Question: please help me with this thank you!! Use the table below and Apple's financial statements in Appendix A to answer the following. 1. Compute times

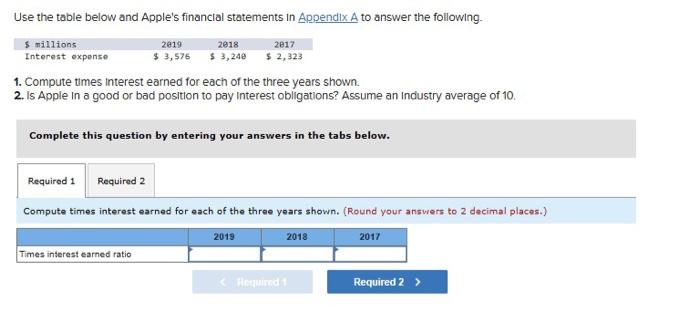

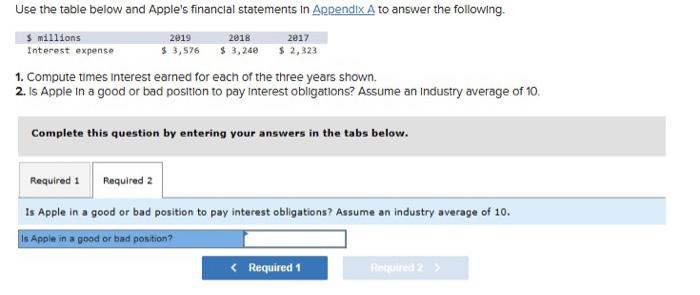

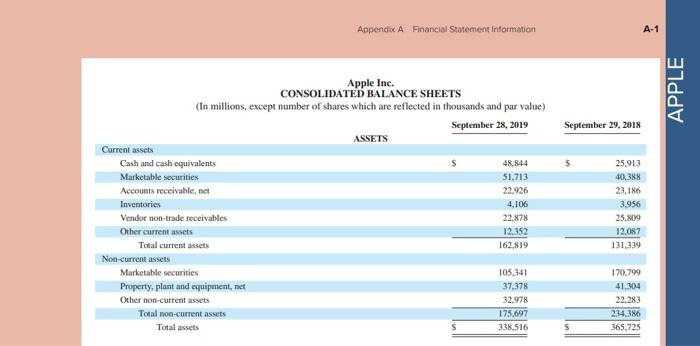

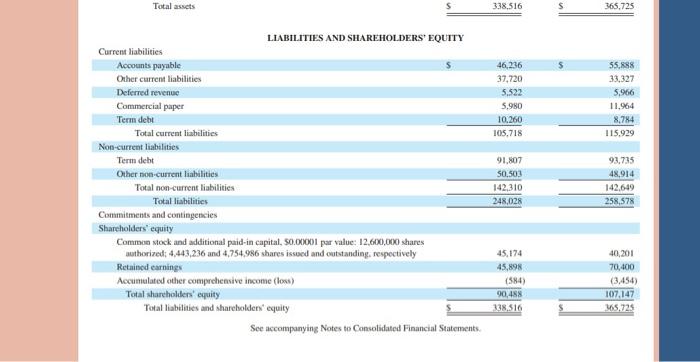

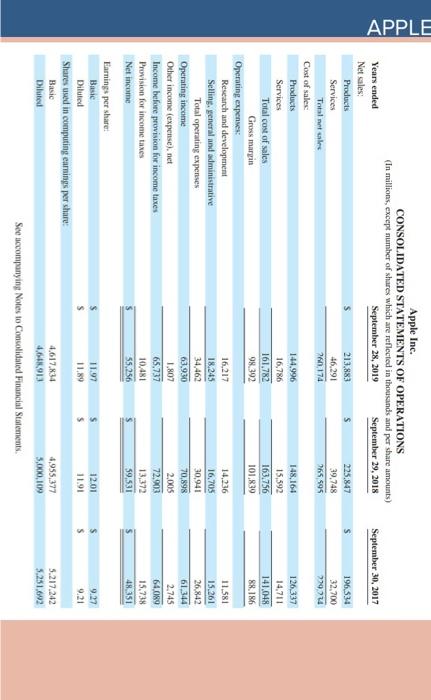

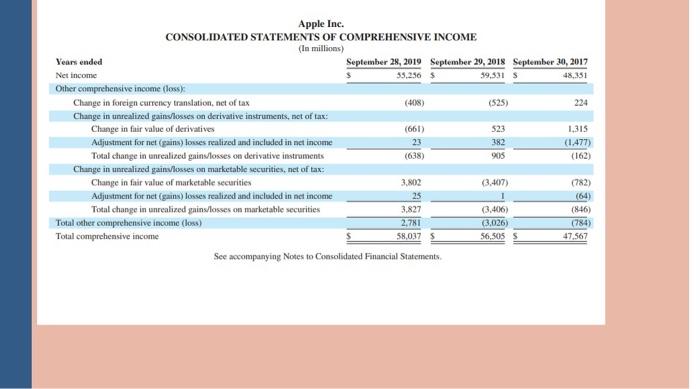

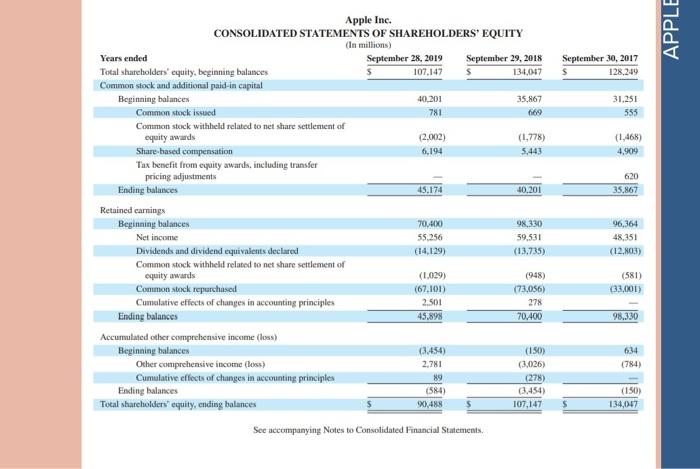

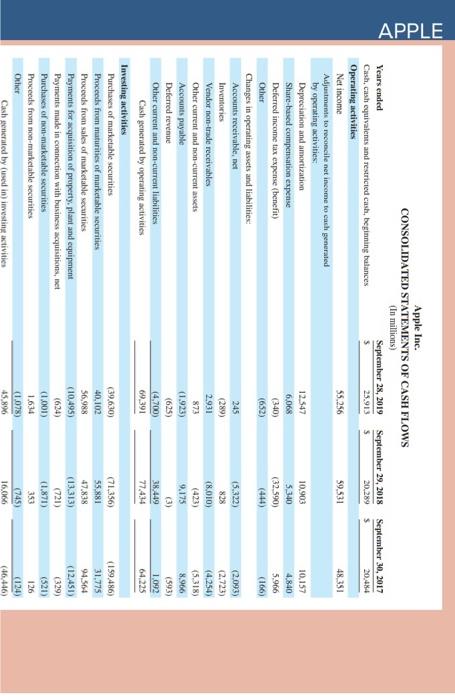

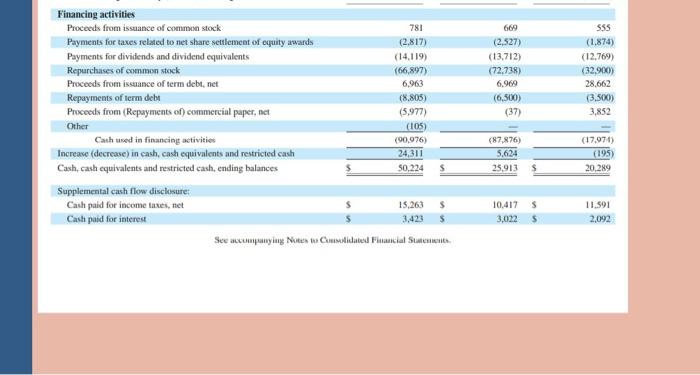

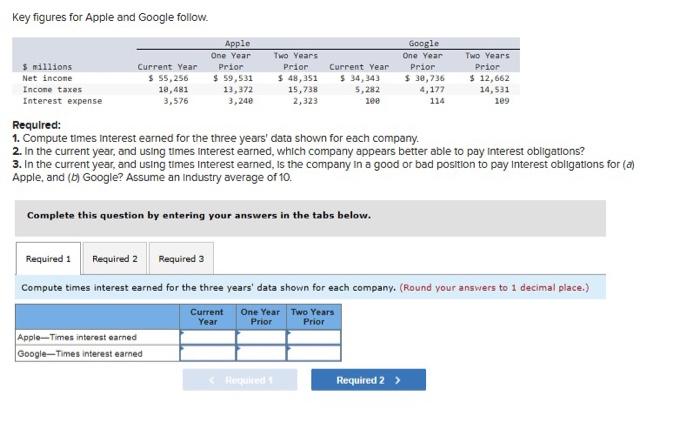

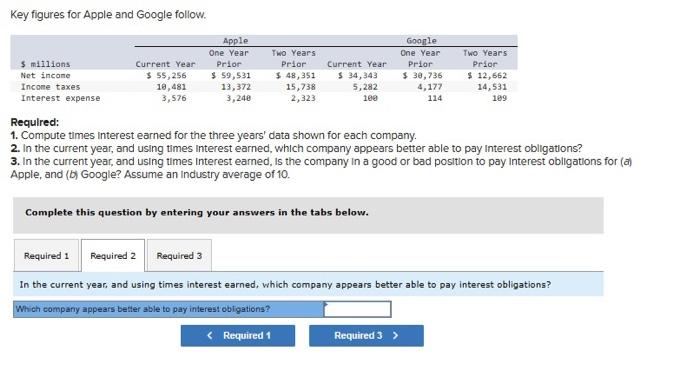

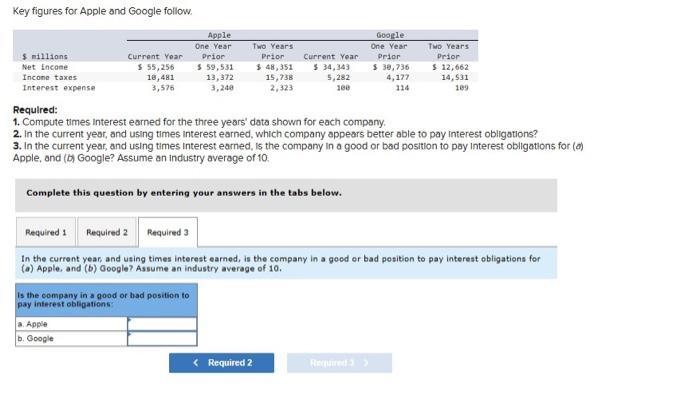

Use the table below and Apple's financial statements in Appendix A to answer the following. 1. Compute times interest earned for each of the three years shown. 2. Is Apple in a good or bad position to pay interest obligations? Assume an industry average of 10. Complete this question by entering your answers in the tabs below. Compute times interest earned for each of the three years shown. (Round your answers to 2 decimal places.) Use the table below and Apple's financlal statements in Appendix A to answer the following. 1. Compute times interest earned for each of the three years shown. 2. Is Apple in a good or bad position to pay interest obligations? Assume an industry average of 10. Complete this question by entering your answers in the tabs below. Is Apple in a good or bad position to pay interest obligations? Assume an industry average of 10. Apple Inc. CONSOLIDATED BALANCE SHEETS In millions, except number of shares which are reflected in thousands and par value) LLABILITIES AND SHAREHOLDERS' EQUTTY Apple Inc. CONSOI.IDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Earnings per share: Basic Diluted res usud in computing carnings per share: Basic Diluted $$11.9711.894.617.8344.648.913$$12.0111.914,955.3775.000,109$59.279.215.217.2425.251.692 See accompanying Notes to Consolidaud Financial Statements. Apple Inc. CONSOI INATEN STATEMENTS ON COMDDEHENSIVE INCOME See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions) Tax benefit from equity awards, including transfer pricing adjustments Retained earnings Sec accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOL.IDATED STATEMENTS OF CASH FLOWS (In millions) Years ended Cash, cash equivalents and restricied cash, beginning balances Operating activities Net income Adjustmens to rocoecile net income to cash generated by operating activities: Changes in operating assets and liabilities: Key figures for Apple and Google follow. Requlred: 1. Compute times interest earned for the three years' data shown for each company. 2. In the current year, and using times interest earned, which company appears better able to pay interest obligations? 3. In the current year, and using times interest eamed, is the company in a good or bad position to pay interest obligations for (a) Apple, and (b) Google? Assume an Industry average of 10. Complete this question by entering your answers in the tabs below. Compute times interest earned for the three years' data shown for each company. (Round your answers to 1 decimal place.) Key figures for Apple and Google follow. Required: 1. Compute times Interest earned for the three years' data shown for each company. 2. In the current year, and using times Interest earned, which company appears better able to pay interest obligations? 3. In the current year, and using times interest earned, Is the company in a good or bad position to pay interest obligations for (a) Apple, and (b) Google? Assume an industry average of 10. Complete this question by entering your answers in the tabs below. In the current year, and using times interest earned, which company appears better able to pay interest obligations? Which company appears betfer able to pay interest obtigations? Key figures for Apple and Google follow. Required: 1. Compute times interest earned for the three years' data shown for each company. 2. In the current year, and using times interest earned, which company appears better able to pay interest obligations? 3. In the current year, and using times interest earned, is the company in a good or bad position to pay interest obligations for (a Apple, and (b) Google? Assume an industry average of 10. Complete this question by entering your answers in the tabs below. In the current year, and using times interest earned, is the company in a good or bad pesition to pay intereat obligations for (a) Apple, and (b) Google? Assume an industry average of 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts