Question: please help no cursive (THIS IS 1 WHOLE QUESTION) clear picture these two then You want to buy a house that has a purchase price

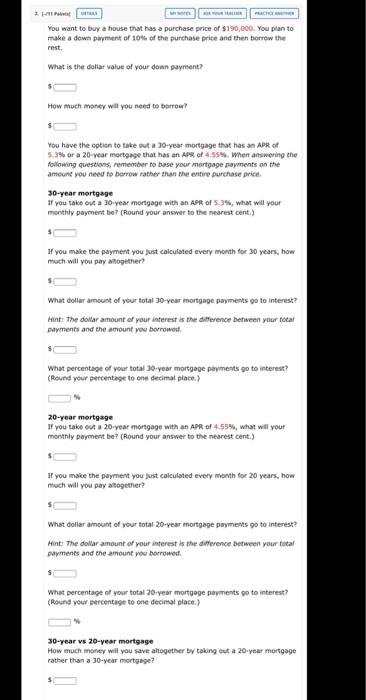

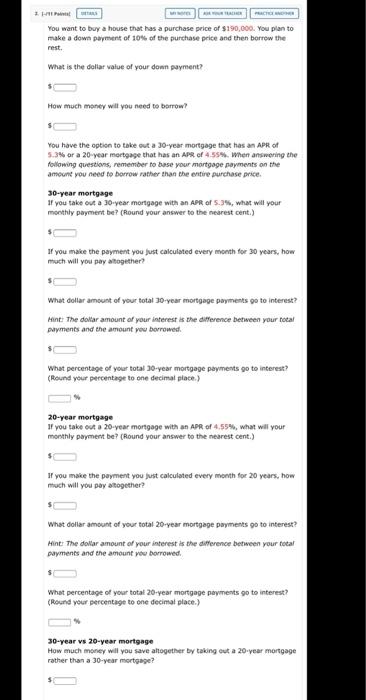

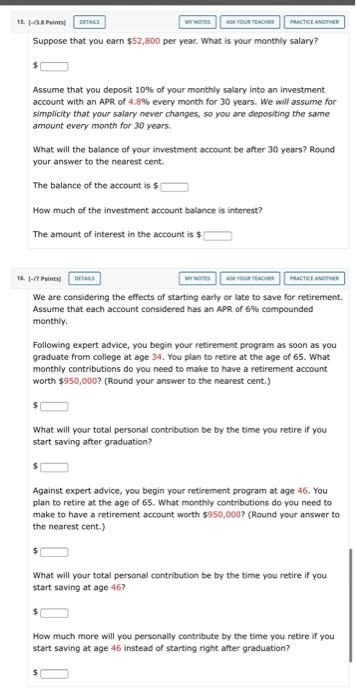

You want to buy a house that has a purchase price of $190,000: You plan to make a down payment of 10% of the purchase price and then borrow the rest What is the dollar value of your down payment? How much money will you need to borrow? You have the option to take out a 30-year mortgage that has an APRO 5.3% or a 20-year mortgage that has an APR of 4.55%. When answering the following questions, remember to base your mortgage payments on the amount you need to borrow rather than the entire purchase price 30-year mortgage if you take out a 30-year mortgage with an APR of 5.3%, what will your monthly payment be? (Round your answer to the nearest cent.) If you make the payment you just calculated every month for 30 years, how much will you pay altogether? What dollar amount of your total 30-year mortgage payments go to interest? Mint: The dollar amount of your interest is the difference between your focal payments and the amount you borrowed. What percentage of your total 30-year mortgage payments go to interest? (Round your percentage to one decimal place) 20-year mortgage If you take out a 20-year mortgage with an APR of 4,55%, what will your monthly payment be? (Round your answer to the nearest cent.) you make the payment you just calculated every month for 20 years, how much will you pay together? What dollar amount of your total 20-year mortgage payments 9 to interest? Hint: The dollar amount of your interest is the difference between your total payments and the amount you borrowed. What percentage of your total 20-year mortgage payments go to interest? (Round your percentage to one decimal place.) 30-year vs 20-year mortgage How much money will you save altogether by taking out a 20-year mortgage rather than a 30-year mortgage? You want to buy a house that has a purchase price of $190,000: You plan to make a down payment of 10% of the purchase price and then borrow the rest What is the dollar value of your down payment? How much money will you need to borrow? You have the option to take out a 30-year mortgage that has an APRO 5.3% or a 20-year mortgage that has an APR of 4.55%. When answering the following questions, remember to base your mortgage payments on the amount you need to borrow rather than the entire purchase price 30-year mortgage if you take out a 30-year mortgage with an APR of 5.3%, what will your monthly payment be? (Round your answer to the nearest cent.) If you make the payment you just calculated every month for 30 years, how much will you pay altogether? What dollar amount of your total 30-year mortgage payments go to interest? Mint: The dollar amount of your interest is the difference between your focal payments and the amount you borrowed. What percentage of your total 30-year mortgage payments go to interest? (Round your percentage to one decimal place) 20-year mortgage If you take out a 20-year mortgage with an APR of 4,55%, what will your monthly payment be? (Round your answer to the nearest cent.) you make the payment you just calculated every month for 20 years, how much will you pay together? What dollar amount of your total 20-year mortgage payments 9 to interest? Hint: The dollar amount of your interest is the difference between your total payments and the amount you borrowed. What percentage of your total 20-year mortgage payments go to interest? (Round your percentage to one decimal place.) 30-year vs 20-year mortgage How much money will you save altogether by taking out a 20-year mortgage rather than a 30-year mortgage? 15. Prints DETALES OR YOUR TEACHER PRACTICE ANOTHER Suppose that you earn $52,800 per year. What is your monthly salary? Assume that you deposit 10% of your monthly salary into an investment account with an APR of 4.8% every month for 30 years. We will assume for simplicity that your salary never changes, so you are depositing the same amount every month for 30 years. What will the balance of your investment account be after 30 years? Round your answer to the nearest cent. The balance of the account is 5 How much of the investment account balances interest? The amount of interest in the account is $ POCTICE ANOTHER 16 - Point DIAS We are considering the effects of starting early or late to save for retirement. Assume that each account considered has an APR of 6% compounded monthly Following expert advice, you begin your retirement program as soon as you graduate from college at age 34. You plan to retire at the age of 65. What monthly contributions do you need to make to have a retirement account worth $950,000? (Round your answer to the nearest cent.) $ What will your total personal contribution be by the time you retire if you start saving after graduation? $ Against expert advice, you begin your retirement program at age 46. You plan to retire at the age of 65. What monthly contributions do you need to make to have a retirement account worth $950,000? (Round your answer to the nearest cent.) What will your total personal contribution be by the time you retire if you start saving at age 467 How much more will you personally contribute by the time you retire if you start saving at age 46 instead of starting right after graduation? $ You want to buy a house that has a purchase price of $190,000: You plan to make a down payment of 10% of the purchase price and then borrow the rest What is the dollar value of your down payment? How much money will you need to borrow? You have the option to take out a 30-year mortgage that has an APRO 5.3% or a 20-year mortgage that has an APR of 4.55%. When answering the following questions, remember to base your mortgage payments on the amount you need to borrow rather than the entire purchase price 30-year mortgage if you take out a 30-year mortgage with an APR of 5.3%, what will your monthly payment be? (Round your answer to the nearest cent.) If you make the payment you just calculated every month for 30 years, how much will you pay altogether? What dollar amount of your total 30-year mortgage payments go to interest? Mint: The dollar amount of your interest is the difference between your focal payments and the amount you borrowed. What percentage of your total 30-year mortgage payments go to interest? (Round your percentage to one decimal place) 20-year mortgage If you take out a 20-year mortgage with an APR of 4,55%, what will your monthly payment be? (Round your answer to the nearest cent.) you make the payment you just calculated every month for 20 years, how much will you pay together? What dollar amount of your total 20-year mortgage payments 9 to interest? Hint: The dollar amount of your interest is the difference between your total payments and the amount you borrowed. What percentage of your total 20-year mortgage payments go to interest? (Round your percentage to one decimal place.) 30-year vs 20-year mortgage How much money will you save altogether by taking out a 20-year mortgage rather than a 30-year mortgage? You want to buy a house that has a purchase price of $190,000: You plan to make a down payment of 10% of the purchase price and then borrow the rest What is the dollar value of your down payment? How much money will you need to borrow? You have the option to take out a 30-year mortgage that has an APRO 5.3% or a 20-year mortgage that has an APR of 4.55%. When answering the following questions, remember to base your mortgage payments on the amount you need to borrow rather than the entire purchase price 30-year mortgage if you take out a 30-year mortgage with an APR of 5.3%, what will your monthly payment be? (Round your answer to the nearest cent.) If you make the payment you just calculated every month for 30 years, how much will you pay altogether? What dollar amount of your total 30-year mortgage payments go to interest? Mint: The dollar amount of your interest is the difference between your focal payments and the amount you borrowed. What percentage of your total 30-year mortgage payments go to interest? (Round your percentage to one decimal place) 20-year mortgage If you take out a 20-year mortgage with an APR of 4,55%, what will your monthly payment be? (Round your answer to the nearest cent.) you make the payment you just calculated every month for 20 years, how much will you pay together? What dollar amount of your total 20-year mortgage payments 9 to interest? Hint: The dollar amount of your interest is the difference between your total payments and the amount you borrowed. What percentage of your total 20-year mortgage payments go to interest? (Round your percentage to one decimal place.) 30-year vs 20-year mortgage How much money will you save altogether by taking out a 20-year mortgage rather than a 30-year mortgage? 15. Prints DETALES OR YOUR TEACHER PRACTICE ANOTHER Suppose that you earn $52,800 per year. What is your monthly salary? Assume that you deposit 10% of your monthly salary into an investment account with an APR of 4.8% every month for 30 years. We will assume for simplicity that your salary never changes, so you are depositing the same amount every month for 30 years. What will the balance of your investment account be after 30 years? Round your answer to the nearest cent. The balance of the account is 5 How much of the investment account balances interest? The amount of interest in the account is $ POCTICE ANOTHER 16 - Point DIAS We are considering the effects of starting early or late to save for retirement. Assume that each account considered has an APR of 6% compounded monthly Following expert advice, you begin your retirement program as soon as you graduate from college at age 34. You plan to retire at the age of 65. What monthly contributions do you need to make to have a retirement account worth $950,000? (Round your answer to the nearest cent.) $ What will your total personal contribution be by the time you retire if you start saving after graduation? $ Against expert advice, you begin your retirement program at age 46. You plan to retire at the age of 65. What monthly contributions do you need to make to have a retirement account worth $950,000? (Round your answer to the nearest cent.) What will your total personal contribution be by the time you retire if you start saving at age 467 How much more will you personally contribute by the time you retire if you start saving at age 46 instead of starting right after graduation? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts