Question: please help me with this one! kindly note fomula and explain it as detailed as possible! Many tks!!! FIN201 - CORPORATE FINANCE EXERCISE #3 (GROUP

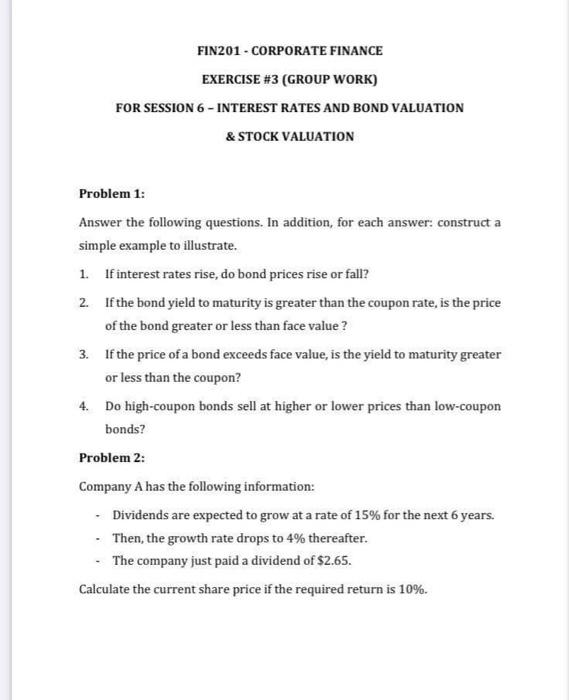

FIN201 - CORPORATE FINANCE EXERCISE \#3 (GROUP WORK) FOR SESSION 6 - INTEREST RATES AND BOND VALUATION \& STOCK VALUATION Problem 1: Answer the following questions. In addition, for each answer: construct a simple example to illustrate. 1. If interest rates rise, do bond prices rise or fall? 2. If the bond yield to maturity is greater than the coupon rate, is the price of the bond greater or less than face value? 3. If the price of a bond exceeds face value, is the yield to maturity greater or less than the coupon? 4. Do high-coupon bonds sell at higher or lower prices than low-coupon bonds? Problem 2: Company A has the following information: - Dividends are expected to grow at a rate of 15% for the next 6 years. - Then, the growth rate drops to 4% thereafter. - The company just paid a dividend of $2.65. Calculate the current share price if the required return is 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts