Question: Please help me with this because I have no idea how to do it. Module 12 - Deliverable 2 is just the name of the

Please help me with this because I have no idea how to do it. Module 12 - Deliverable 2 is just the name of the project, which mean that i will need to submit completely project.

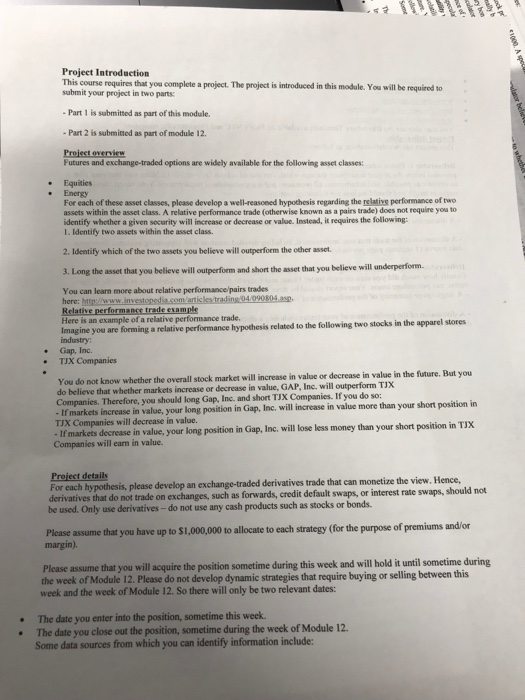

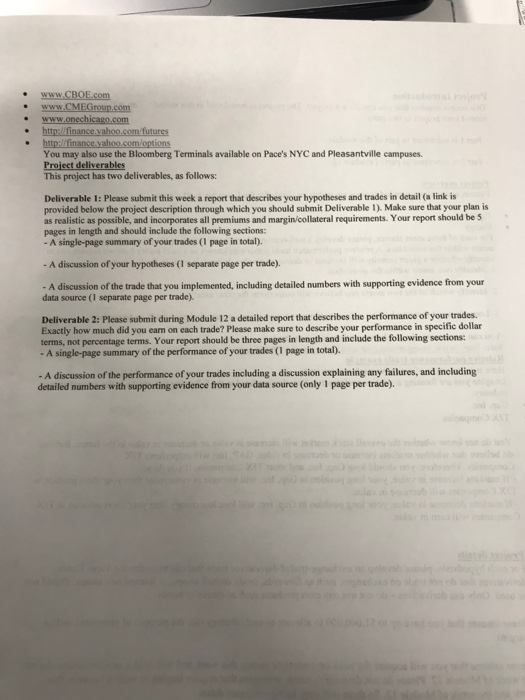

Project Introduction This course requires that you complete a project. The project is introduceod in this module. You will be required to submit your project in two parts: -Part 1 is submitted as part of this module. - Part 2 is submitted as part of module 12. Futures and exchange-traded options are widely available for the following asset classes: .Equities Energy For each of these asset classes, please develop a well-reasoned hypothesis regarding the relative performance of two assets within the asset class. A relative performance trade (otherwise known as a pairs trade) does not require you to identify whether a given security will increase or decrease or value. Instead, it requires the follow ing: I. Identify two assets within the asset class. 2. Identify which of the two assets you believe will outperform the other asset 3. Long the asset that you believe will outperform and shont the asset that you believe will underperform. You can learn more about relative performance pairs trades Here is an example of a relative performance trade Imagine you are forming a relative performance hypothesis related to the following two stocks in the apparel stores industry: . Gap, Inc . TIX Companies You do not know whether the overall tock market will incresse in value or dscrease in value in the future. But you do believe that whether markets increase or decrease in value, GAP, Inc. will Companies. Therefore, you should long Gap, Inc. and short TJX Companies. If you do so: ease in value, your long position in Gap. Inc. will increase in value more than your short position in in value, your long position in Gap, Inc. will lose less money than your short position in TJXx TJX Companies will decrease in value. Companies will earn in value. Project details For each hypothesis, please develop an exchange-traded derivatives that do not trade on exchanges, such as forwards, credit default swaps, or interest rate swaps, should not be used. Only use derivatives - do not use any cash products such as stocks or bonds. derivatives trade that can monetize the view. Hence, Please assume that you have up to $1,000,000 to allocate to each strategy (for the purpose of premiums and/on margin). Please assume that you will acquire the position sometime during this week and will hold it until sometime during the week of Module 12. Please do not develop dynamic strategies that require buying or selling between this week and the week of Module 12. So there will only be two relevant dates: The date you enter into the position, sometime this week. The date you close out the position, sometime during the week of Module 12 Some data sources from which you can identify information include: Project Introduction This course requires that you complete a project. The project is introduceod in this module. You will be required to submit your project in two parts: -Part 1 is submitted as part of this module. - Part 2 is submitted as part of module 12. Futures and exchange-traded options are widely available for the following asset classes: .Equities Energy For each of these asset classes, please develop a well-reasoned hypothesis regarding the relative performance of two assets within the asset class. A relative performance trade (otherwise known as a pairs trade) does not require you to identify whether a given security will increase or decrease or value. Instead, it requires the follow ing: I. Identify two assets within the asset class. 2. Identify which of the two assets you believe will outperform the other asset 3. Long the asset that you believe will outperform and shont the asset that you believe will underperform. You can learn more about relative performance pairs trades Here is an example of a relative performance trade Imagine you are forming a relative performance hypothesis related to the following two stocks in the apparel stores industry: . Gap, Inc . TIX Companies You do not know whether the overall tock market will incresse in value or dscrease in value in the future. But you do believe that whether markets increase or decrease in value, GAP, Inc. will Companies. Therefore, you should long Gap, Inc. and short TJX Companies. If you do so: ease in value, your long position in Gap. Inc. will increase in value more than your short position in in value, your long position in Gap, Inc. will lose less money than your short position in TJXx TJX Companies will decrease in value. Companies will earn in value. Project details For each hypothesis, please develop an exchange-traded derivatives that do not trade on exchanges, such as forwards, credit default swaps, or interest rate swaps, should not be used. Only use derivatives - do not use any cash products such as stocks or bonds. derivatives trade that can monetize the view. Hence, Please assume that you have up to $1,000,000 to allocate to each strategy (for the purpose of premiums and/on margin). Please assume that you will acquire the position sometime during this week and will hold it until sometime during the week of Module 12. Please do not develop dynamic strategies that require buying or selling between this week and the week of Module 12. So there will only be two relevant dates: The date you enter into the position, sometime this week. The date you close out the position, sometime during the week of Module 12 Some data sources from which you can identify information include:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts