Question: Please help me with this problem! Thank you Problem 10. (10 pts) You are given the following data for a stock index assuming a Black-Scholes

Please help me with this problem! Thank you

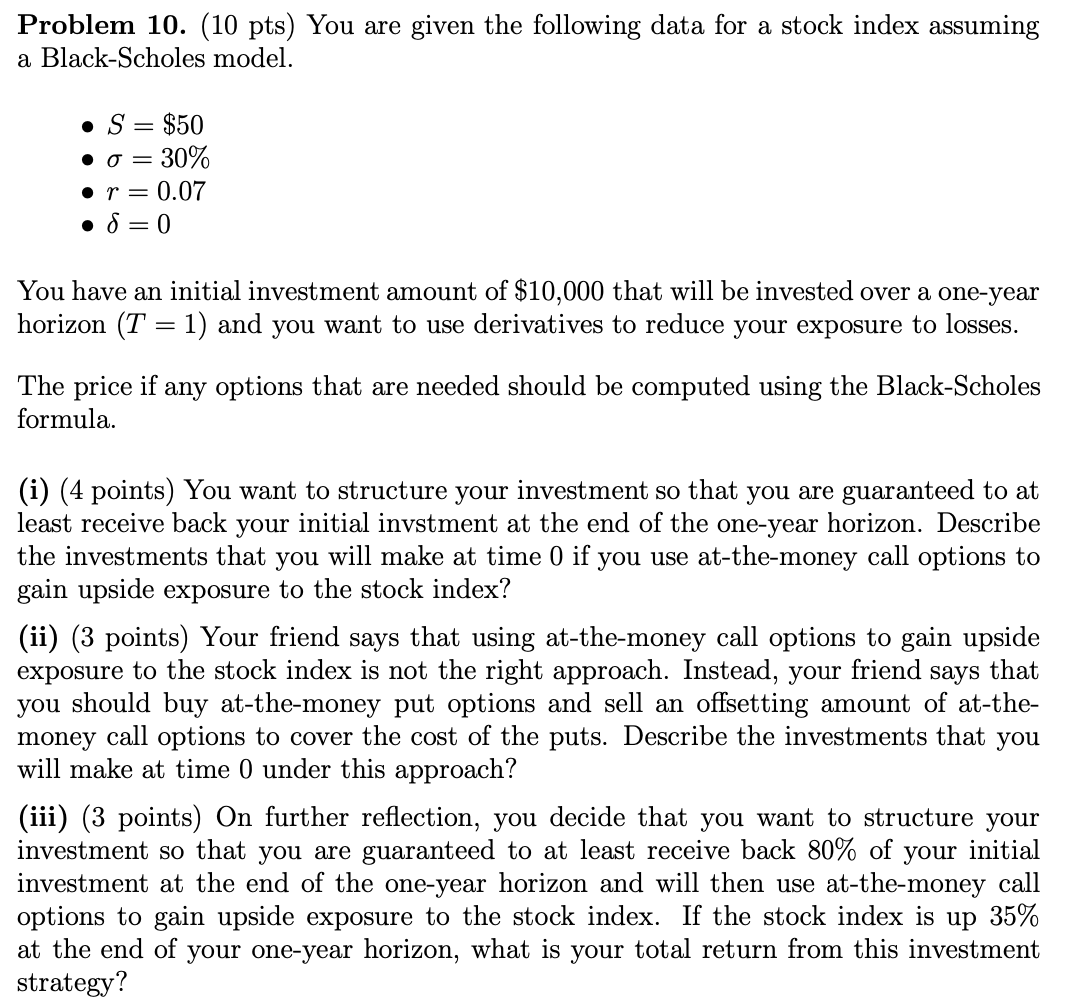

Problem 10. (10 pts) You are given the following data for a stock index assuming a Black-Scholes model. . S = $50 = 30% r = 0.07 0 = You have an initial investment amount of $10,000 that will be invested over a one-year horizon (T = 1) and you want to use derivatives to reduce your exposure to losses. The price if any options that are needed should be computed using the Black-Scholes formula. (i) (4 points) You want to structure your investment so that you are guaranteed to at least receive back your initial invstment at the end of the one-year horizon. Describe the investments that you will make at time 0 if you use at-the-money call options to gain upside exposure to the stock index? (ii) (3 points) Your friend says that using at-the-money call options to gain upside exposure to the stock index is not the right approach. Instead, your friend says that you should buy at-the-money put options and sell an offsetting amount of at-the- money call options to cover the cost of the puts. Describe the investments that you will make at time 0 under this approach? (iii) (3 points) On further reflection, you decide that you want to structure your investment so that you are guaranteed to at least receive back 80% of your initial investment at the end of the one-year horizon and will then use at-the-money call options to gain upside exposure to the stock index. If the stock index is up 35% at the end of your one-year horizon, what is your total return from this investment strategy? Problem 10. (10 pts) You are given the following data for a stock index assuming a Black-Scholes model. . S = $50 = 30% r = 0.07 0 = You have an initial investment amount of $10,000 that will be invested over a one-year horizon (T = 1) and you want to use derivatives to reduce your exposure to losses. The price if any options that are needed should be computed using the Black-Scholes formula. (i) (4 points) You want to structure your investment so that you are guaranteed to at least receive back your initial invstment at the end of the one-year horizon. Describe the investments that you will make at time 0 if you use at-the-money call options to gain upside exposure to the stock index? (ii) (3 points) Your friend says that using at-the-money call options to gain upside exposure to the stock index is not the right approach. Instead, your friend says that you should buy at-the-money put options and sell an offsetting amount of at-the- money call options to cover the cost of the puts. Describe the investments that you will make at time 0 under this approach? (iii) (3 points) On further reflection, you decide that you want to structure your investment so that you are guaranteed to at least receive back 80% of your initial investment at the end of the one-year horizon and will then use at-the-money call options to gain upside exposure to the stock index. If the stock index is up 35% at the end of your one-year horizon, what is your total return from this investment strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts