Question: please help begin{tabular}{|l|l|} hline Jan & JE hline 1 & Took out a loan for $100,000. To be repaid annually $20,000+7% interest 2

please help

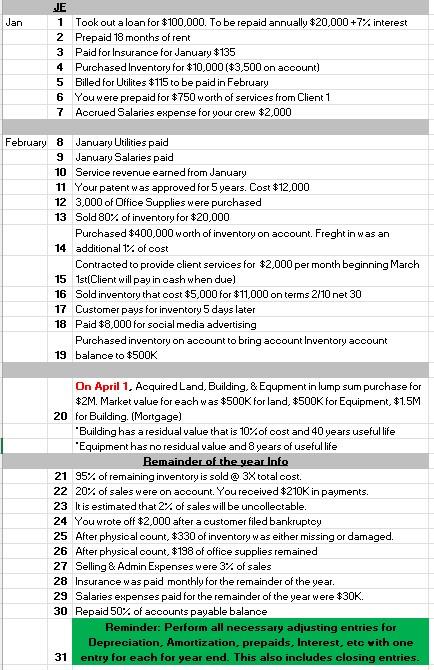

\begin{tabular}{|l|l|} \hline Jan & JE \\ \hline 1 & Took out a loan for $100,000. To be repaid annually $20,000+7% interest \\ 2 & Prepaid 18 months of rent \\ \hline 3 & Paid for Insurance for January $135 \\ \hline 4 & Purchased Inventory for $10,000 ( $3,500 on account) \\ 5 & Billed for Utilites $115 to be paid in February \\ 6 & You were prepaid for $750 worth of services from Client 1 \\ \hline 7 & Accrued Salaries expense for your crew $2,000 \end{tabular} February 8 January Utilities paid 9 January Salaries paid 10 Service revenue earned from January 11 Your patent was approved for 5 years. Cost $12,000 123,000 of Drfice Supplies were purchased 13 Sold 80% of inventory for $20,000 Purchased $400,000 worth of inventory on acoount. Freght in was an 14 additional 1% of cost Contracted to provide client services for $2,000 per month beginning March 15 1st(Client will pay in cash when due) 16 Sold inventory that cost $5,000 for $11,000 on terms 2/10 net 30 17 Customer pays for inventory 5 days later 18 Paid $8,000 for social media advertising Purchased inventory on account to bring acoount inventory account 19 balance to $500K On April 1. Aequired Land, Building, \& Equpment in lump sum purchase for $2M. Market value for each was $500K for land, $500K for Equipment, $1.5M 20 for Building. (Mortgage) "Building has a residual value that is 10% of cost and 40 years useful life "Equipment has no residual value and 8 years of useful life Bemainder of the year info 2195% of remaining inventory is sold @3 total cost. 2220% of sales were on account. You received $210K in payments. 23 It is estimated that 2% of sales will be uncollectable. 24 You wrote off $2,000 after a customer filed bankruptoy 25 After physical count, $330 of inventory was either missing or damaged. 26 After physical count, $198 of office supplies remained 27 Selling \& Admin Expenses were 3\% of sales 28 Insurance was paid monthly for the remainder of the year. 29 Salaries expenses paid for the remainder of the year were $30K. 30 Repaid 50% of acoounts payable balance Reminder: Perform all necessary adjusting entries for Depreciation, Amortization, prepaids, Interest, etc vith one 31 entry for each for year end. This also includes closing entries. \begin{tabular}{|c|l} \hline Acct No. & \multicolumn{1}{|c}{ Acct Name } \\ \hline 1001 & Cash \\ \hline 1002 & Accounts Receivable \\ \hline 1003 & Office Supplies \\ \hline 1004 & Prepaid Rent \\ \hline 1005 & Prepaid Insurance \\ \hline 1006 & Inventory \\ \hline 1007 & Land \\ \hline 1008 & Building \\ \hline 1009 & Acc. Depr.-Building \\ \hline 1010 & Equipment \\ \hline 1011 & Acc. Depr.-Equipment \\ \hline 1012 & Furniture \\ \hline 1013 & Acc. Depr.-Furniture \\ \hline 1014 & Patent \\ \hline 1015 & Copyrights \\ \hline 1016 & Goodwill \\ \hline 1017 & Investment \\ \hline 2001 & Accounts Payable \\ \hline 2002 & Utilities Payable \\ \hline 2003 & Salaries Payable \\ \hline 2004 & Interest Payable \\ \hline 2005 & Unearned Revenue \\ \hline 2006 & Notes Payable \\ \hline 2007 & Mortgage Payable \\ \hline 3001 & Common Stock \\ \hline 3002 & Paid in Capital \\ \hline 3003 & Retained Earnings \\ \hline 3004 & Dividends \\ \hline 3005 & Service Revenue \\ \hline 3006 & Sales Revenue \\ \hline 3007 & Discount Forfeited \\ \hline 3008 & Cost of Goods Sold \\ \hline 3009 & Rent Expense \\ \hline 3010 & Salaries Expense \\ \hline 3011 & Supplies Expense \\ \hline 3012 & Utilities Expense \\ \hline 3013 & Interest Expense \\ \hline 3014 & Depr. Exp.-Equipment \\ \hline 3015 & Depr. Exp.-Furniture \\ \hline 3016 & Depr. Exp.-Building \\ \hline \end{tabular} Business Name Post-Closing Trial Balance December 31, 2021 \begin{tabular}{|l|l|} \hline Jan & JE \\ \hline 1 & Took out a loan for $100,000. To be repaid annually $20,000+7% interest \\ 2 & Prepaid 18 months of rent \\ \hline 3 & Paid for Insurance for January $135 \\ \hline 4 & Purchased Inventory for $10,000 ( $3,500 on account) \\ 5 & Billed for Utilites $115 to be paid in February \\ 6 & You were prepaid for $750 worth of services from Client 1 \\ \hline 7 & Accrued Salaries expense for your crew $2,000 \end{tabular} February 8 January Utilities paid 9 January Salaries paid 10 Service revenue earned from January 11 Your patent was approved for 5 years. Cost $12,000 123,000 of Drfice Supplies were purchased 13 Sold 80% of inventory for $20,000 Purchased $400,000 worth of inventory on acoount. Freght in was an 14 additional 1% of cost Contracted to provide client services for $2,000 per month beginning March 15 1st(Client will pay in cash when due) 16 Sold inventory that cost $5,000 for $11,000 on terms 2/10 net 30 17 Customer pays for inventory 5 days later 18 Paid $8,000 for social media advertising Purchased inventory on account to bring acoount inventory account 19 balance to $500K On April 1. Aequired Land, Building, \& Equpment in lump sum purchase for $2M. Market value for each was $500K for land, $500K for Equipment, $1.5M 20 for Building. (Mortgage) "Building has a residual value that is 10% of cost and 40 years useful life "Equipment has no residual value and 8 years of useful life Bemainder of the year info 2195% of remaining inventory is sold @3 total cost. 2220% of sales were on account. You received $210K in payments. 23 It is estimated that 2% of sales will be uncollectable. 24 You wrote off $2,000 after a customer filed bankruptoy 25 After physical count, $330 of inventory was either missing or damaged. 26 After physical count, $198 of office supplies remained 27 Selling \& Admin Expenses were 3\% of sales 28 Insurance was paid monthly for the remainder of the year. 29 Salaries expenses paid for the remainder of the year were $30K. 30 Repaid 50% of acoounts payable balance Reminder: Perform all necessary adjusting entries for Depreciation, Amortization, prepaids, Interest, etc vith one 31 entry for each for year end. This also includes closing entries. \begin{tabular}{|c|l} \hline Acct No. & \multicolumn{1}{|c}{ Acct Name } \\ \hline 1001 & Cash \\ \hline 1002 & Accounts Receivable \\ \hline 1003 & Office Supplies \\ \hline 1004 & Prepaid Rent \\ \hline 1005 & Prepaid Insurance \\ \hline 1006 & Inventory \\ \hline 1007 & Land \\ \hline 1008 & Building \\ \hline 1009 & Acc. Depr.-Building \\ \hline 1010 & Equipment \\ \hline 1011 & Acc. Depr.-Equipment \\ \hline 1012 & Furniture \\ \hline 1013 & Acc. Depr.-Furniture \\ \hline 1014 & Patent \\ \hline 1015 & Copyrights \\ \hline 1016 & Goodwill \\ \hline 1017 & Investment \\ \hline 2001 & Accounts Payable \\ \hline 2002 & Utilities Payable \\ \hline 2003 & Salaries Payable \\ \hline 2004 & Interest Payable \\ \hline 2005 & Unearned Revenue \\ \hline 2006 & Notes Payable \\ \hline 2007 & Mortgage Payable \\ \hline 3001 & Common Stock \\ \hline 3002 & Paid in Capital \\ \hline 3003 & Retained Earnings \\ \hline 3004 & Dividends \\ \hline 3005 & Service Revenue \\ \hline 3006 & Sales Revenue \\ \hline 3007 & Discount Forfeited \\ \hline 3008 & Cost of Goods Sold \\ \hline 3009 & Rent Expense \\ \hline 3010 & Salaries Expense \\ \hline 3011 & Supplies Expense \\ \hline 3012 & Utilities Expense \\ \hline 3013 & Interest Expense \\ \hline 3014 & Depr. Exp.-Equipment \\ \hline 3015 & Depr. Exp.-Furniture \\ \hline 3016 & Depr. Exp.-Building \\ \hline \end{tabular} Business Name Post-Closing Trial Balance December 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts