Question: please help. only have one chance left. TY expected ente of return and risks, Inc. is condidering an investment in one of two common tods

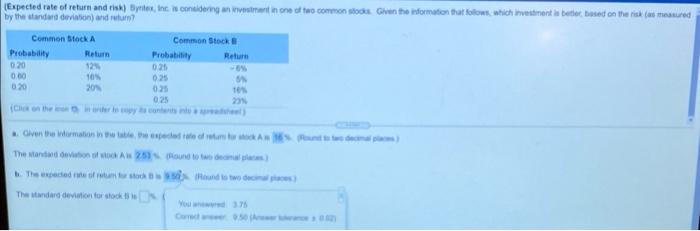

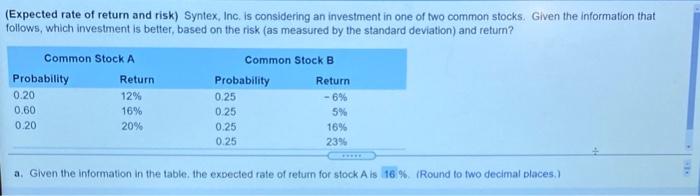

expected ente of return and risks, Inc. is condidering an investment in one of two common tods Oven the information that low which investimet beter based on the list (as masured by standard deviation rulum Common Stock A Common Stock Probability Return Probability Return 0.20 021 0.00 10 0.25 020 201 025 tes 025 20 Cheo then we con . Given the Wormation in de datos The Man of 25 pound to be The wete went and to two decades The tandard deviation for stock You w37 Com (Expected rate of return and risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on the risk (as measured by the standard deviation) and return? Common Stock A Common Stock B Probability Return Probability Return 12% 0.25 - 6% 5% 0.20 0.60 0.20 16% 20% 0.25 0.25 0.25 16% 23 a. Given the information in the table. the expected rate of return for stock Als 16% (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts