Question: Please help me with this tax research assignment, as I am lost and have no idea what I am doing. thank you! Preview File Edit

Please help me with this tax research assignment, as I am lost and have no idea what I am doing. thank you!

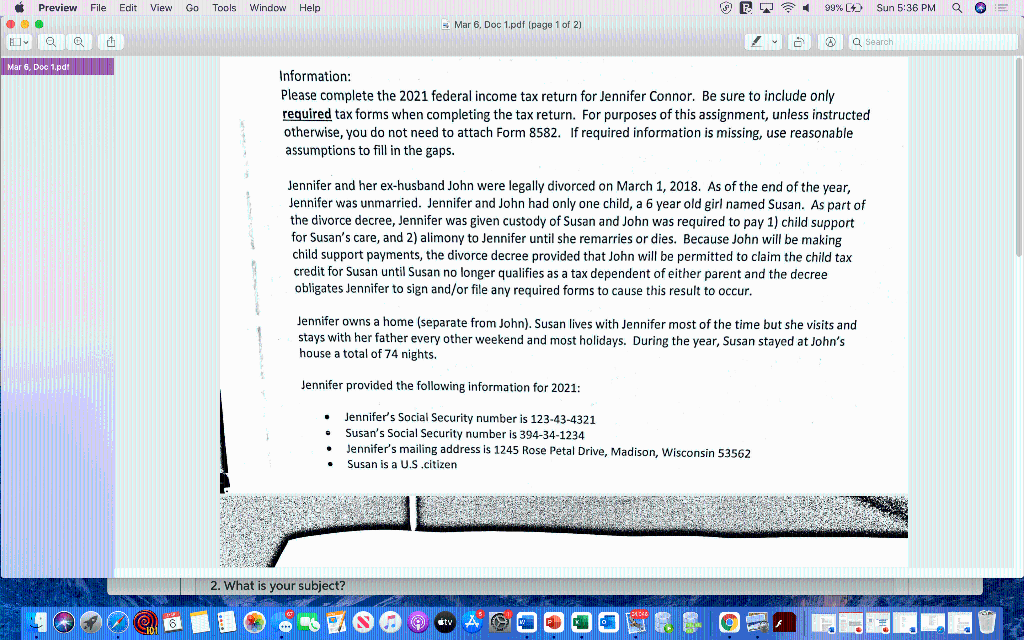

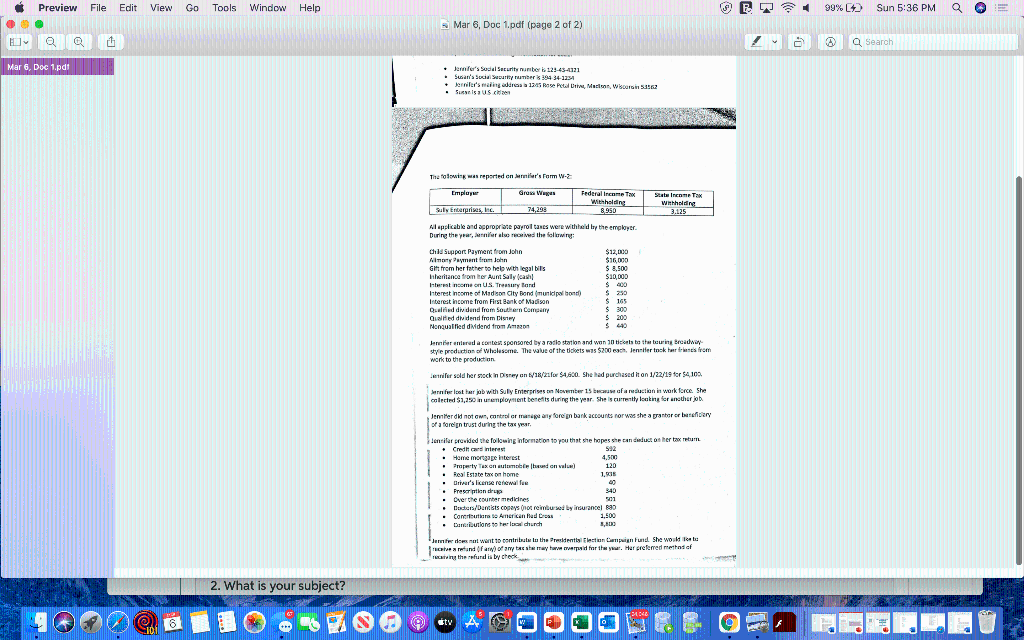

Preview File Edit View Go Tools Window Help @g 99% (42 Sun 5:36 PM Q 0 . Mar 6, Doc 1.pdf (page 1 of 2) O @ @ Search Mar 6, Doc 1.pdf Information: Please complete the 2021 federal income tax return for Jennifer Connor. Be sure to include only required tax forms when completing the tax return. For purposes of this assignment, unless instructed otherwise, you do not need to attach Form 8582. If required information is missing, use reasonable assumptions to fill in the gaps. Jennifer and her ex-husband John were legally divorced on March 1, 2018. As of the end of the year, Jennifer was unmarried. Jennifer and John had only one child, a 6 year old girl named Susan. As part of the divorce decree, Jennifer was given custody of Susan and John was required to pay 1) child support for Susan's care, and 2) alimony to Jennifer until she remarries or dies. Because John will be making child support payments, the divorce decree provided that John will be permitted to claim the child tax credit for Susan until Susan no longer qualifies as a tax dependent of either parent and the decree obligates Jennifer to sign and/or file any required forms to cause this result to occur. Jennifer owns a home (separate from John). Susan lives with Jennifer most of the time but she visits and stays with her father every other weekend and most holidays. During the year, Susan stayed at John's house a total of 74 nights. Jennifer provided the following information for 2021: Jennifer's Social Security number is 123-43-4321 Susan's Social Security number is 394-34-1234 Jennifer's mailing address is 1245 Rose Petal Drive, Madison, Wisconsin 53562 Susan is a U.S.citizen 2. What is your subject? 6 Preview File Edit View Go Tools Window Help @gp4 99% [4] Sun 5:36 PM Q Mar 6, Doc 1.pdf (page 2 of 2) JY @ @ Search Mar 6, Doc 1.pd! Jennifer's Soul Security number 123-45-4721 Susan's Wory whers 384 34-1231 + Jernier's mangasala 125 Rose PD Muar, corsi 53562 l, Wiscuri . SENSUS The Swing was reported onder's Form W-> Employee Grow. Wees Federal Innme Tax Statinee wholding withholding Bully Enterprises, lic. 74,293 8950 3.125 All applicable and appropriate payroltants were withheld by the employer During the year, also received the follow Child Support Payment from John $12.000 Amony Payment from John $16.000 Git from her father to help with legal bils $ 8.500 Inheritance from her um Salya $10,000 Interest income on US Treasury fond Interest income of Madison City Bond (municipal bond $ 290 Interest income from First Bank of Madison $ 165 Qual di dund from southern Comery $300 Qualified dividend from Disney $ 200 Nonguilled didend from $ Dernier anrud a contest sponsored by a radio station and won 30 tista sering Breadway style production of Wholesome. The value of the tickets was $200 each. Jenniter took terserom work to the production cifer sold her stock in Disney ent/18/21 for $4,600. She had purchased it on 1/22/19 for $4,100 Serfect har job with Sully Enterprises on November 15 brouw of a reduction in workforce. She colected $1,250 napon bereits during the year. She is currently looking for chur job Jenner did not own, control or mange any foreign bank accounts row she a pantar or brey of a foreign trust during the tae year. Jennifer provided the following information to you that she hapes she candiductos her tax return . Cred interest 542 Home mortgage interest 4.500 Property Taxon tehtud on va 120 Real Estate tax on home . Dr's license rewal fue . Presrption drup 340 . Over the counter medicines 401 Deters/Dans coas vos reimbursed by insurancel 890 . Correto American Red Cross 1.500 Dentono alche welcherch BUD Jurnt does not want to contribut the Presidential Election pign Fund. She work on tu catertundan orta sa may hawweld for you. Her preferred method of y the refund is by check 1.90 2. What is your subject? 6 stv F 101 Preview File Edit View Go Tools Window Help @g 99% (42 Sun 5:36 PM Q 0 . Mar 6, Doc 1.pdf (page 1 of 2) O @ @ Search Mar 6, Doc 1.pdf Information: Please complete the 2021 federal income tax return for Jennifer Connor. Be sure to include only required tax forms when completing the tax return. For purposes of this assignment, unless instructed otherwise, you do not need to attach Form 8582. If required information is missing, use reasonable assumptions to fill in the gaps. Jennifer and her ex-husband John were legally divorced on March 1, 2018. As of the end of the year, Jennifer was unmarried. Jennifer and John had only one child, a 6 year old girl named Susan. As part of the divorce decree, Jennifer was given custody of Susan and John was required to pay 1) child support for Susan's care, and 2) alimony to Jennifer until she remarries or dies. Because John will be making child support payments, the divorce decree provided that John will be permitted to claim the child tax credit for Susan until Susan no longer qualifies as a tax dependent of either parent and the decree obligates Jennifer to sign and/or file any required forms to cause this result to occur. Jennifer owns a home (separate from John). Susan lives with Jennifer most of the time but she visits and stays with her father every other weekend and most holidays. During the year, Susan stayed at John's house a total of 74 nights. Jennifer provided the following information for 2021: Jennifer's Social Security number is 123-43-4321 Susan's Social Security number is 394-34-1234 Jennifer's mailing address is 1245 Rose Petal Drive, Madison, Wisconsin 53562 Susan is a U.S.citizen 2. What is your subject? 6 Preview File Edit View Go Tools Window Help @gp4 99% [4] Sun 5:36 PM Q Mar 6, Doc 1.pdf (page 2 of 2) JY @ @ Search Mar 6, Doc 1.pd! Jennifer's Soul Security number 123-45-4721 Susan's Wory whers 384 34-1231 + Jernier's mangasala 125 Rose PD Muar, corsi 53562 l, Wiscuri . SENSUS The Swing was reported onder's Form W-> Employee Grow. Wees Federal Innme Tax Statinee wholding withholding Bully Enterprises, lic. 74,293 8950 3.125 All applicable and appropriate payroltants were withheld by the employer During the year, also received the follow Child Support Payment from John $12.000 Amony Payment from John $16.000 Git from her father to help with legal bils $ 8.500 Inheritance from her um Salya $10,000 Interest income on US Treasury fond Interest income of Madison City Bond (municipal bond $ 290 Interest income from First Bank of Madison $ 165 Qual di dund from southern Comery $300 Qualified dividend from Disney $ 200 Nonguilled didend from $ Dernier anrud a contest sponsored by a radio station and won 30 tista sering Breadway style production of Wholesome. The value of the tickets was $200 each. Jenniter took terserom work to the production cifer sold her stock in Disney ent/18/21 for $4,600. She had purchased it on 1/22/19 for $4,100 Serfect har job with Sully Enterprises on November 15 brouw of a reduction in workforce. She colected $1,250 napon bereits during the year. She is currently looking for chur job Jenner did not own, control or mange any foreign bank accounts row she a pantar or brey of a foreign trust during the tae year. Jennifer provided the following information to you that she hapes she candiductos her tax return . Cred interest 542 Home mortgage interest 4.500 Property Taxon tehtud on va 120 Real Estate tax on home . Dr's license rewal fue . Presrption drup 340 . Over the counter medicines 401 Deters/Dans coas vos reimbursed by insurancel 890 . Correto American Red Cross 1.500 Dentono alche welcherch BUD Jurnt does not want to contribut the Presidential Election pign Fund. She work on tu catertundan orta sa may hawweld for you. Her preferred method of y the refund is by check 1.90 2. What is your subject? 6 stv F 101

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts