Question: Please help me with this one. The course subject is Intermediate Accounting. Question is posted below. Thank you. 1. On December 31, 2013, the shareholders'

Please help me with this one. The course subject is Intermediate Accounting. Question is posted below. Thank you.

1.

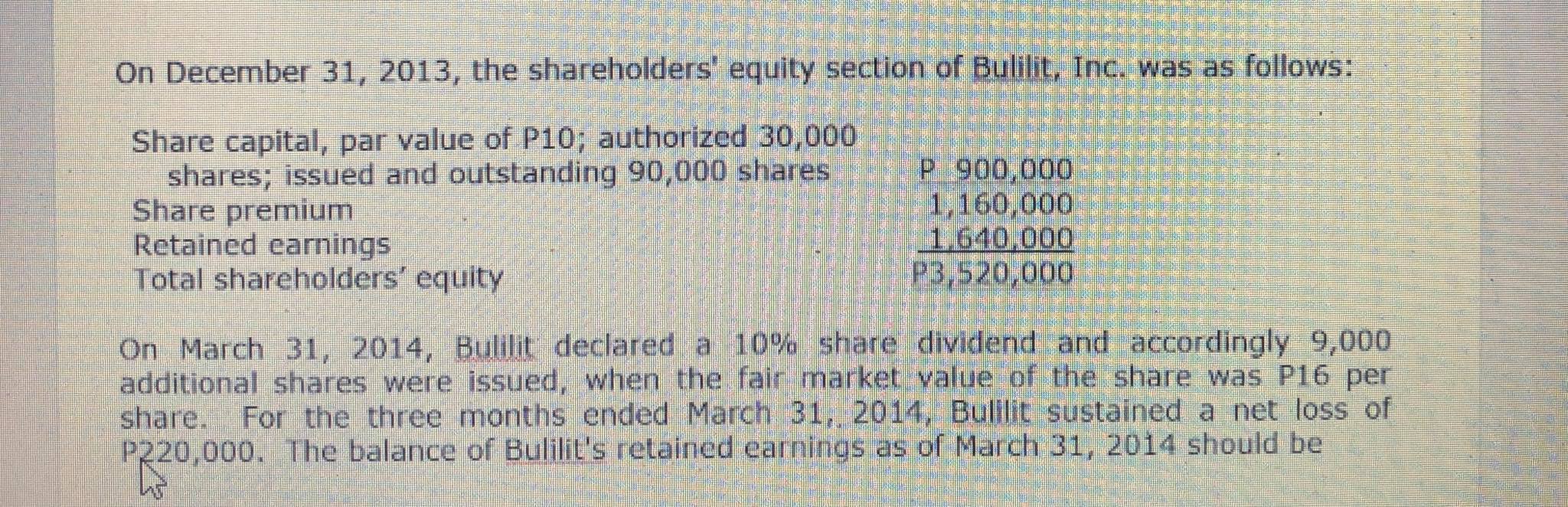

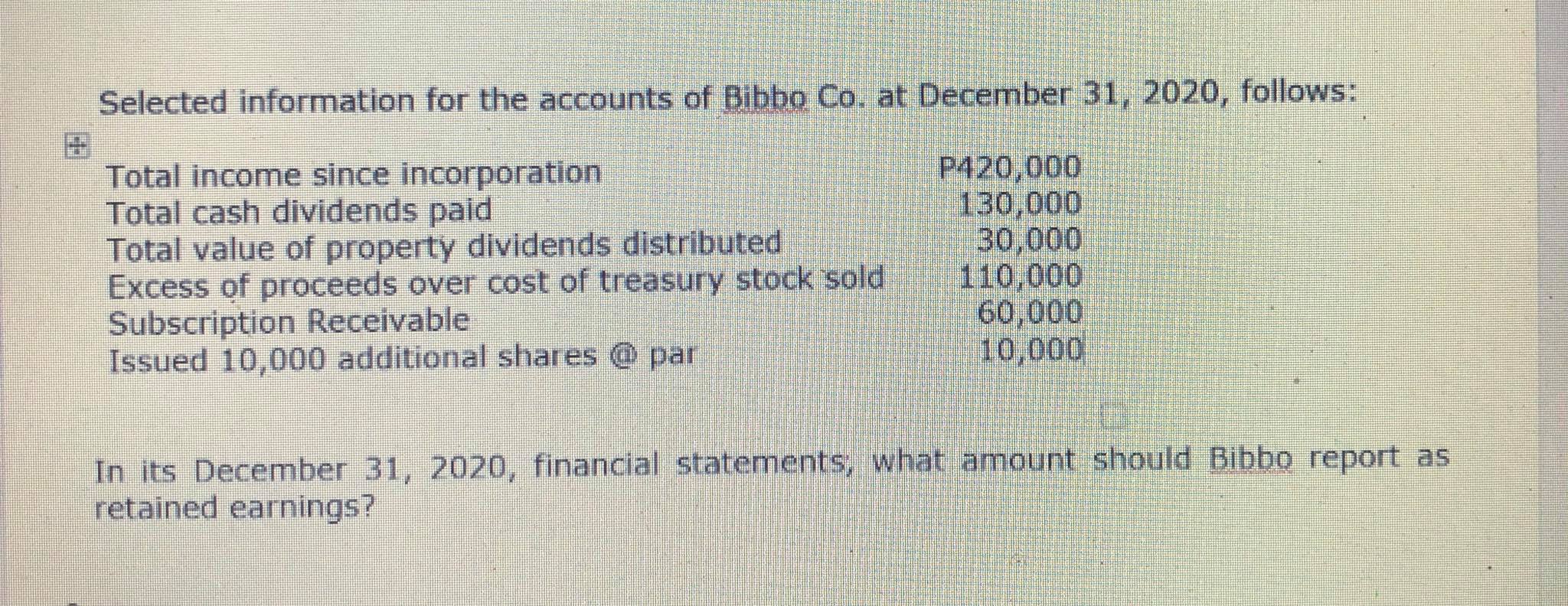

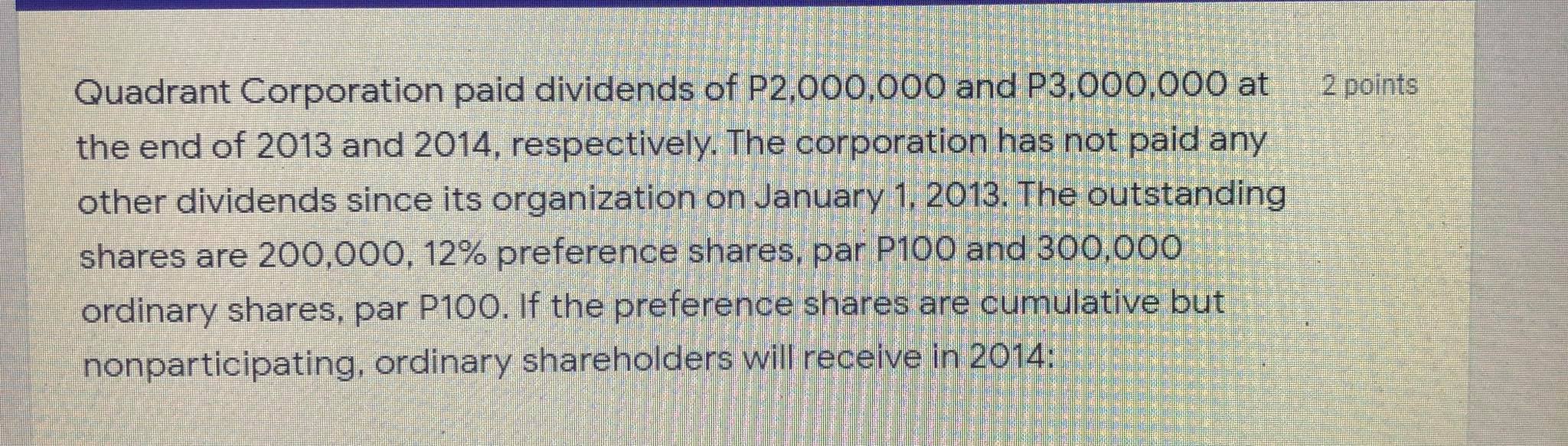

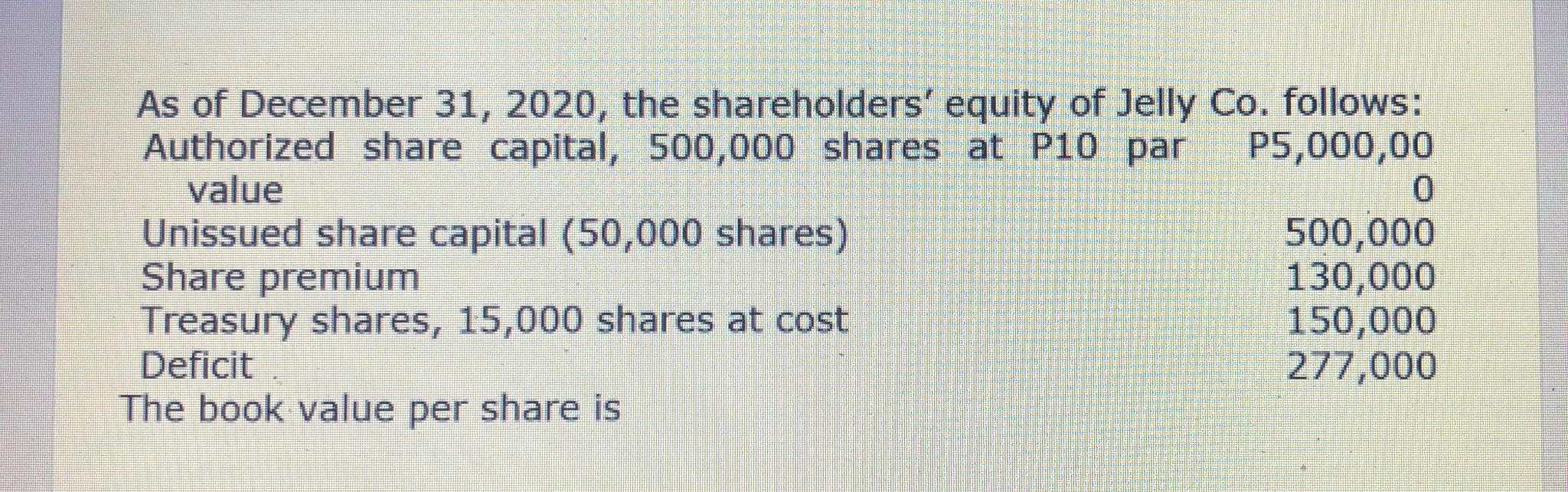

On December 31, 2013, the shareholders' equity section of Bulilit, Inc. was as follows: Share capital, par value of P10; authorized 30,000 shares; issued and outstanding 90,000 shares P 900.000 Share premium 1,160,000 Retained earnings 1 640.000 Total shareholders equity P3,520,000 On March 31, 2014, Bulilit declared a 10% share dividend and accordingly 9,000 additional shares were issued, when the fair market value of the share was P16 per share. For the three months ended March 31, 2014, Bulllit sustained a net loss of P220,000. The balance of Bulilit's retained earnings as of March 31, 2014 should beSelected information for the accounts of Bibbo Co. at December 31, 2020, follows: Total income since incorporation P420.000 Total cash dividends paid 130,000 Total value of property dividends distributed 30.000 Excess of proceeds over cost of treasury stock sold 110,000 Subscription Receivable 60,000 Issued 10,000 additional shares @ par 10,000 In its December 31, 2020, financial statements, what amount should Bibbo report as retained earnings?Quadrant Corporation paid dividends of P2,000,000 and P3,000,000 at 2 points the end of 2013 and 2014, respectively. The corporation has not paid any other dividends since its organization on January 1, 2013. The outstanding shares are 200,000, 12% preference shares, par P100 and 300,000 ordinary shares, par P100. If the preference shares are cumulative but nonparticipating, ordinary shareholders will receive in 2014:As of December 31, 2020, the shareholders' equity of Jelly Co. follows: Authorized share capital, 500,000 shares at P10 par P5,000,00 value Unissued share capital (50,000 shares) 500,000 Share premium 130,000 Treasury shares, 15,000 shares at cost 150,000 Deficit 277,000 The book value per share is