Question: Please help me with this question, thank you! PART 1: Record Transactions Don't forget Part 2 - the Income Record the transactions for Henley Outdoor

Please help me with this question, thank you!

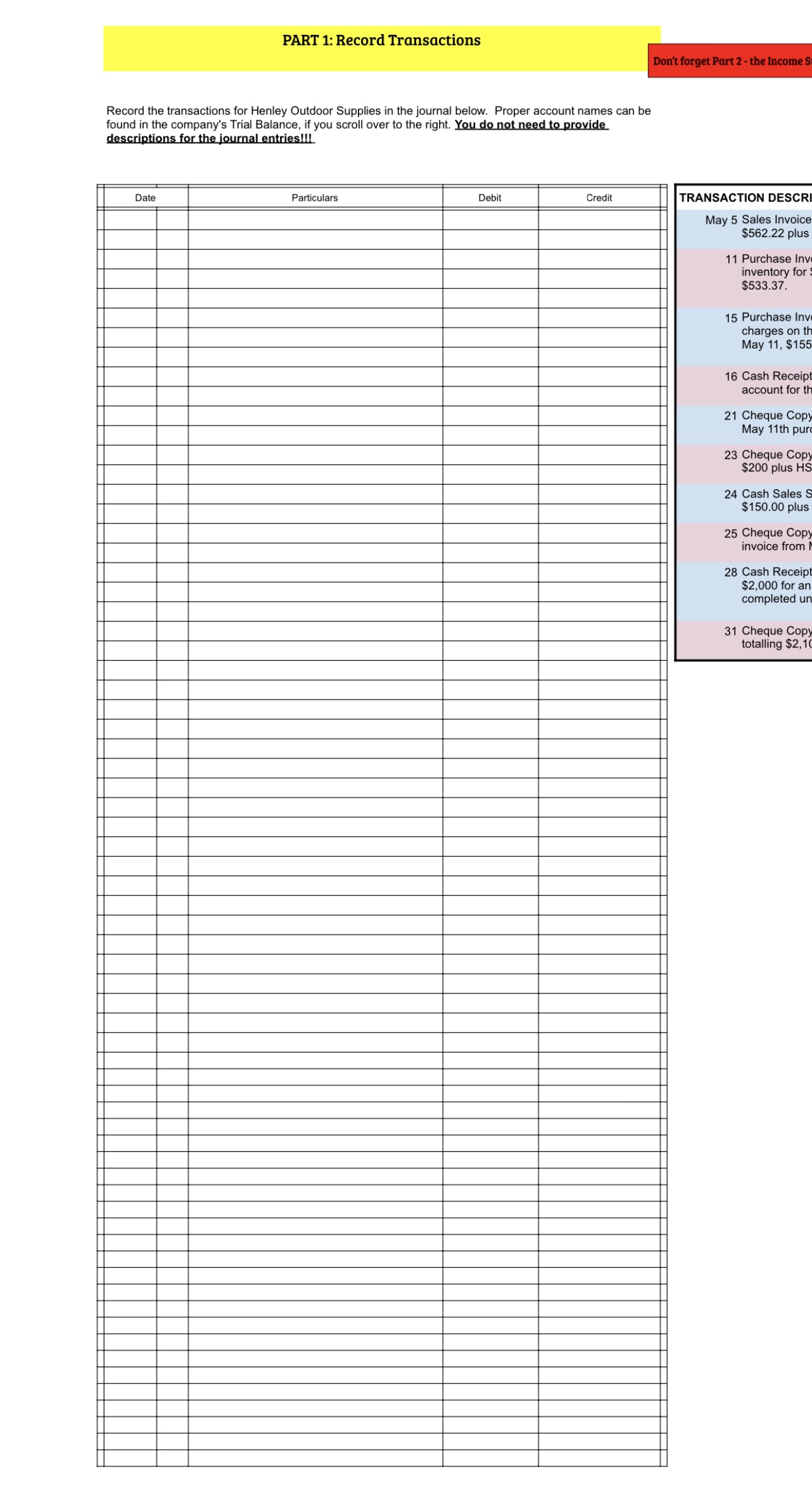

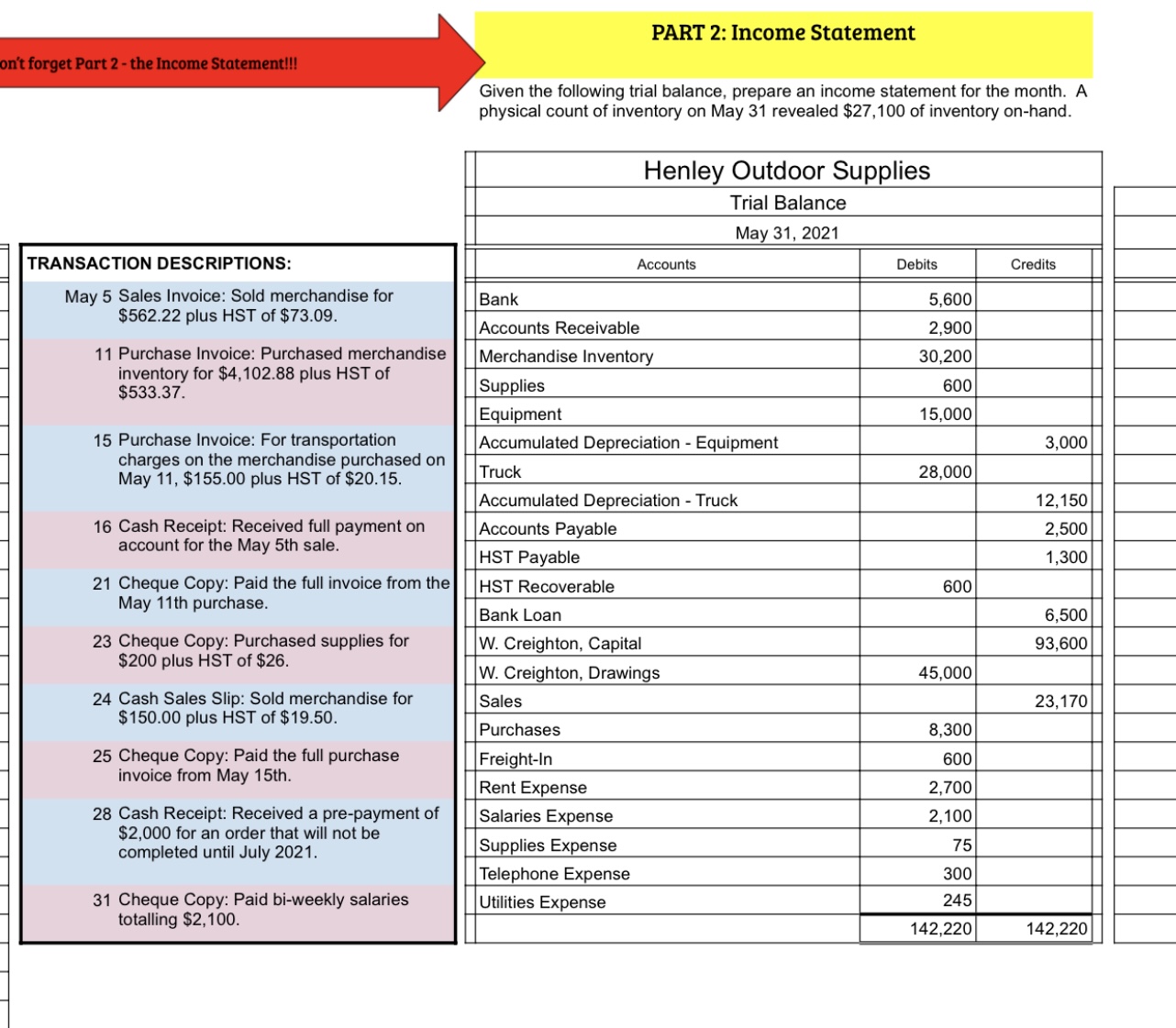

PART 1: Record Transactions Don't forget Part 2 - the Income Record the transactions for Henley Outdoor Supplies in the journal below. Proper account names can be found in the company's Trial Balance, if you scroll over to the right. You do not need to provide descriptions for the journal entries!!! Date Particulars Debit Credit TRANSACTION DESCRI May 5 Sales Invoice $562.22 plus 11 Purchase Inv inventory for $533.37. 15 Purchase Inv charges on th May 11, $155 16 Cash Receip account for th 21 Cheque Copy May 11th pur 23 Cheque Cop $200 plus HS 24 Cash Sales S $150.00 plus 25 Cheque Copy invoice from 28 Cash Receipt $2,000 for an completed un 31 Cheque Cop totalling $2,1PART 2: Income Statement on't forget Part 2 - the Income Statement! Given the following trial balance, prepare an income statement for the month. A physical count of inventory on May 31 revealed $27,100 of inventory on-hand. Henley Outdoor Supplies Trial Balance May 31, 2021 TRANSACTION DESCRIPTIONS: Accounts Debits Credits May 5 Sales Invoice: Sold merchandise for Bank 5,600 $562.22 plus HST of $73.09. Accounts Receivable 2,900 11 Purchase Invoice: Purchased merchandise Merchandise Inventory 30,200 inventory for $4, 102.88 plus HST of $533.37. Supplies 600 Equipment 15,000 15 Purchase Invoice: For transportation Accumulated Depreciation - Equipment 3,000 charges on the merchandise purchased on May 11, $155.00 plus HST of $20.15. Truck 28,000 Accumulated Depreciation - Truck 12,150 16 Cash Receipt: Received full payment on Accounts Payable 2,500 account for the May 5th sale. HST Payable 1,300 21 Cheque Copy: Paid the full invoice from the HST Recoverable 600 May 11th purchase. Bank Loan 6,500 23 Cheque Copy: Purchased supplies for W. Creighton, Capital 93,600 $200 plus HST of $26. W. Creighton, Drawings 45,000 24 Cash Sales Slip: Sold merchandise for Sales 23, 170 $150.00 plus HST of $19.50. Purchases 8,300 25 Cheque Copy: Paid the full purchase Freight-In 600 invoice from May 15th. Rent Expense 2,700 28 Cash Receipt: Received a pre-payment of Salaries Expense 2, 100 $2,000 for an order that will not be completed until July 2021. Supplies Expense 75 Telephone Expense 300 31 Cheque Copy: Paid bi-weekly salaries Utilities Expense 245 totalling $2, 100. 142,220 142,220Argue's Craft Shop Income Statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts