Question: Please help me with this econ I need help with this. begin{tabular}{|c|l} hline Acct No. & multicolumn{1}{|c}{ Acct Name } hline 1001 & Cash

Please help me with this econ

I need help with this.

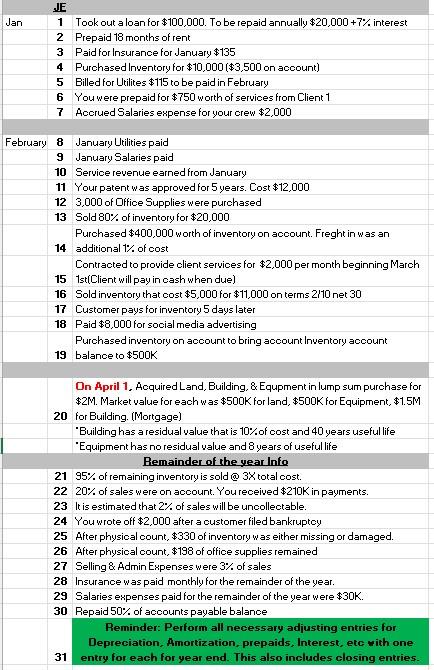

\begin{tabular}{|c|l} \hline Acct No. & \multicolumn{1}{|c}{ Acct Name } \\ \hline 1001 & Cash \\ \hline 1002 & Accounts Receivable \\ \hline 1003 & Office Supplies \\ \hline 1004 & Prepaid Rent \\ \hline 1005 & Prepaid Insurance \\ \hline 1006 & Inventory \\ \hline 1007 & Land \\ \hline 1008 & Building \\ \hline 1009 & Acc. Depr.-Building \\ \hline 1010 & Equipment \\ \hline 1011 & Acc. Depr.-Equipment \\ \hline 1012 & Furniture \\ \hline 1013 & Acc. Depr.-Furniture \\ \hline 1014 & Patent \\ \hline 1015 & Copyrights \\ \hline 1016 & Goodwill \\ \hline 1017 & Investment \\ \hline 2001 & Accounts Payable \\ \hline 2002 & Utilities Payable \\ \hline 2003 & Salaries Payable \\ \hline 2004 & Interest Payable \\ \hline 2005 & Unearned Revenue \\ \hline 2006 & Notes Payable \\ \hline 2007 & Mortgage Payable \\ \hline 3001 & Common Stock \\ \hline 3002 & Paid in Capital \\ \hline 3003 & Retained Earnings \\ \hline 3004 & Dividends \\ \hline 3005 & Service Revenue \\ \hline 3006 & Sales Revenue \\ \hline 3007 & Discount Forfeited \\ \hline 3008 & Cost of Goods Sold \\ \hline 3009 & Rent Expense \\ \hline 3010 & Salaries Expense \\ \hline 3011 & Supplies Expense \\ \hline 3012 & Utilities Expense \\ \hline 3013 & Interest Expense \\ \hline 3014 & Depr. Exp.-Equipment \\ \hline 3015 & Depr. Exp.-Furniture \\ \hline 3016 & Depr. Exp.-Building \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Jan & JE \\ \hline 1 & Took out a loan for $100,000. To be repaid annually $20,000+7% interest \\ 2 & Prepaid 18 months of rent \\ \hline 3 & Paid for Insurance for January $135 \\ \hline 4 & Purchased Inventory for $10,000 ( $3,500 on account) \\ 5 & Billed for Utilites $115 to be paid in February \\ 6 & You were prepaid for $750 worth of services from Client 1 \\ \hline 7 & Accrued Salaries expense for your crew $2,000 \end{tabular} February 8 January Utilities paid 9 January Salaries paid 10 Service revenue earned from January 11 Your patent was approved for 5 years. Cost $12,000 123,000 of Drfice Supplies were purchased 13 Sold 80% of inventory for $20,000 Purchased $400,000 worth of inventory on acoount. Freght in was an 14 additional 1% of cost Contracted to provide client services for $2,000 per month beginning March 15 1st(Client will pay in cash when due) 16 Sold inventory that cost $5,000 for $11,000 on terms 2/10 net 30 17 Customer pays for inventory 5 days later 18 Paid $8,000 for social media advertising Purchased inventory on account to bring acoount inventory account 19 balance to $500K On April 1. Aequired Land, Building, \& Equpment in lump sum purchase for $2M. Market value for each was $500K for land, $500K for Equipment, $1.5M 20 for Building. (Mortgage) "Building has a residual value that is 10% of cost and 40 years useful life "Equipment has no residual value and 8 years of useful life Bemainder of the year info 2195% of remaining inventory is sold @3 total cost. 2220% of sales were on account. You received $210K in payments. 23 It is estimated that 2% of sales will be uncollectable. 24 You wrote off $2,000 after a customer filed bankruptoy 25 After physical count, $330 of inventory was either missing or damaged. 26 After physical count, $198 of office supplies remained 27 Selling \& Admin Expenses were 3\% of sales 28 Insurance was paid monthly for the remainder of the year. 29 Salaries expenses paid for the remainder of the year were $30K. 30 Repaid 50% of acoounts payable balance Reminder: Perform all necessary adjusting entries for Depreciation, Amortization, prepaids, Interest, etc vith one 31 entry for each for year end. This also includes closing entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts