Question: Please help on how to solve ! ! ! Record each of the transactions listed above in the 'General Journal' tab ( these are shown

Please help on how to solve

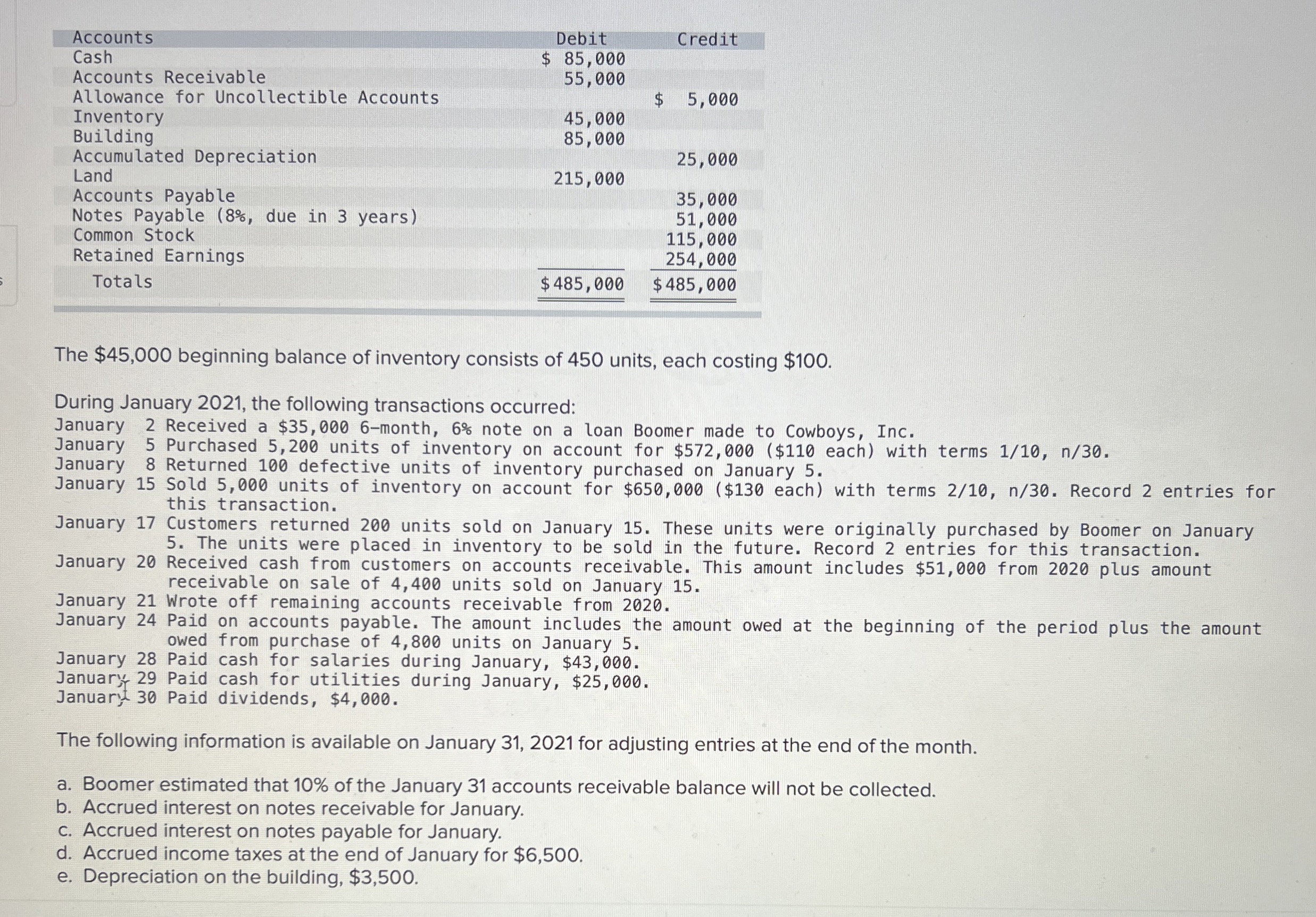

Record each of the transactions listed above in the 'General Journal' tab these are shown as items assuming a

FIFO perpetual inventory system. The gross method is used for recording discounts on purchases and sales of inventory.

Review the unadjusted Trial Balance in the 'Trial Balance' tab to confirm that debits equal credits and that ending account

balances are shown correctly as debits or credits. The year on the Trial Balance tab is incorrectly shown as instead

of

Record adjusting entries on January in the 'General Journal' tab these are shown as items

Review the Adjusted Trial Balance as of January in the 'Trial Balance' tab to confirm that debits equal credits

and that ending account balances are shown correctly as debits or credits.

Prepare a multiplestep income statement for the period ended January in the 'Income Statement' tab. Select

"Adjusted Trial Balance" at the top left. You may not use every line on the income statement. Enter "Net income" as the

title for the last line.

Prepare a classified balance sheet as of January in the 'Balance Sheet' tab. Select "Adjusted Trial Balance" at

the top left. Show any NONCURRENT liabilities on the line below the Current section.

Record the closing entries in the 'General Journal' tab these are shown as items and In the second closing entry,

close all temporary accounts with debit balances expenses contrarevenues, dividends

Review the Postclosing Trial Balance as of January in the 'Trial Balance' tab to confirm that only permanent

account balances are included; temporary accounts should be closed.

The $ beginning balance of inventory consists of units, each costing $

During January the following transactions occurred:

January Received a $month, note on a loan Boomer made to Cowboys, Inc.

January Purchased units of inventory on account for $ $ each with terms

January Returned defective units of inventory purchased on January

January Sold units of inventory on account for $ $ each with terms n Record entries for

this transaction.

January Customers returned units sold on January These units were originally purchased by Boomer on January

The units were placed in inventory to be sold in the future. Record entries for this transaction.

January Received cash from customers on accounts receivable. This amount includes $ from plus amount

receivable on sale of units sold on January

January Wrote off remaining accounts receivable from

January Paid on accounts payable. The amount includes the amount owed at the beginning of the period plus the amount

owed from purchase of units on January

January Paid cash for salaries during January, $

January Paid cash for utilities during January, $

Januar, Paid dividends, $

The following information is available on January for adjusting entries at the end of the month.

a Boomer estimated that of the January accounts receivable balance will not be collected.

b Accrued interest on notes receivable for January.

c Accrued interest on notes payable for January.

d Accrued income taxes at the end of January for $

e Depreciation on the building, $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock