Question: Please help me with this one. The course subject is Intermediate Accounting. Questions are posted below. Thank you. 1. +Willy Company's equity balances on December

Please help me with this one. The course subject is Intermediate Accounting. Questions are posted below. Thank you.

1.

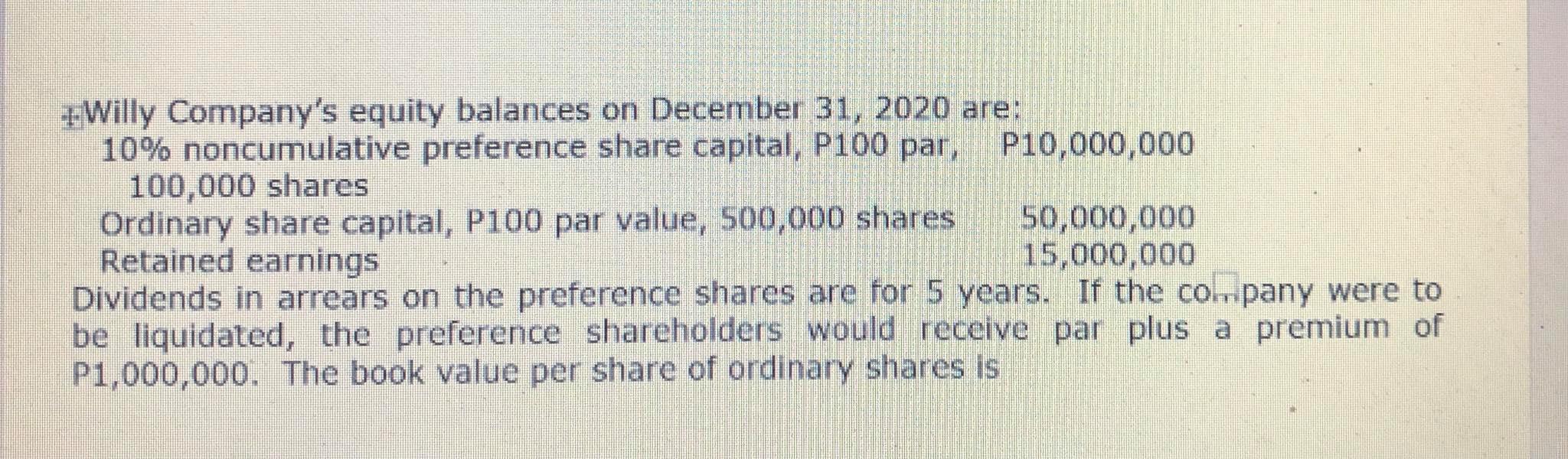

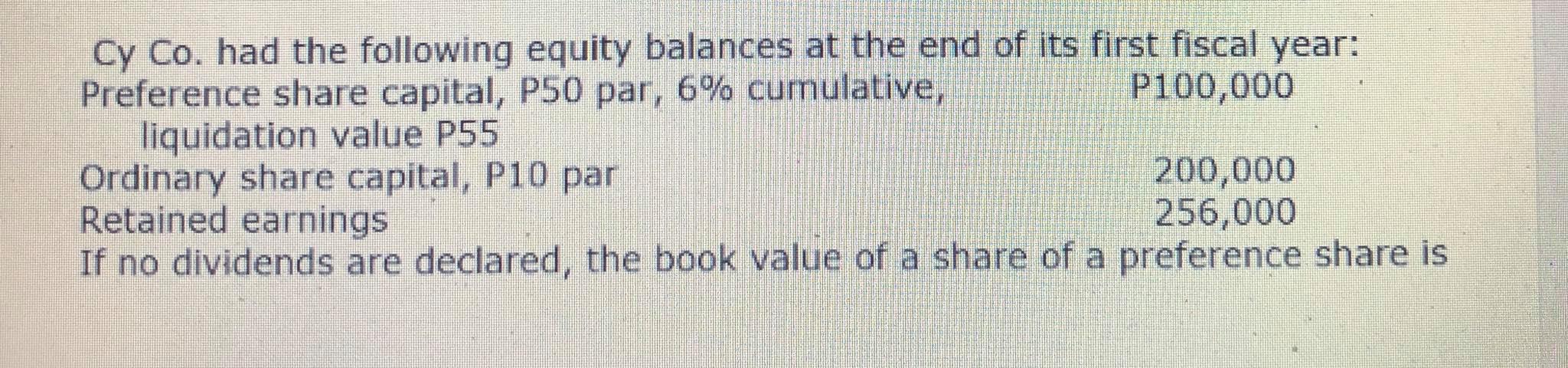

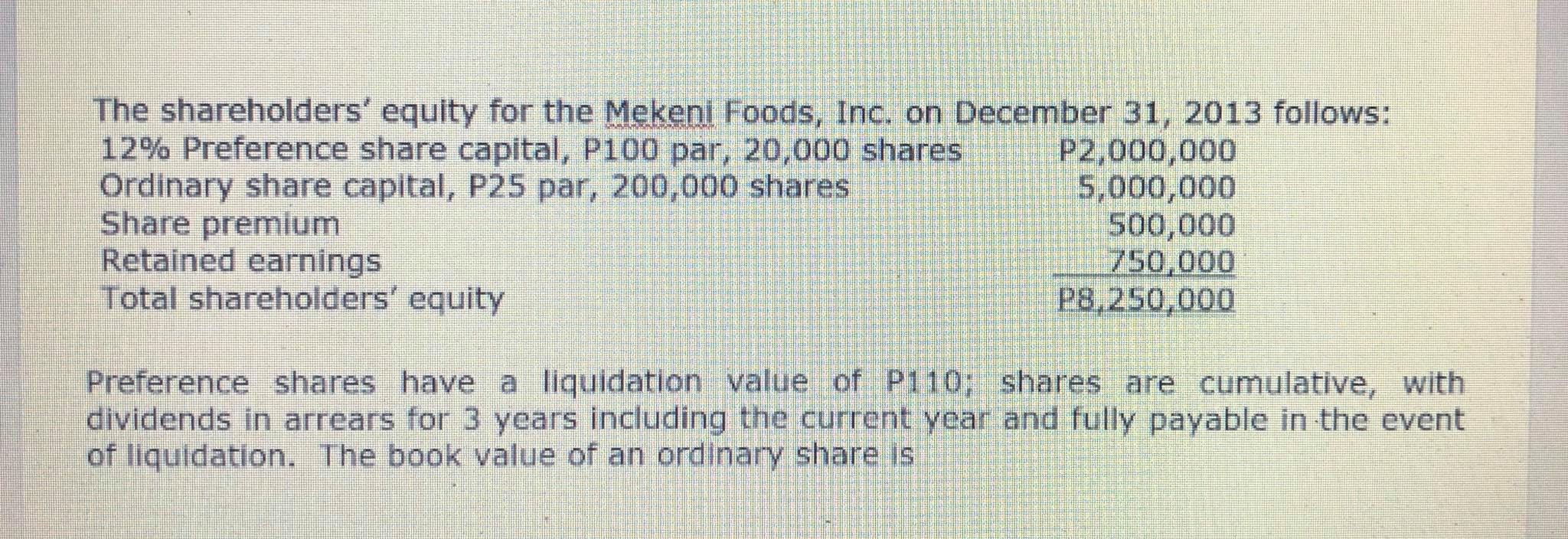

+Willy Company's equity balances on December 31, 2020 are: 10% noncumulative preference share capital, P100 par, P10,000,000 100,000 shares Ordinary share capital, P100 par value, 500,000 shares 50,000,000 Retained earnings 15,000,000 Dividends in arrears on the preference shares are for 5 years. If the company were to be liquidated, the preference shareholders would receive par plus a premium of P1,000,000. The book value per share of ordinary shares isCy Co. had the following equity balances at the end of its first fiscal year: Preference share capital, P50 par, 6% cumulative, P100,000 liquidation value P55 Ordinary share capital, P10 par 200,000 Retained earnings 256,000 If no dividends are declared, the book value of a share of a preference share isThe shareholders' equity for the Mekent Foods, Inc. on December 31, 2013 follows: 12% Preference share capital, P100 par, 20,000 shares P2,000,000 Ordinary share capital, P25 par, 200,000 shares 5,000,000 Share premium 500,000 Retained earnings 750,000 Total shareholders' equity P8.250,000 Preference shares have a liquidation value of P110; shares are cumulative, with dividends in arrears for 3 years including the current year and fully payable in the event of liquidation. The book value of an ordinary share is