Question: please help me with this problem and the account name because it is not capital reserve Power Corporation acquired 100 percent ownership of Scrub Company

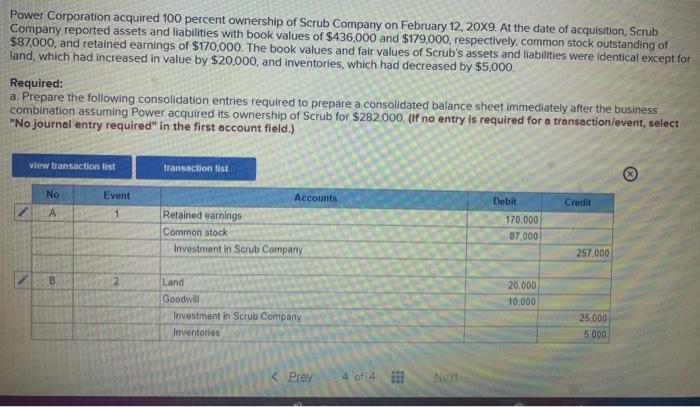

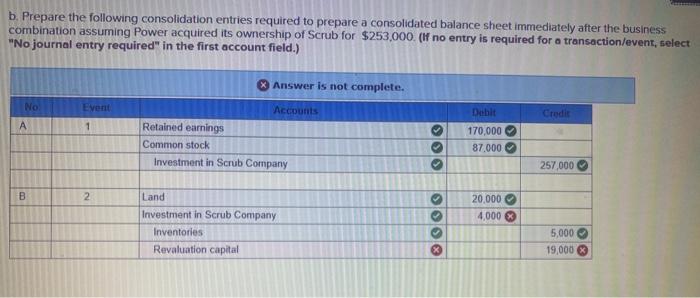

Power Corporation acquired 100 percent ownership of Scrub Company on February 12, 20X9. At the date of acquisition, Scrub Company reported assets and liabilities with book values of $436,000 and $179,000, respectively, common stock outstanding of $87,000, and retained earnings of $170,000. The book values and fair values of Scrub's assets and liabilities were identical except for land, which had increased in value by $20,000, and inventories, which had decreased by $5,000 Required: a. Prepare the following consolidation entries required to prepare a consolidated balance sheet immediately after the business combination assuming Power acquired its ownership of Scrub for $282,000. (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list transaction list No Event 1 Credit A Accounts Retained earnings Common stock Investment in Scrub Company Debit 170.000 87.000 257 000 B 20.000 10 000 Land Goodwill Investment in Scrub Company Inventories 25.000 5.000 > 257,000 B 2 Land Investment in Scrub Company Inventories Revaluation capital 20.000 4,000 solo 5,000 19,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts