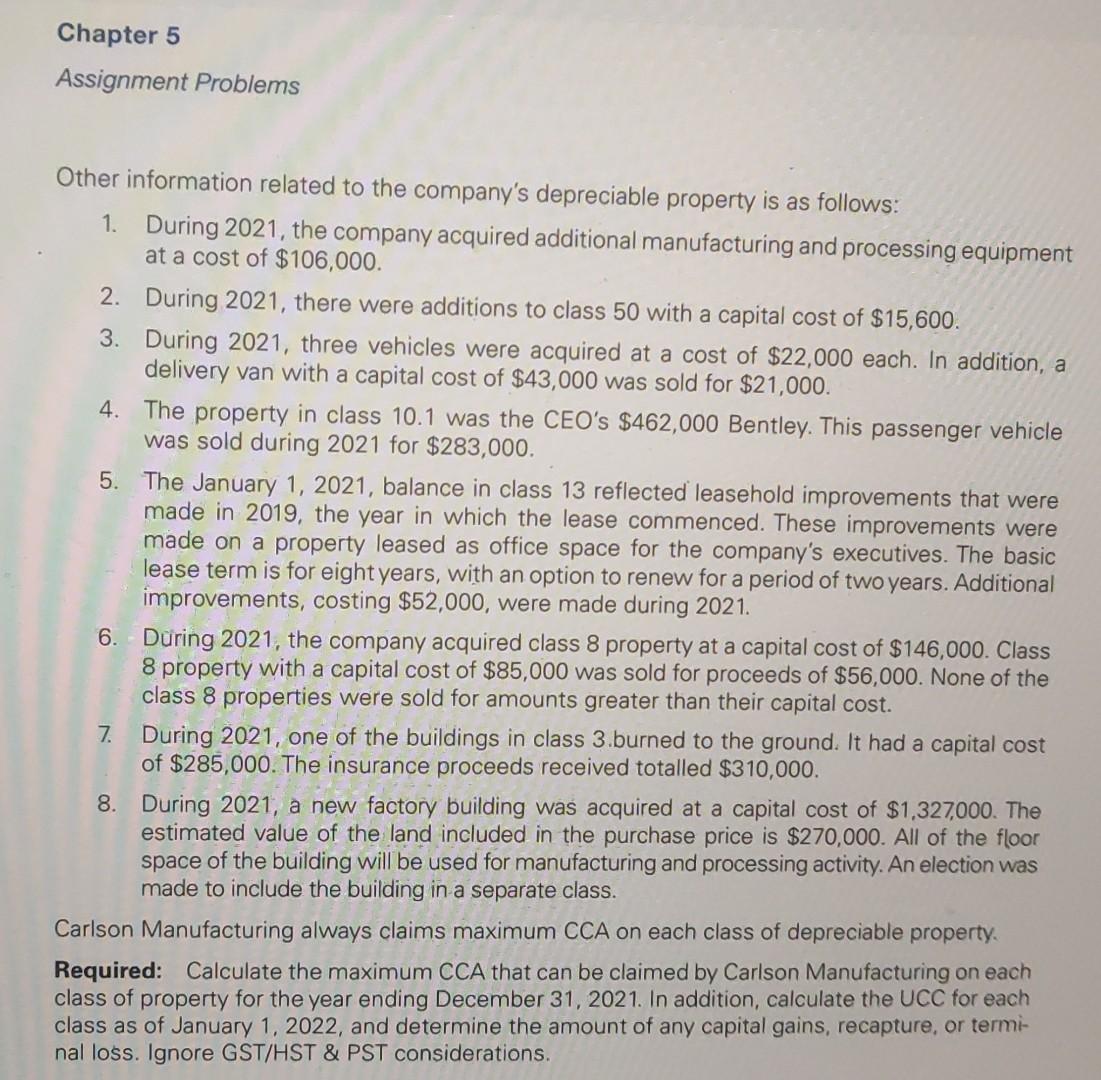

AP 5-2 (CCA Calculations) On January 2, 2021, Carlson Manufacturing had the following UCC balances: Class 53 Class 50 Class 10 Class 10.1 Class 13 Class 8 Class 3 $462,000 82,000 142.000 16,500 102,000 96,000 326,000 Chapter 5 Assignment Problems Other information related to the company's depreciable property is as follows: 1. During 2021, the company acquired additional manufacturing and processing equipment at a cost of $106,000. 2. During 2021, there were additions to class 50 with a capital cost of $15,600. 3. During 2021, three vehicles were acquired at a cost of $22,000 each. In addition, a delivery van with a capital cost of $43,000 was sold for $21,000. 4. The property in class 10.1 was the CEO's $462,000 Bentley. This passenger vehicle was sold during 2021 for $283,000. 5. The January 1, 2021, balance in class 13 reflected leasehold improvements that were made in 2019, the year in which the lease commenced. These improvements were made on a property leased as office space for the company's executives. The basic lease term is for eight years, with an option to renew for a period of two years. Additional improvements, costing $52,000, were made during 2021. 6. During 2021, the company acquired class 8 property at a capital cost of $146,000. Class 8 property with a capital cost of $85,000 was sold for proceeds of $56,000. None of the class 8 properties were sold for amounts greater than their capital cost. 7. During 2021, one of the buildings in class 3.burned to the ground. It had a capital cost of $285,000. The insurance proceeds received totalled $310,000. 8. During 2021, a new factory building was acquired at a capital cost of $1,327,000. The estimated value of the land included in the purchase price is $270,000. All of the floor space of the building will be used for manufacturing and processing activity. An election was made to include the building in a separate class. Carlson Manufacturing always claims maximum CCA on each class of depreciable property Required: Calculate the maximum CCA that can be claimed by Carlson Manufacturing on each class of property for the year ending December 31, 2021. In addition, calculate the UCC for each class as of January 1, 2022, and determine the amount of any capital gains, recapture, or termi- nal loss. Ignore GST/HST & PST considerations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts