Question: Please help me with this challenge question. I've been stuck on it for days 14. Challenge Problem: Preparing a statement of cash flows with amortization

Please help me with this challenge question. I've been stuck on it for days

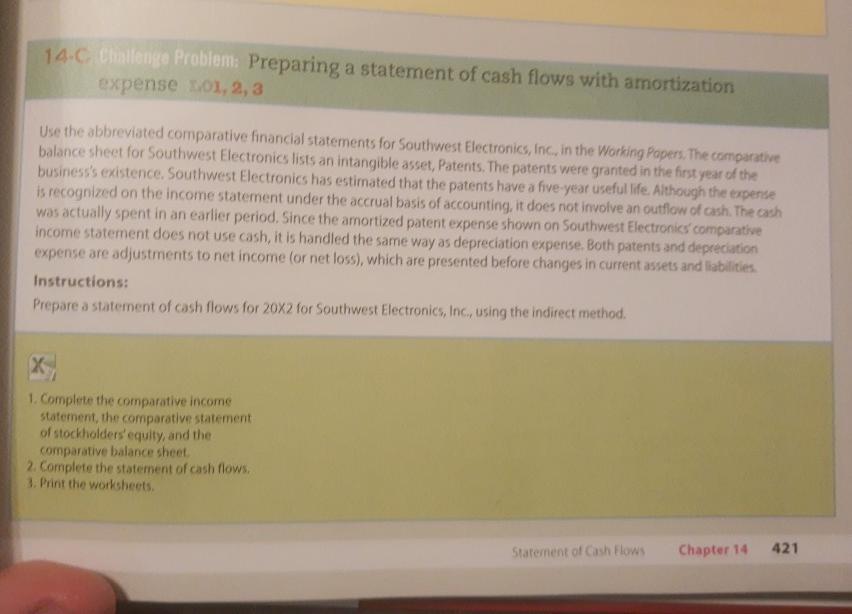

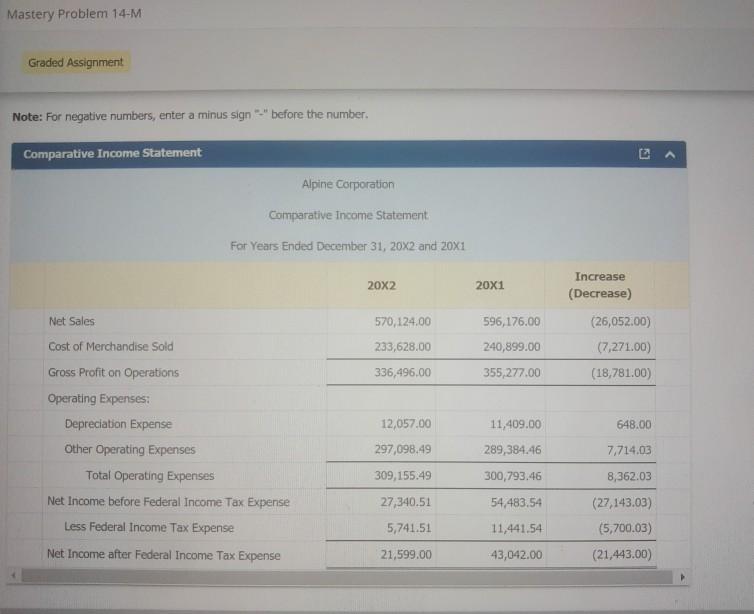

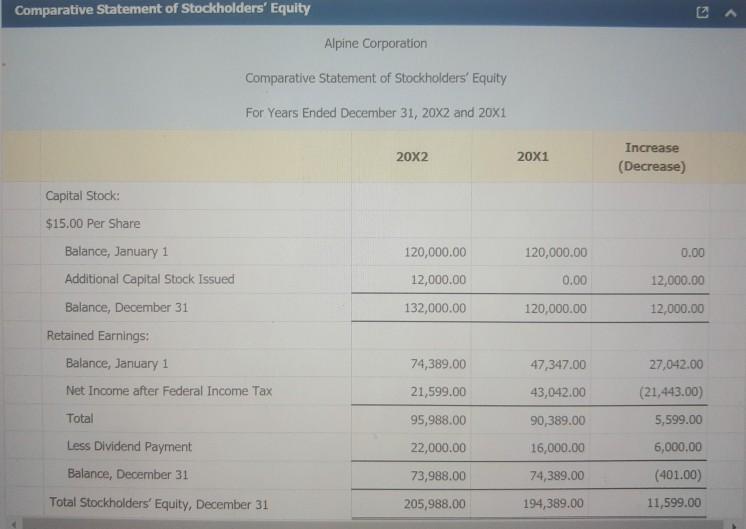

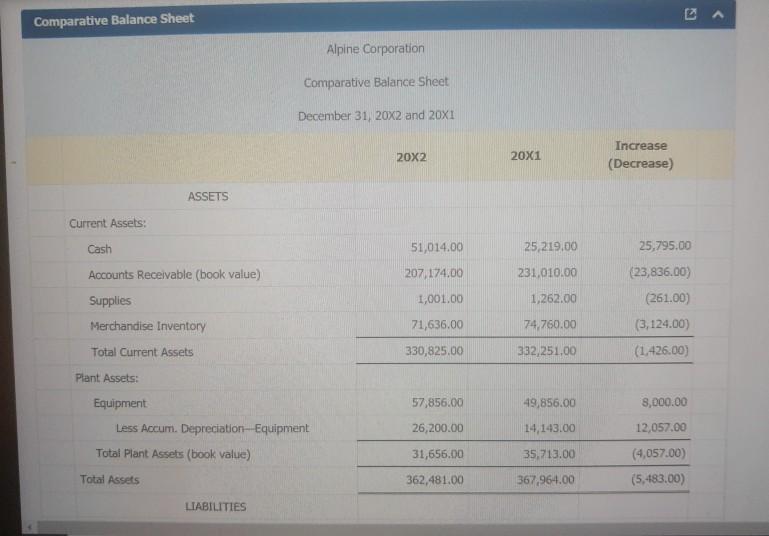

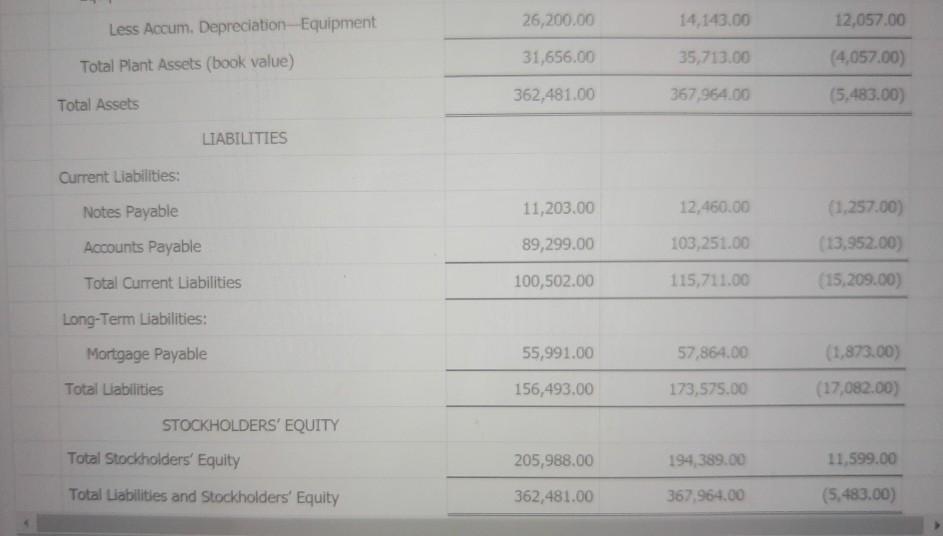

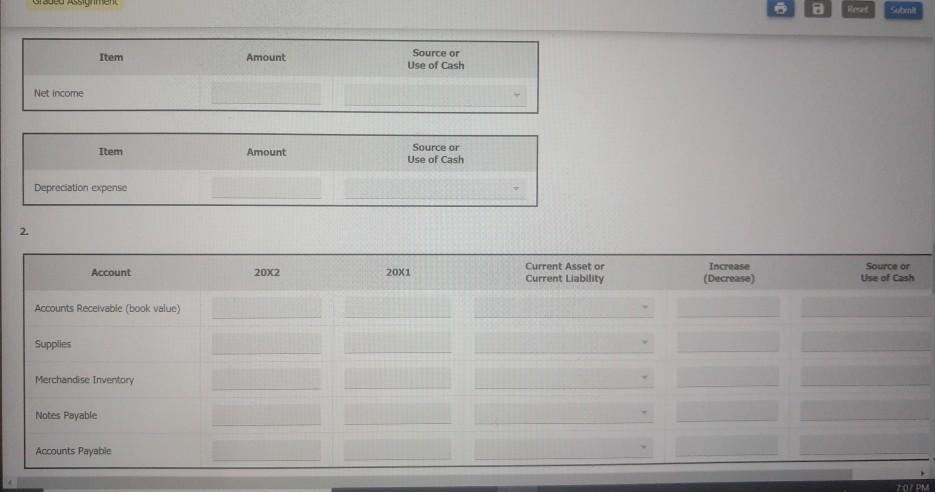

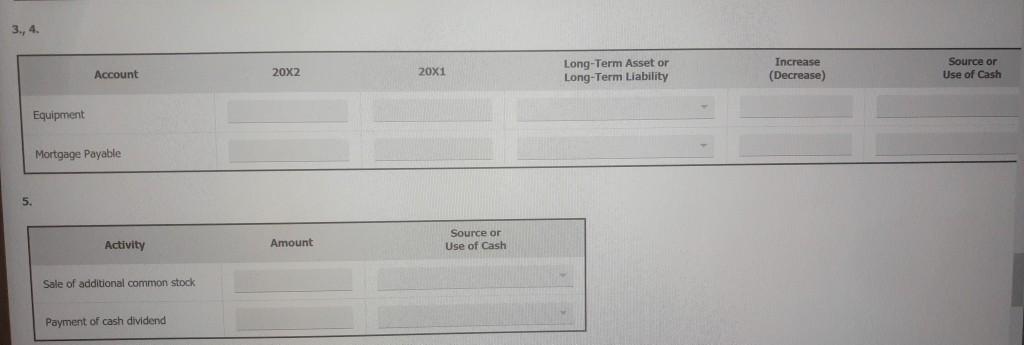

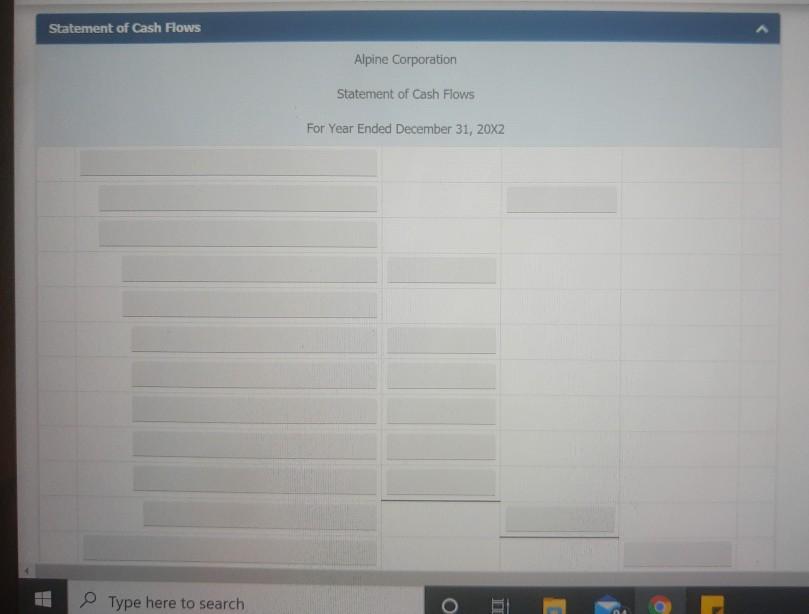

14. Challenge Problem: Preparing a statement of cash flows with amortization expense 01, 2, 3 Use the abbreviated comparative financial statements for Southwest Electronics, Inc., in the Working Papers. The comparative balance sheet for Southwest Electronics lists an intangible asset, Patents. The patents were granted in the first year of the business's existence. Southwest Electronics has estimated that the patents have a five-year useful life. Although the crense is recognized on the income statement under the accrual basis of accounting, it does not involve an outflow of cash. The cash was actually spent in an earlier period. Since the amortized patent expense shown on Southwest Electronics comparative income statement does not use cash, it is handled the same way as depreciation experise. Both patents and depreciation expense are adjustments to net income for net loss), which are presented before changes in current assets and liabilities Instructions: Prepare a statement of cash flows for 20x2 for Southwest Electronics, Inc., using the indirect method. 1. Complete the comparative income statement, the comparative statement of stockholders' equity, and the comparative balance sheet 2. Complete the statement of cash flows 3. Print the worksheets Statement of Cash Flows Chapter 14 421 Mastery Problem 14-M Graded Assignment Note: For negative numbers, enter a minus sign before the number. Comparative Income Statement LS Comparative Balance Sheet Alpine Corporation Comparative Balance Sheet December 31, 20X2 and 20X1 20X2 20X1 Increase (Decrease) ASSETS Current Assets: Cash 25,219.00 25,795.00 51,014.00 207. 174.00 1,001.00 231.010.00 1,262.00 Accounts Receivable (book value) Supplies Merchandise Inventory Total Current Assets Plant Assets: (23,836.00) (261.00) (3,124.00) (1.426.00) 71,636.00 74,760.00 330,825.00 332,251,00 57,856.00 49,856.00 Equipment Less Accum. Depreciation Equipment Total Plant Assets (book value) 8,000.00 12,057.00 26,200.00 14,143.00 35,713.00 31,656.00 362,481.00 (4,057.00) (5.483.00) Total Assets 367,964.00 LIABILITIES 26,200.00 14,143.00 12,057.00 Less Accum. Depreciation Equipment Total Plant Assets (book value) 31,656.00 35,713.00 (4,057.00) 362,481.00 367,964.00 (5.483.00) Total Assets LIABILITIES Current Liabilities: 11,203.00 12,460.00 Notes Payable Accounts Payable (1,257.00) (13.952.00) 89,299.00 103,251.00 Total Current Liabilities 100,502.00 115,711.00 (15,209.00) Long-Term Liabilities: Mortgage Payable 55,991.00 57,864.00 (1,873.00) Total Liabilities 156,493.00 173,575.00 (17,082.00) STOCKHOLDERS' EQUITY Total Stockholders' Equity 205,988.00 194,389.00 11,599.00 Total Liabilities and Stockholders' Equity 362,481.00 367,964.00 (5,483.00) B Item Amount Source or Use of Cash Net Income Item Amount Source or Use of Cash Depreciation expense 2 Account 20X2 20X1 Current Asset or Current Liability Increase (Decrease) Source or Use of Cash Accounts Receivable (book value) Supplies Merchandise Inventory Notes Payable Accounts Payable 707 PM 3., 4. Account 20X2 20X1 Long-Term Asset or Long-Term Liability Increase (Decrease) Source or Use of Cash Equipment Mortgage Payable 5 Activity Amount Source or Use of Cash Sale of additional common stock Payment of cash dividend Statement of Cash Flows Alpine Corporation Statement of Cash Flows For Year Ended December 31, 20X2 Type here to search o 10. Operating cash flow ratio Cash flow margin ratio 11. Operating cash flow ratio: Alpine Corporation's operating cash flow from .In the corporation had cash flow to pay every dollar of current liability. In the company has in operating cash flow for every dollar of current liability, Cash flow margin ratio: Alpine Corporation's cash flow margin ratio from . In the corporation acquired operating cash flows for every of sales. In the company acquired of operating cash flows for every

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts