Question: Please help MGMT FFAC Ch 5? Exercises: and Review Over Entries There is a Part A and Part B to this CE-do them both as

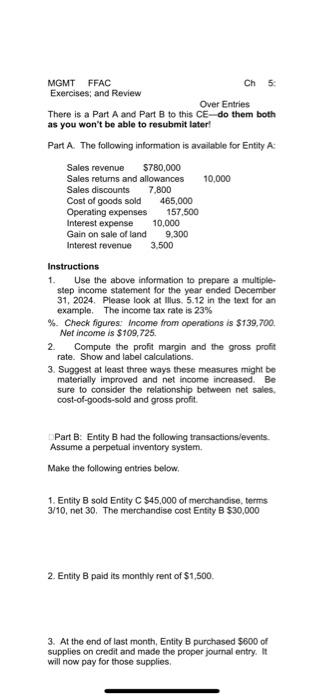

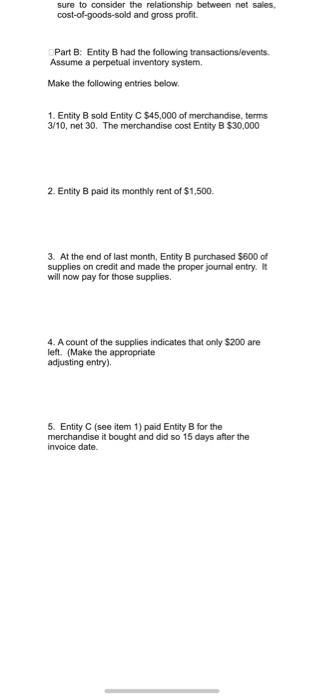

MGMT FFAC Ch 5? Exercises: and Review Over Entries There is a Part A and Part B to this CE-do them both as you won't be able to resubmit later! Part A. The following information is available for Entity A- Instructions 1. Use the above information to prepare a multiplestep income statement for the year ended December 31, 2024. Please look at llius. 5.12 in the lext for an example. The income tax rate is 23% \%. Check figures: income from operations is $139,700. Net income is $109,725. 2. Compute the profit margin and the gross profit rate. Show and label calculations. 3. Suggest at least three ways these measures might be materially improved and net income increased. Be sure to consider the relationship between net sales, cost-of-goods-sold and gross profit. Part B: Entity B had the following transactionslevents: Assume a perpetual inventory system. Make the following entries below. 1. Entity B sold Entity C$45,000 of merchandise, terms 3/10, net 30 . The merchandise cost Entity B $30,000 2. Entity B paid its monthly rent of $1,500. 3. At the end of last month, Entity B purchased $600 of supplies on credit and made the proper joumal entry. It will now pay for those supplies, sure to consider the relationship between net sales. cost-of-goods-sold and gross profit. Part B: Entity B had the following transactionsievents. Assume a perpetual inventory system. Make the following entries below. 1. Entity B sold Entity C$45,000 of merchandise, terms 3/10, net 30 . The merchandise cost Entity B $30,000 2. Entity 8 paid its monthiy rent of $1,500. 3. At the end of last month, Entity B purchased $600 of supplies on credit and made the proper joumal entry. It will now pay for thase supplies. 4. A count of the supplies indicates that only $200 are left. (Make the appropriate adjusting entry). 5. Entity C (see item 1) paid Entity B for the merchandise it bought and did so 15 days after the invoice date. MGMT FFAC Ch 5? Exercises: and Review Over Entries There is a Part A and Part B to this CE-do them both as you won't be able to resubmit later! Part A. The following information is available for Entity A- Instructions 1. Use the above information to prepare a multiplestep income statement for the year ended December 31, 2024. Please look at llius. 5.12 in the lext for an example. The income tax rate is 23% \%. Check figures: income from operations is $139,700. Net income is $109,725. 2. Compute the profit margin and the gross profit rate. Show and label calculations. 3. Suggest at least three ways these measures might be materially improved and net income increased. Be sure to consider the relationship between net sales, cost-of-goods-sold and gross profit. Part B: Entity B had the following transactionslevents: Assume a perpetual inventory system. Make the following entries below. 1. Entity B sold Entity C$45,000 of merchandise, terms 3/10, net 30 . The merchandise cost Entity B $30,000 2. Entity B paid its monthly rent of $1,500. 3. At the end of last month, Entity B purchased $600 of supplies on credit and made the proper joumal entry. It will now pay for those supplies, sure to consider the relationship between net sales. cost-of-goods-sold and gross profit. Part B: Entity B had the following transactionsievents. Assume a perpetual inventory system. Make the following entries below. 1. Entity B sold Entity C$45,000 of merchandise, terms 3/10, net 30 . The merchandise cost Entity B $30,000 2. Entity 8 paid its monthiy rent of $1,500. 3. At the end of last month, Entity B purchased $600 of supplies on credit and made the proper joumal entry. It will now pay for thase supplies. 4. A count of the supplies indicates that only $200 are left. (Make the appropriate adjusting entry). 5. Entity C (see item 1) paid Entity B for the merchandise it bought and did so 15 days after the invoice date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts