Question: Please help me with this question 0 The lecture assumed the following situation for Magnificent Shoe Corporation: Price per pair of shoes sold 1 75

Please help me with this question

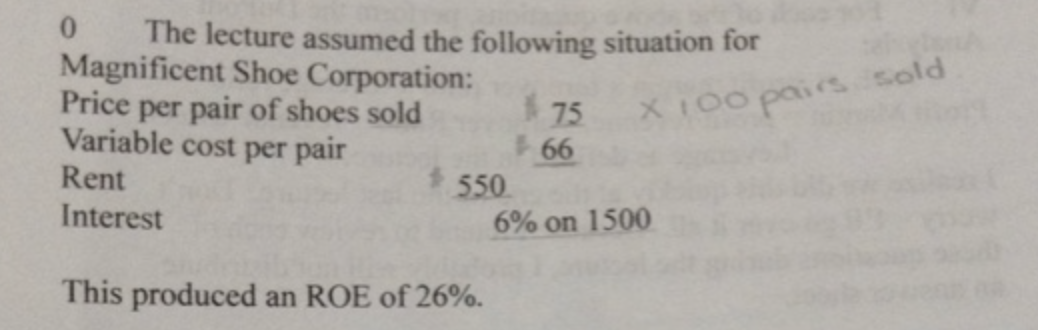

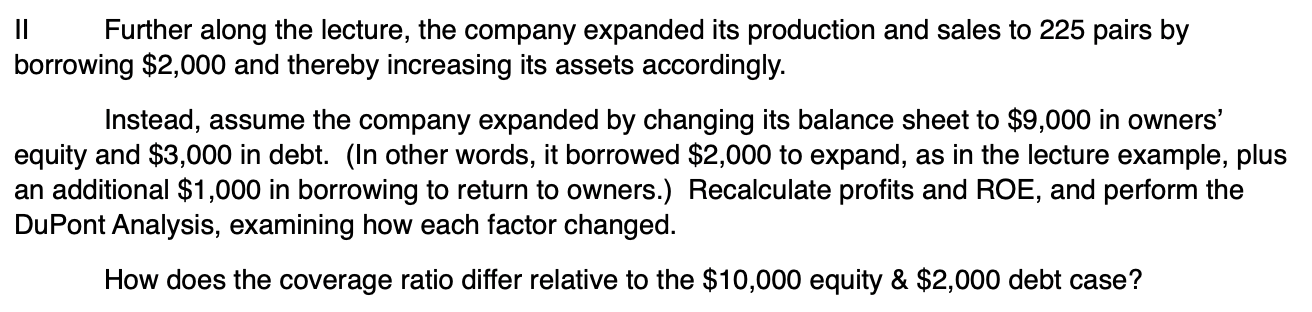

0 The lecture assumed the following situation for Magnificent Shoe Corporation: Price per pair of shoes sold 1 75 X 100 Variable cost per pair 66 Rent 550 Interest 6% on 1500 X 100 pairs sold This produced an ROE of 26%. II Further along the lecture, the company expanded its production and sales to 225 pairs by borrowing $2,000 and thereby increasing its assets accordingly. Instead, assume the company expanded by changing its balance sheet to $9,000 in owners' equity and $3,000 in debt. (In other words, it borrowed $2,000 to expand, as in the lecture example, plus an additional $1,000 in borrowing to return to owners.) Recalculate profits and ROE, and perform the DuPont Analysis, examining how each factor changed. How does the coverage ratio differ relative to the $10,000 equity & $2,000 debt case? 0 The lecture assumed the following situation for Magnificent Shoe Corporation: Price per pair of shoes sold 1 75 X 100 Variable cost per pair 66 Rent 550 Interest 6% on 1500 X 100 pairs sold This produced an ROE of 26%. II Further along the lecture, the company expanded its production and sales to 225 pairs by borrowing $2,000 and thereby increasing its assets accordingly. Instead, assume the company expanded by changing its balance sheet to $9,000 in owners' equity and $3,000 in debt. (In other words, it borrowed $2,000 to expand, as in the lecture example, plus an additional $1,000 in borrowing to return to owners.) Recalculate profits and ROE, and perform the DuPont Analysis, examining how each factor changed. How does the coverage ratio differ relative to the $10,000 equity & $2,000 debt case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts