Question: please help me with this chart. I don't know what they want me to put on the tabular form. I thought it was a change

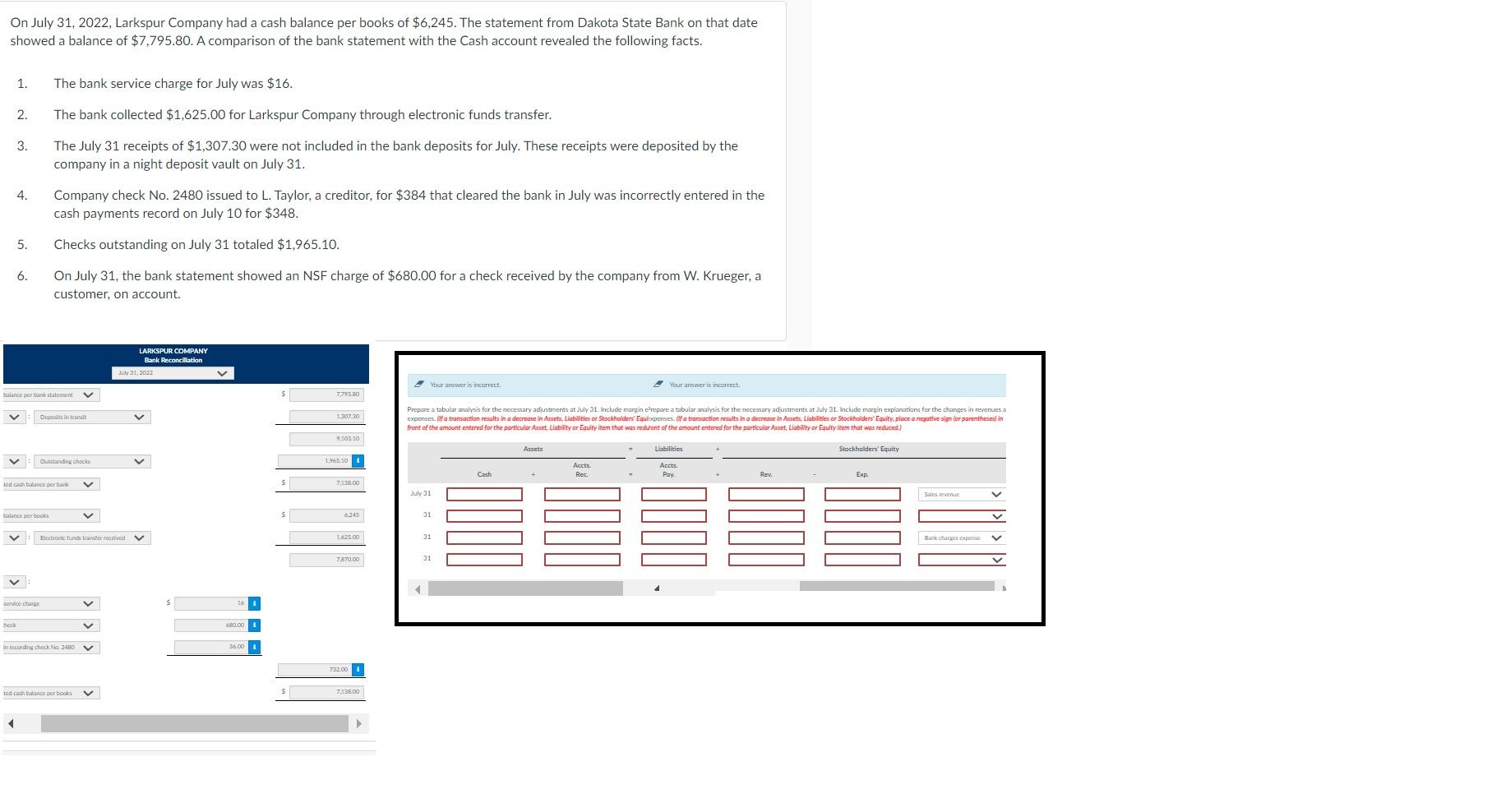

please help me with this chart. I don't know what they want me to put on the tabular form. I thought it was a change in cash, but I got this wrong, and the system didn't tell me what it wanted. How do you know what they want on here? What should the chart have, and why should it have that? Thank you.

please help me with this chart. I don't know what they want me to put on the tabular form. I thought it was a change in cash, but I got this wrong, and the system didn't tell me what it wanted. How do you know what they want on here? What should the chart have, and why should it have that? Thank you.

On July 31, 2022, Larkspur Company had a cash balance per books of $6,245. The statement from Dakota State Bank on that date showed a balance of $7,795.80. A comparison of the bank statement with the Cash account revealed the following facts. 1. The bank service charge for July was $16. 2. The bank collected $1,625.00 for Larkspur Company through electronic funds transfer. 3. The July 31 receipts of $1,307.30 were not included in the bank deposits for July. These receipts were deposited by the company in a night deposit vault on July 31. 4. Company check No. 2480 issued to L. Taylor, a creditor, for $384 that cleared the bank in July was incorrectly entered in the cash payments record on July 10 for $348. 5. Checks outstanding on July 31 totaled $1,965.10. 6. On July 31, the bank statement showed an NSF charge of $680.00 for a check received by the company from W. Krueger, a customer, on account. LARKSPUR COMPANY Bank Reconciliation July 21, 2012 Your answer is incorrect. Your answer is incorrect se per tank statement V 7.79580 Deposits in trandt V L307 30 Prepare a tabular analysis for the necessary adjustments at July 31. Include marginerepare a tabular analysis for the necessary adjustments at July 31. Include margin explanations for the changes in revenues a expenses. (transaction results in a decrease in Assets, Liabilities or Stockholders Equixpenses. (If transaction results in a decrease in Assets, Liabilities or Stockholders Equity, place a negative sign for parentheses in front of the amount entered for the particular Asset, Liability or Equity item that was reduiront of the amount entered for the particular Asset, Liability or Equity item that was reduced) *.103:30 Assets Liabilities Stockholders' Equity Outstanding checks 1.96510 Accts Rec Accts Pay Cash - Rew Exp. tot cash banen per bank V $ 7.138.00 July 31 Sales menus V balance ber books V $ 31 Electronic funds and received 125.00 31 Bank charges expense 7870.00 31 Service change V 680.00 this recording check No 2480 36.00 1 732.00 1 teda blanca per books 7.138.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts