Question: please help on these two part. (please put answers in the millions) IBM purchased computer chips from NEC, a Japanese electronics concern, and was billed

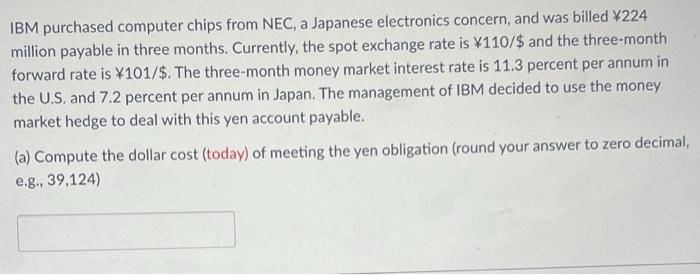

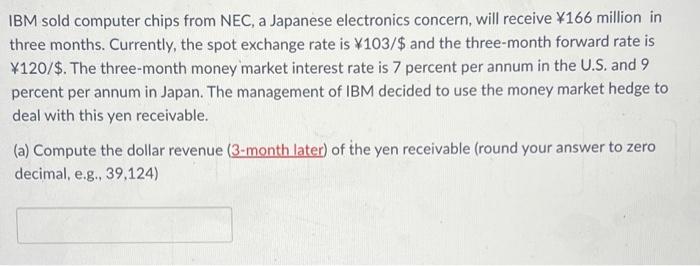

IBM purchased computer chips from NEC, a Japanese electronics concern, and was billed X224 million payable in three months. Currently, the spot exchange rate is 110/$ and the three-month forward rate is 101/$. The three-month money market interest rate is 11.3 percent per annum in the U.S. and 7.2 percent per annum in Japan. The management of IBM decided to use the money market hedge to deal with this yen account payable. (a) Compute the dollar cost (today) of meeting the yen obligation (round your answer to zero decimal, e.g., 39,124) IBM sold computer chips from NEC, a Japanese electronics concern, will receive 166 million in three months. Currently, the spot exchange rate is 103/$ and the three-month forward rate is 120/$. The three-month money market interest rate is 7 percent per annum in the U.S. and 9 percent per annum in Japan. The management of IBM decided to use the money market hedge to deal with this yen receivable. (a) Compute the dollar revenue (3-month later) of the yen receivable (round your answer to zero decimal, e.g., 39,124)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts