Question: Please help me with this question. After looking into debt financing through notes, mortgage, and bonds payable, Calla Canoe Company decides to raise additional capital

Please help me with this question.

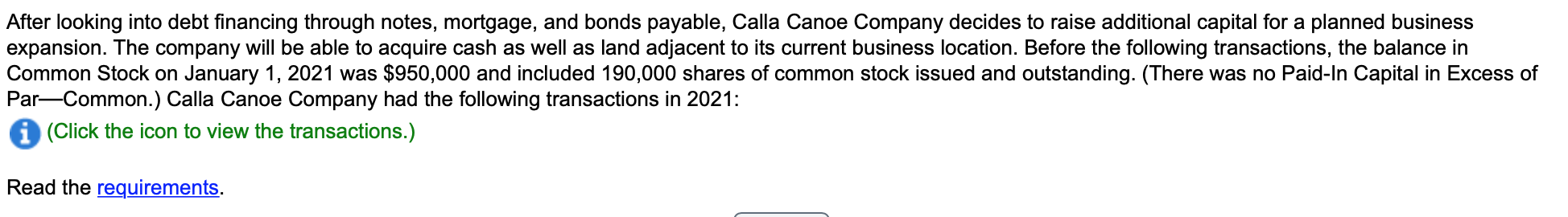

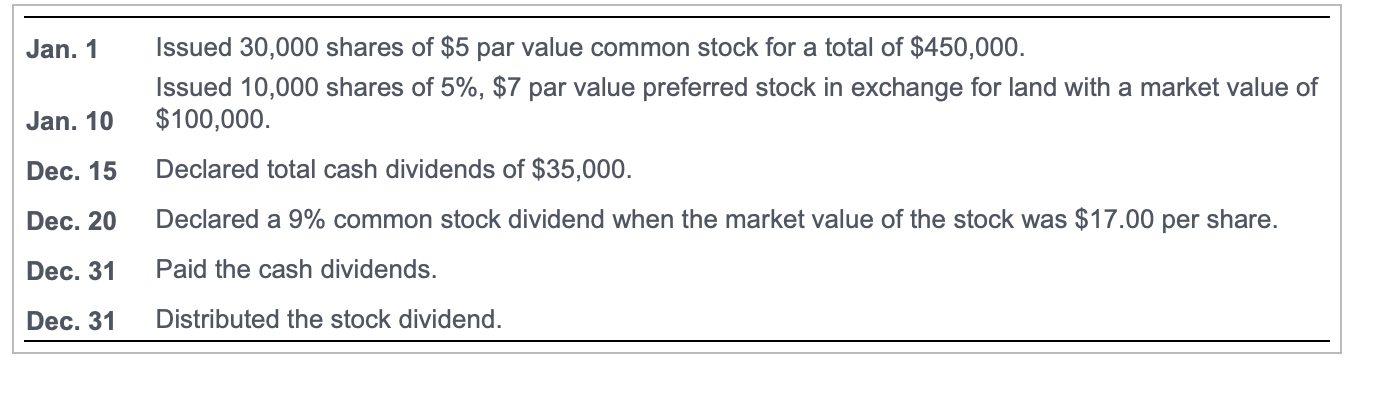

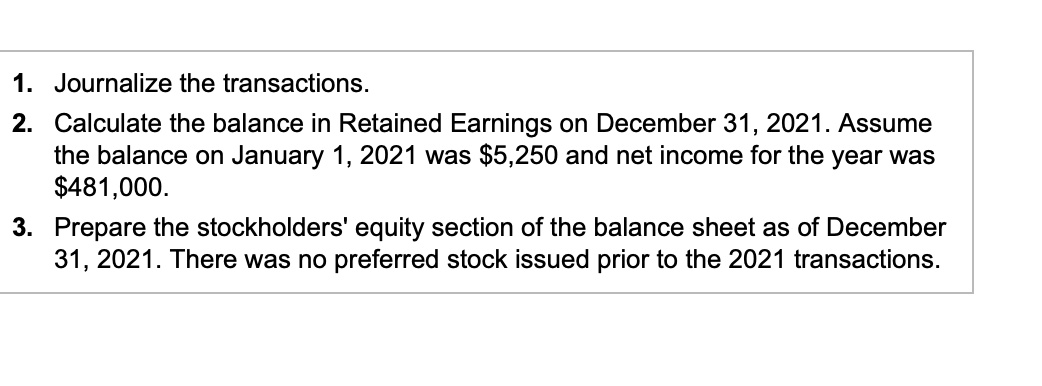

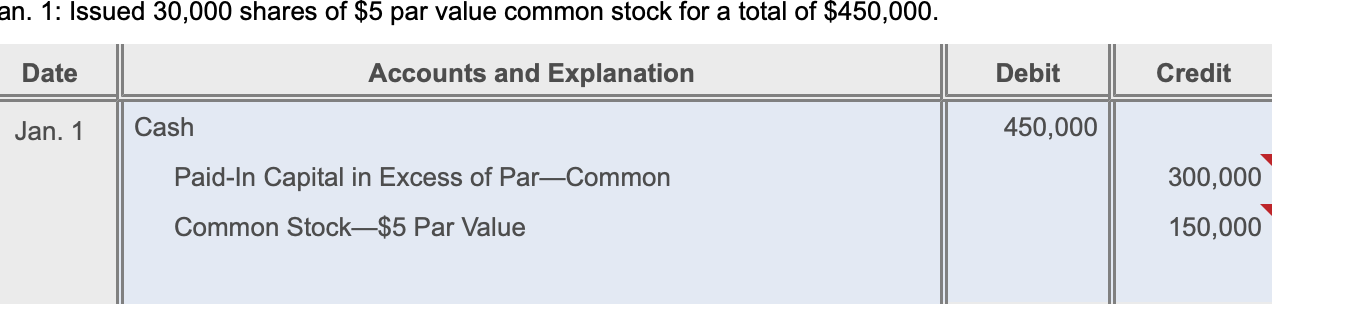

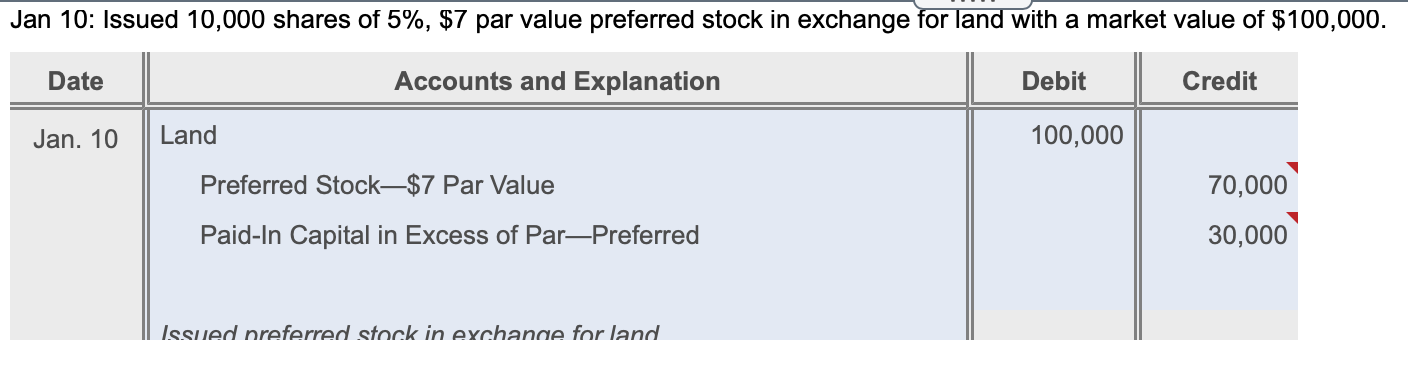

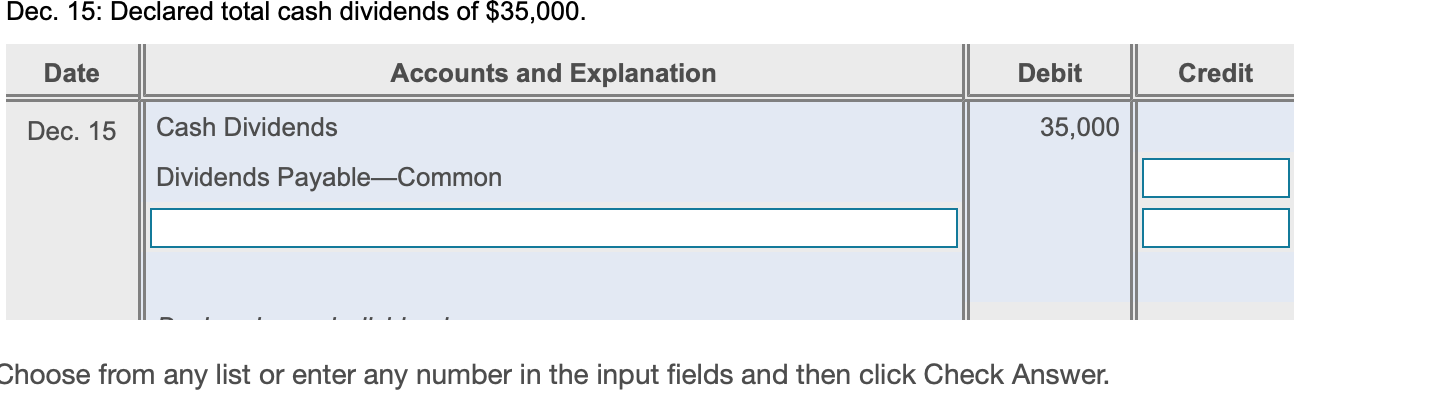

After looking into debt financing through notes, mortgage, and bonds payable, Calla Canoe Company decides to raise additional capital for a planned business expansion. The company will be able to acquire cash as well as land adjacent to its current business location. Before the following transactions, the balance in Common Stock on January 1, 2021 was $950,000 and included 190,000 shares of common stock issued and outstanding. (There was no Paid-In Capital in Excess of ParCommon.) Calla Canoe Company had the following transactions in 2021: (Click the icon to view the transactions.) Read the requirements. Jan. 1 Jan. 10 Issued 30,000 shares of $5 par value common stock for a total of $450,000. Issued 10,000 shares of 5%, $7 par value preferred stock in exchange for land with a market value of $100,000 Declared total cash dividends of $35,000. Declared a 9% common stock dividend when the market value of the stock was $17.00 per share. Dec. 15 Dec. 20 Dec. 31 Paid the cash dividends. Dec. 31 Distributed the stock dividend. 1. Journalize the transactions. 2. Calculate the balance in Retained Earnings on December 31, 2021. Assume the balance on January 1, 2021 was $5,250 and net income for the year was $481,000. 3. Prepare the stockholders' equity section of the balance sheet as of December 31, 2021. There was no preferred stock issued prior to the 2021 transactions. an. 1: Issued 30,000 shares of $5 par value common stock for a total of $450,000. Date Accounts and Explanation Debit Credit Jan. 1 Cash 450,000 Paid-In Capital in Excess of ParCommon 300,000 150,000 Common Stock-$5 Par Value Jan 10: Issued 10,000 shares of 5%, $7 par value preferred stock in exchange for land with a market value of $100,000. Date Accounts and Explanation Debit Credit Jan. 10 Land 100,000 1 70,000 Preferred Stock-$7 Par Value Paid-In Capital in Excess of ParPreferred 30,000 Issued preferred stock in exchange for land Dec. 15: Declared total cash dividends of $35,000. Date Accounts and Explanation Debit Credit Dec. 15 Cash Dividends 35,000 Dividends PayableCommon Choose from any list or enter any number in the input fields and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts