Question: please help need it asap A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a government

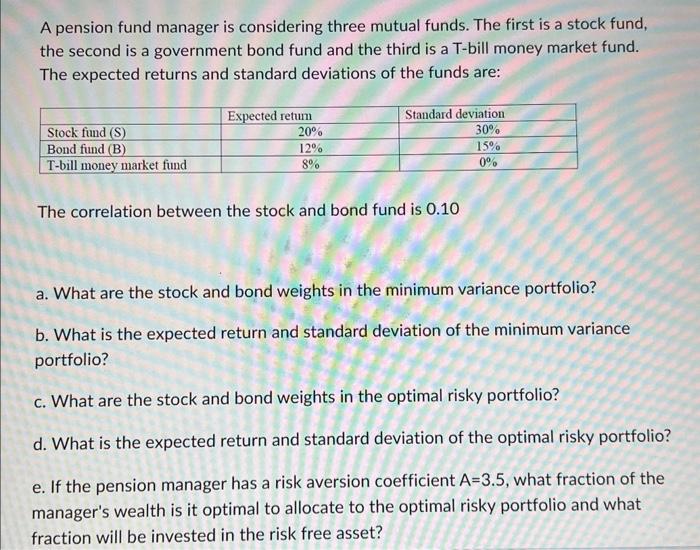

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a government bond fund and the third is a T-bill money market fund. The expected returns and standard deviations of the funds are: The correlation between the stock and bond fund is 0.10 a. What are the stock and bond weights in the minimum variance portfolio? b. What is the expected return and standard deviation of the minimum variance portfolio? c. What are the stock and bond weights in the optimal risky portfolio? d. What is the expected return and standard deviation of the optimal risky portfolio e. If the pension manager has a risk aversion coefficient A=3.5, what fraction of the manager's wealth is it optimal to allocate to the optimal risky portfolio and what fraction will be invested in the risk free asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts